Current account deficit narrows

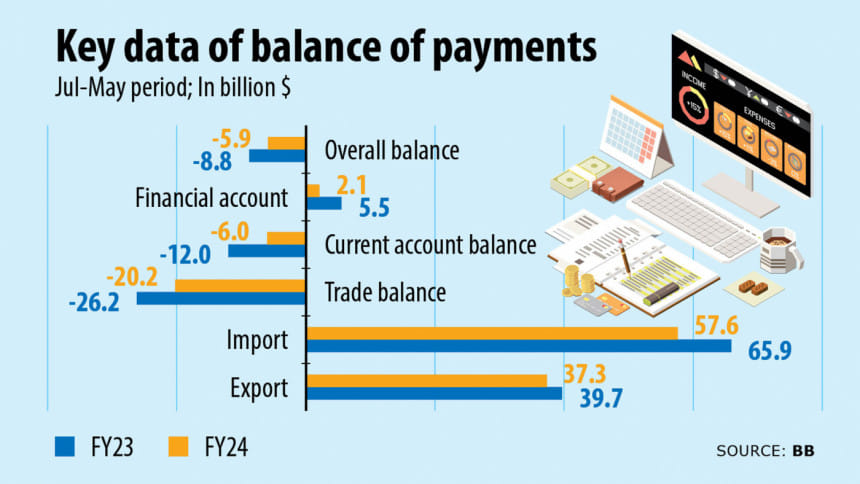

Bangladesh's current account deficit dropped by half year-on-year to stand at $5.98 billion in the 11 months till the end of May of fiscal year 2023-24 as imports fell in tune with Bangladesh Bank's (BB) measures amidst a US dollar crisis.

Data made public by the central bank showed that the current account deficit was $12.02 billion during the same period a year ago.

The current account records a nation's transactions with the rest of the world—specifically net trade in goods and services, net earnings on cross-border investments, and net transfer payments, reads investopedia.com.

The current account may be positive (a surplus) or negative (a deficit); positive means the country is a net exporter and negative means it is a net importer of goods and services, it adds.

The downturn in exports continued in May and overall earnings declined 5.9 percent year-on-year to $37.34 billion in the July-May period of fiscal year (FY) 2023-24.

Meanwhile, import payments declined 12.6 percent year-on-year to $57.56 billion.

As a result, the overall trade deficit stood at $20.2 billion.

Bangladesh's current account turned negative in April of FY24 after the BB corrected export data and published new figures which showed that shipments had dropped instead of rising.

Zahid Hussain, a former lead economist at the World Bank's Dhaka office, said the deficit in current account increased further in May. It means that there is pressure on the country's external account, he said.

In July-May of FY24, Bangladesh suffered a $5.88 billion deficit in its balance of payments (BoP), down from $8.80 billion during the same period a year ago.

Hussain said the latest data indicates that there would be no relief in the upcoming days even though the financial account turned positive following corrections to the export data.

The BB data showed that the financial account stood at $2.08 billion during the July-May period of FY24, down from $5.51 billion in the same period of last fiscal year.

Hussain said Bangladesh received a good amount of foreign aid recently. As a result, the financial account showed a surplus.

"This might not continue in the upcoming days," he said.

"There is a lot of uncertainty regarding the economic situation in the coming days. This may adversely impact the country's exports and imports," he added.

The BoP is the record of all international financial transactions made by the residents of a country. It has three main categories -- the current account, the capital account, and the financial account, reads investopedia.com.

The current account is used to mark the inflow and outflow of goods and services into a country. The capital account is where all international capital transfers are recorded. In the financial account, international monetary flows related to investment in business, real estate, bonds, and stocks are documented, it added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments