Credit growth to pick up in 2016: study

Credit growth will pick up modestly in Bangladesh in 2016 in light of the recent political stability, improving macroeconomic environment and declining interest rates, according to a global investment firm.

“2016 began on a positive note and this may set the tone for an improved macro-economic outlook and ultimately acceleration in credit growth,” the London-based Exotix Partners LLP said after analysing data from five local banks.

Exotix looked into the numbers of Brac Bank, Prime Bank, United Commercial Bank, Eastern Bank and Islami Bank Bangladesh.

Last year was a difficult year with the first three months lost to political turmoil. As a result, credit growth remained low, while operating income growth was almost non-existent. Rising costs meant higher cost or income ratios and low return on average equities (RoAEs).

Over the past two years, the country experienced a significant decline in interest rates, partially driven by low inflation. However, build-up of excess liquidity caused by low credit demand, current account surpluses and low government borrowing also played a major role in driving interest rates lower.

The analysis said sharp decline in interest rates has mixed implications. “Historically banks in Bangladesh benefitted from declining rates, but this time the benefit might not be as profound.”

The benefit of lower rates on credit growth will become even more profound as lending rates in the taka come down and the dollar rates keep rising with the Fed rate, the analysis said.

“This is because it will make borrowing in the taka, as opposed to the dollar, more attractive for large companies.”

Over the past couple of years, a large number of local corporate customers borrowed in the dollar from external sources, and the stock of such loans outstanding right now stands at $8 billion.

The asset quality challenges are not over for Bangladesh's banks despite an improving macroeconomic environment and declining interest rates, the study said. Exotix believes that non-performing loans (NPLs) are under-reported in the five banks it has covered.

“On our assumption, banks still have unreported NPLs equalling 4 percent of total loans which are permanently impaired and have to be written off in the next five years. The need for increased provisioning will continue to hamstring RoAEs in our opinion. However, we believe that the low RoAE outlook for our banks is currently priced in by the market.”

The total margin loans outstanding given to stockmarket investors through brokerages and merchant banks stand at Tk 22,500 crore or 4.2 percent of the of total loans.

“Very little of these loans have been recognised as NPLs as brokerages and merchant banks usually take credit lines and have been servicing the interest. In our estimate half of all margin loans have to be written-off.”

Lending to real estate amounted to Tk 33,500 crore or 6.2 percent of the total loans as of 2013. Of that, Tk 13,800 crore or 41 percent were impaired loans.

“The real estate sector continues to struggle with apartment prices coming down and large unsold inventories.”

Of the corporate borrowers who defaulted, a sizable portion comprised of Chittagong-based commodity importers who have been permanently impaired during the rapid commodity price decline.

“Many others had diverted money into land and found their repayment capacity to be limited. However, some of these groups do have cash generative businesses and an improvement in the economy can help them gradually de-leverage,” it said.

Exotix Partners also touched upon exports. Quoting the manufacturers association, the analysis said the order flow looks quite strong.

“This is happening despite appreciation of the taka in real effective exchange terms, which highlight the cost advantage that Bangladesh enjoys over its peers.”

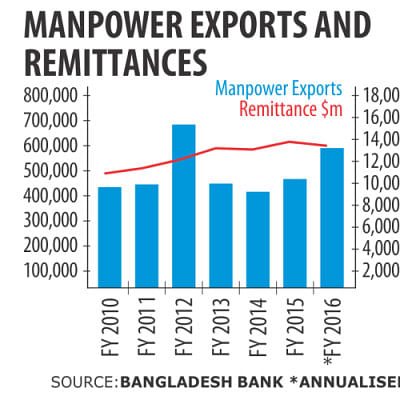

The analysis also said remittance income would grow in 2016.

“The decline in remittances appears to have levelled off towards the end of 2015. We believe this can be explained by the gradual improvement in Bangladesh's relationships with a number of the gulf countries.”

More encouraging is the fact that the number of people going abroad for employment jumped in 2015, which should drive remittances in 2016.

Bangladesh exported about 6.34 lakh men and women in manpower in 2015, up 30 percent over the previous year, according to the Refugee and Migratory Movements Research Unit of Dhaka University. The number is one of the highest in recent years.

Exotix Partners said Bangladesh remains one of the biggest beneficiaries of the global weakness in commodity price, particularly oil.

Despite the significant fall in the price of oil, the government is yet to reduce oil prices and is therefore making a profit, which is being used to help keep the fiscal deficit under control, it said.

“Therefore, even though there is a risk that a persistent low oil price could adversely impact remittances, Bangladesh will be a net beneficiary of the low commodity price cycle.”

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments