Govt e-transfer to individuals nearly triples

A new Bangladesh Bank platform has helped the government settle almost 100 per cent of its payments made to individuals electronically, giving a boost to the country's financial inclusion efforts.

The digital transfer of funds to individuals includes salaries paid to public sector employees, cash support to the poor and marginalised, and stipends to students.

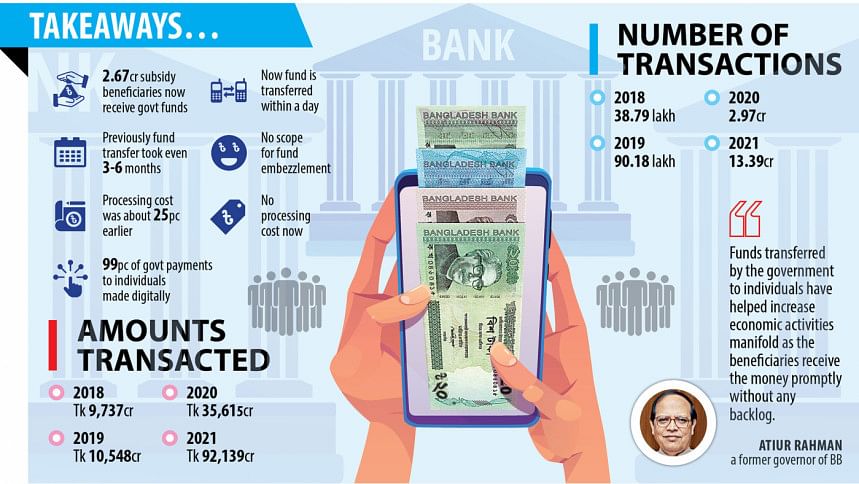

The payment through the platform -- Government eTransaction Processing Hub (GeTPH) -- escalated 159 per cent year-on-year to Tk 92,139 crore last year, according to data from the central bank.

The system settles transactions made through the Bangladesh Electronic Fund Transfer Network (BEFTN), enabling beneficiaries to receive funds within a day.

BEFTN facilitates the transfer of payments through banks electronically, making it a faster and more efficient means of inter-bank clearing over the paper-based system.

Although the GeTPH was introduced in October 2019, the central bank officially launched it in December last year. It has helped eliminate corruption while distributing funds under social safety net programmes.

Some 2.67 crore beneficiaries under 16 social safety net programmes are now receiving funds through the digital method.

Allegations were rife that local-level public representatives manipulated the data of beneficiaries to embezzle funds. But the new platform transfers the money to the account-holders directly after the central bank receives the fund from the government, a BB official said.

Every beneficiary now has to open accounts with either banks or mobile financial service (MFS) providers. The list of the accounts is preserved with the central bank's platform.

It has also cut the time needed to make the payments. Previously, the manual system took three to six months to settle the monthly payments in favour of the beneficiaries.

The central bank started to transfer salaries to government employees in 2015 on a limited scale through the BEFTN, replacing the manual system that took three to five days.

Initially, the BB was able to settle around 1.15 lakh transactions per day. It has now gone past six lakh per hour after the establishment of the GeTPH.

The number of transactions stood at 13.39 crore last year under the digital platform, up 350 per cent year-on-year.

Savers receive both interest and principal of their investment in national savings certificate through the GeTPH, while retired employees of the government, semi-government, autonomous and semi-autonomous bodies are withdrawing monthly retirement benefits such as pensions.

It has brought huge relief for the elderlies since they had to queue up for hours before cash counters of banks to receive entitlements. The digital system has also saved money for the government.

In the past, the government had to shell out 25 per cent against every disbursement when it settled the transactions manually. Now no cost is involved for the transfer of funds since it is carried out through bank accounts.

The government counts 0.70 per cent cost if it is sent through MFS.

The GeTPH emerged as a saviour during the coronavirus pandemic as it allowed the government to disburse funds without putting the beneficiaries at any health risk.

The transfer of the fund from the government coffer to the central bank's platform is highly secured as transaction-related data is sent following an encrypted model.

Both the government and banks earlier had to deploy many employees to process transactions. The number has gone down significantly thanks to the digital system.

"The digitalisation of the government payment has had a great impact on the financial inclusion," said Atiur Rahman, a former governor of the central bank.

"This has helped expand economic activities manifolds as the beneficiaries receive the fund promptly."

The money multiplier also enjoys a positive impact from the rapid fund transfer, according to the economist.

The money multiplier refers to how an initial deposit can lead to a bigger final increase in the total money supply.

"The multiplier effect is larger in a vibrant digital economy than the manual one. The productive sector also benefits from the digital fund transfer," said Rahman, who led the central bank to accelerate financial inclusion in Bangladesh.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments