Bangladesh can be the next outsourcing destination: PwC

Bangladesh has immense potential to become the next outsourcing destination riding on a higher proportion of the working age population and the government's initiatives aimed at attracting investments, a new study said.

PwC Bangladesh, in its flagship report "Destination Bangladesh", an analysis of the country as an investment destination, said the country is striving to enhance its exports on all fronts of production.

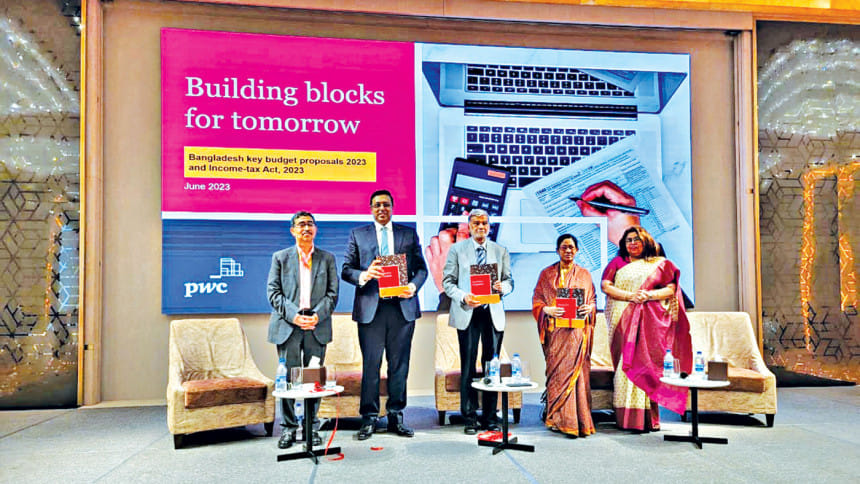

Planning Minister MA Mannan launched the report at an event at the Sheraton Dhaka hotel.

The study covers areas such as entry to Bangladesh's market, funding opportunities, incentives to draw foreign investments, regulations, tax incentives and steps needed to operate businesses.

"Once again, after the pandemic, Bangladesh managed to be an exemplar of resilience in terms of economic recovery," it said.

The economy recorded a 6.9 per cent growth in the fiscal year of 2020 21 and 7.2 per cent in 2021 22.

PwC Bangladesh's report highlights the facilities Bangladesh is providing to woo foreign companies.

The Bangladesh Economic Zones Authority has undertaken an initiative to set up 100 economic zones, in both public and private sectors.

Many of them are already operational and are ready for investments and exports, said PwC.

Bangladesh is also heavily investing in the export sector and has provided 100 per cent tax exemption to IT and IT-enabled service providers up to 2024 and the benefit could be extended up to 2030.

There is a provision of 100 per cent profit repatriation and a 10 per cent cash incentive for IT or ITES exports.

The ICT infrastructure encompasses a plan to develop IT professionals through 35,000 Sheikh Russel Digital Labs, and 39 hi-tech IT parks.

Bangladesh's attractiveness as an outsourcing destination for services continues to grow due to its capable working-age population, which is demonstrated through its improvement in the ranking in AT Kearney's Global Services Location Index 2021 by two places to 35th.

The government is looking to create more than 200,000 direct and 50,000 indirect jobs and earn $5 billion a year in the next decade through outsourcing.

"With a high proportion of university-educated youth under 25 years of age, the outsourcing opportunity is attractive for the growth of the ICT or outsourcing-tech-savvy sector," the report said.

It said the demand for intermediate goods is expected to continue to rise, which may be justified by the government's undertaking of mega infrastructure projects such as Padma Bridge, metro rail and the Bangabandhu Sheikh Mujibur Rahman Tunnel under the Karnaphuli river.

"Significant progress has been made in terms of infrastructure development after the opening of the Padma Bridge."

The Padma Bridge is expected to increase the GDP growth of the southwestern part of the country by 2.5 per cent and the national GDP by 1.23 per cent.

The report said Bangladesh's export basket primarily comprises readymade garments and textiles. The efforts to diversify the export basket by promoting other manufacturing industries and ICT have been pushed by the government as dependence on one export product makes the economy vulnerable.

The manufacturing sector constitutes 35 per cent of the foreign investment and the government has put thrust on light engineering, agro-processing and ICT.

The PwC report said the incremental growth of the economy will be beneficial for the country in terms of its global economic standing. Investment in higher education, training, and healthcare from both public and private sectors will rise as a result of the country's graduation to a developing nation in 2026.

The construction of a new terminal at the Hazrat Shahjalal International Airport will aid in attracting more international players and investors, enabling competitive trade across borders.

"Besides, the sovereign rating is also expected to lower risk premiums while making investments in debt and equity-based instruments," said the report.

It said Bangladesh has until 2027 to build the necessary infrastructure to remain competitive following the withdrawal of duty-free and quota-free market access after the country graduates from the group of least-developed countries.

The country has undertaken policy reforms and is pursuing bilateral and multilateral trade agreements to develop its capacity to compete in the global market, the PwC study added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments