Bangladesh could capture $1.2b of recycled textile industry

Bangladesh has the potential to produce $1.2 billion worth of recycled textile and garment items as the country has a big production base for cotton fibre clothing items, according to a recent study by the Global Fashion Agenda (GFA) and McKinsey & Company.

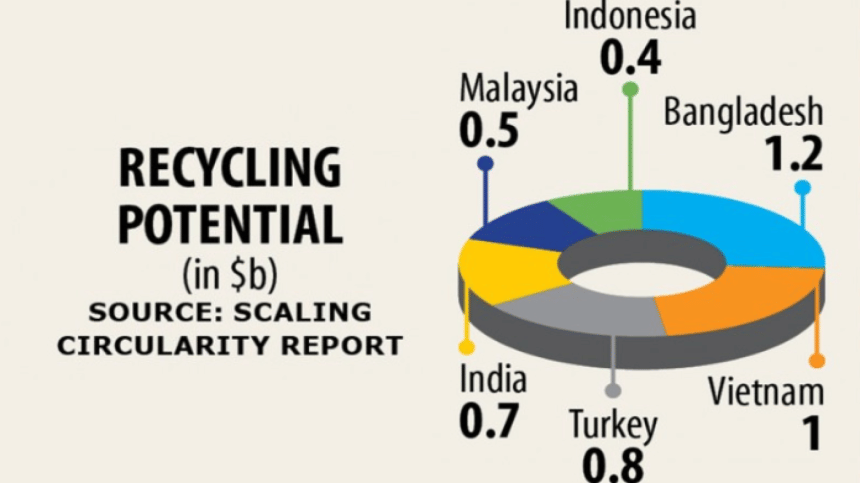

In total, six major manufacturing countries -- Vietnam, Turkey, India, Malaysia, Indonesia and Bangladesh -- could tap into a $4.5 billion market in the form of this post-industrial recycling opportunity, as per the analysis.

These are all markets with high viability for such a model, given the economic significance of the textile industry and commitment of local policymakers to supporting the sector.

"There is huge economic potential to scale up this model beyond Bangladesh," the study said.

Less than 1 per cent of materials used to produce clothes is recycled, representing a loss of more than $100 billion in materials each year, it added.

The study -- Circular Fashion Partnership (CFP) Scaling Circularity Report -- was launched virtually yesterday.

The CFP is a cross-sectoral project to support the development of textile recycling in Bangladesh.

In 2020, the overall uptake of recycled fibres compared to the total fibre production was only around 8.1 per cent, with 7.6 per cent coming from recycled polyester from plastic bottles, not textiles.

Cotton accounted for 24 per cent, or 26.5 million tonnes, of the global fibre market in 2020, while recycled cotton made up less than 1 per cent.

So, there is a clear opportunity in building the enablers to scale up textile recycling, the study said.

"The government plans to make use of the CFP project, but there will be a lot of challenges to implement such an initiative in the country," said Faiyaz Murshid Kazi, director general of the foreign ministry's wing for west Europe and the European Union.

Bangladesh's apparel industry has shown its resilience even amidst the ongoing Covid-19 pandemic, he added.

Circular products, which require little to no virgin resources, are key to ensuring a more sustainable fashion industry as 40 per cent of greenhouse gas emissions from factories are created during the manufacturing process.

Based on reverse resources analysis, 35 per cent of the total amount of fibres wasted while making garment items is generated during production.

To capture the full opportunity and close the loop on this part of the system, the CFP would need to be replicated in other major textile producing countries.

However, less than 1 per cent of textile waste is being recycled into new fibres, and there is no evidence to suggest the coming of a sharp change in this growth rate in the near future.

For major brands and manufacturers to deliver on their commitments, new strategies are required, according to the study.

From November 2020 to November 2021, the CFP mapped and traced 1,013 tonnes of textile waste on the Reverse Resources platform with 0.2 per cent of this waste coming from Bangladesh. It now regularly traces over 200 tonnes per month.

The project has achieved significant results despite multiple Covid-19 lockdowns.

The CFP is led by the Global Fashion Agenda alongside Reverse Resources and the Bangladesh Garment Manufacturers and Exporters Association with the support of the Partnership for Growth.

The CFP's goal is to reduce dependency on virgin materials and increase the availability of recycled materials by establishing a long-term, scalable transition to a circular fashion system in garment manufacturing countries.

The CFP has an ecosystem approach that facilitates circular commercial collaborations between textile and garment manufacturers, recyclers and global fashion brands to capture and direct post-industrial textile waste back into the production of new fashion products.

It also engages stakeholders, including local and European policymakers, and the investment community, to create a conducive environment for a circular fashion system.

Mumit Hasan, head of operations in Bangladesh of Reverse Resources; Jasmin Malik Chua, sourcing and labour editor at the Sourcing Journal; Peder Michael Pruzan-Jorgensen, interim chief impact officer of the Global Fashion Agenda; Irene Maffini, sustainable investment expert; Martin Stenfors, chief operating officer of Renewcell; and Corinne Sawers, associate partner of McKinsey & Company, also spoke.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments