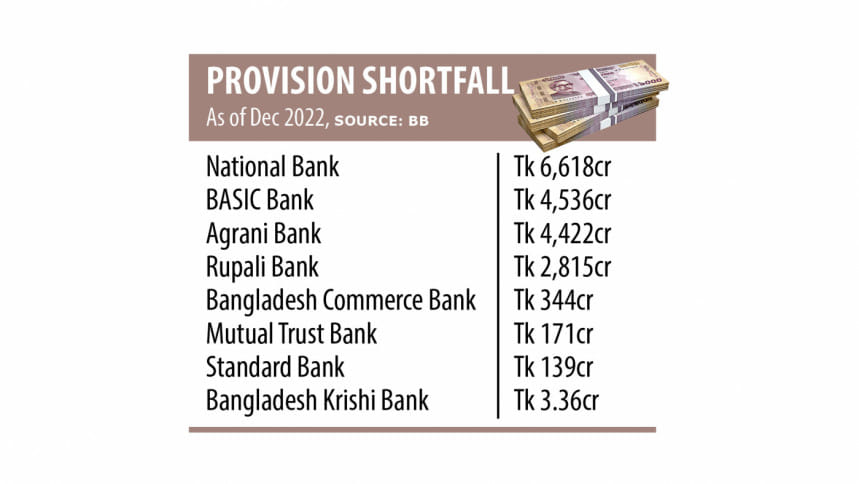

Eight banks face provision shortfall of Tk 19,048cr

Eight banks in Bangladesh faced a collective provisioning shortfall of Tk 19,048 crore in 2022, creating a risk for their depositors.

The lenders are National Bank, BASIC Bank, Agrani Bank, Rupali Bank, Bangladesh Commerce Bank, Mutual Trust Bank, Standard Bank, and Bangladesh Krishi Bank. All of the banks except Krishi Bank also witnessed a provision deficit in 2021 as well.

Provision shortfall occurs when a financial obligation exceeds the amount of cash available. It can be temporary, arising out of a unique set of circumstances, or persistent, indicating poor financial management practices.

Banks have to earmark 0.5 per cent to 5 per cent of their operating profit as provisions against general category loans, 20 per cent against classified loans of the substandard category, and 50 per cent against classified loans of the doubtful category.

It has to set aside 100 per cent provisioning against the classified loans of bad or loss category.

"The provision shortfall at the banks means they are distributing profits and dividends to their shareholders without protecting the interest of depositors," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

He said high-default loans were mainly responsible for the provisioning shortfall in the banks.

"In the past, the majority of the eight banks faced a wide range of scams. As a result, their default loans have widened," said Mansur, also a former official of the International Monetary Fund.

Of the eight banks, National Bank, which witnessed a number of scams in recent years, was at the top of the list of the lenders facing provision shortfall.

The deficit at the bank stood at Tk 6,618 crore as of December, up 103 per cent a year ago, data from the Bangladesh Bank showed. Non-performing loans at the private lender rose 12 per cent year-on-year to Tk 6,658 crore in December.

The central bank earlier banned National Bank from disbursing loans. But the measures have not contributed to improving its financial health.

Md Mehmood Husain, managing director of the bank, did not respond to The Daily Star's requests for comment.

State-run BASIC Bank saw a provision shortfall of Tk 4,536 crore in 2022 in contrast to Tk 4,115 crore in 2021.

The state lender, which had been considered a good bank thanks to its strong corporate governance, faced earth-shaking scams in 2010 and 2011. Its bad loans accounted for 57.55 per cent of the outstanding credit last year.

Md Anisur Rahman, managing director of BASIC Bank, said: "The current management is trying heart and soul to improve the financial health."

"Our operating loss is falling. We always return money to depositors on time."

Bangladesh Commerce Bank had a provision shortfall of Tk 344 crore in December. The private lender, which has also been hit with irregularities, has been facing a shortfall for years.

Contacted, Md Tajul Islam, managing director of the bank, declined to comment.

Mutual Trust Bank faced a shortfall of Tk 171 crore last year.

Syed Mahbubur Rahman, managing director of the lender, said that the bank had not faced any irregularities.

"All indicators of the bank except the provisioning are in good shape. We are making efforts to reduce the shortfall. And the situation will improve in the days to come."

Although defaulted loans in the overall banking sector increased last year, the provisioning deficit decreased to Tk 11,009 crore from Tk 14,007 crore in 2021. Bad loans jumped 17 per cent to Tk 120,656 crore.

But Mansur is doubtful about the provisioning shortfall figure.

"Many banks might have not calculated their provisioning accurately, so the overall shortfall declined," he said, suggesting the central bank monitor the issue.

He says a provision shortfall actually portrays a bank's vulnerability and it may find it hard to absorb shocks.

"So, the central bank should gear up its monitoring of the banks so that they improve their provision base to protect the interest of depositors."

Zahid Hussain, a former lead economist of the World Bank's Dhaka office, says that banks should keep required provisions to mitigate credit risks.

"The banks that are facing the provision shortfall usually show profits and provide dividends. This is not logical. This raises the risk of depositors."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments