Electric vehicle makers get VAT, duty waivers

In a bid to accelerate the shift to cleaner transport and promote domestic manufacturing, the interim government plans to roll out a series of tax benefits focusing on electric vehicles, including electric bicycles (e-bikes), and lithium and graphene batteries.

The move signals a strategic push to reduce excessive reliance on fossil fuels, cut import dependency, and promote sustainable urban mobility through the growth of the domestic e-vehicle industry.

Finance Adviser Salehuddin Ahmed announced the measures while presenting the national budget for FY26 on June 2.

These include a five-year value-added tax (VAT) exemption, alongside customs and other duty reductions of up to 60 percent, for key components, according to a separate notification issued by the National Board of Revenue (NBR).

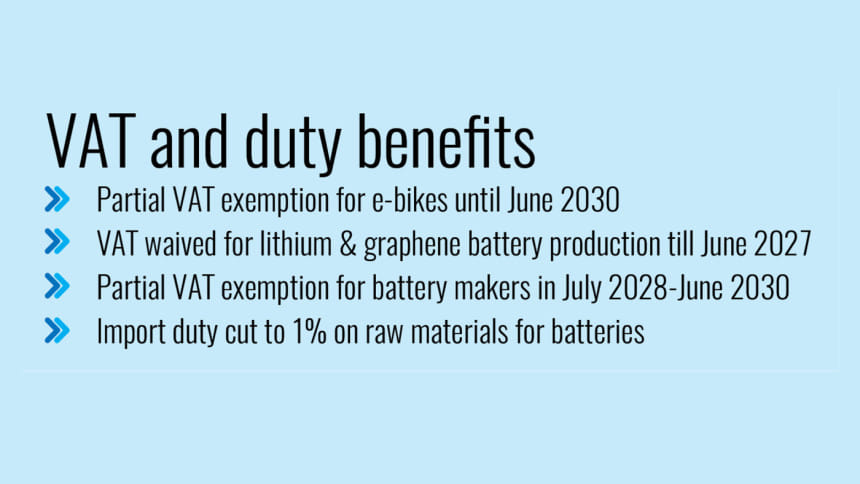

For example, all VAT on e-bikes has been cut to 5 percent until June 2030.

For manufacturers of lithium and graphene batteries, the entire VAT at the manufacturing stage has been waived until June 30, 2027.

Afterwards, from July 1, 2028 to June 30, 2030, all VAT will be limited to 5 percent.

Moreover, all import taxes on key raw materials have been limited to 1 percent, subject to conditions.

Currently, customs duties range from 26 percent to 42 percent for lithium batteries and 26 percent to 60 percent for e-bikes, depending on the components, according to the NBR.

"The government has significantly reduced duties, but it is not for encouraging any form of assembling. Our focus is on true manufacturing and that's a critical distinction," said Mokitul Hasan, second secretary (Customs Policy) at the NBR.

"To make these projects viable, we've separated the lithium battery policy from the e-bike policy. A company can use some batteries for its own bikes and sell the rest in the market. This flexibility ensures financial sustainability," he said.

"Producing lithium batteries requires massive investment. We've made it clear that the cell, which makes up a significant portion of the battery's value, must be manufactured locally," said Hasan.

"Importing cells and assembling the rest isn't true manufacturing. We want full-scale production from raw materials," he said.

Furthermore, although an environmental surcharge is applicable if an individual owns multiple vehicles, a provision has been kept exempting electric vehicles from this surcharge to promote the use of environmentally friendly vehicles.

An official of the NBR pointed out that though some companies utilised duty structures under statutory regulatory orders to set up assembly units, it did not necessarily build up an industry.

"The NBR has consciously avoided the issue," he said.

"Our goal is to attract real investors with capital and technology, not mere assemblers. Even partial local production of lithium batteries would be a major step forward for Bangladesh," he said.

He also said major foreign companies were already considering shifting their battery manufacturing operations to Bangladesh. "This is a strategic opportunity."

However, the NBR has set various conditions to access the tax benefits.

Companies must employ at least 250 Bangladeshi workers, obtain International Organization for Standardization (ISO) certifications, and meet environmental and safety standards.

Besides, they must submit a detailed declaration for NBR vetting, register with Bangladesh Economic Zones Authority or similar agencies, get approval from Bangladesh Road Transport Authority, and set up dedicated manufacturing units with advanced machinery like CNC machines and molding systems.

Welcoming the move, Hafizur Rahman Khan, chairman of Runner Automobiles, said the new notifications have addressed several "unnecessary" conditions for accessing the benefits.

"Any automobile industry is always vendor-dependent. Industries don't manufacture everything themselves; they source components and assemble the vehicles," he said.

The notification that has been issued is beneficial only for industries that are established with the required machinery. However, many of the machines listed are unnecessary for the automobile industry, he said.

It seems like the focus is now more on electric vehicles and lithium battery production, but this approach needs to be more carefully considered, he said.

The policy should focus on facilitating industry growth, not creating hurdles. It needs to be more thought out, with feedback from the industries that will be directly impacted, he added.

"We will soon raise our concerns with the government," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments