Challenges that capital market faces

Capital market provides an important alternative source of long-term finance for long-term productive investments. This helps in diffusing stresses on the banking system by matching long-term investments with long-term capital. In Bangladesh, the capital market has the opportunity to provide equity capital and infrastructure development capital for strong socio-economic benefits -- roads, water and sewer systems, housing, energy, telecommunications, public transport, and so on. The capital market can encourage broader ownership of productive assets by small savers to enable them benefit from Bangladesh's economic growth. The capital market can provide avenues for investment opportunities that encourage a thrift culture critical to increasing domestic savings and investment ratios that are essential for rapid industrialisation. Equity financing through the capital market can reduce the debt level of businesses.

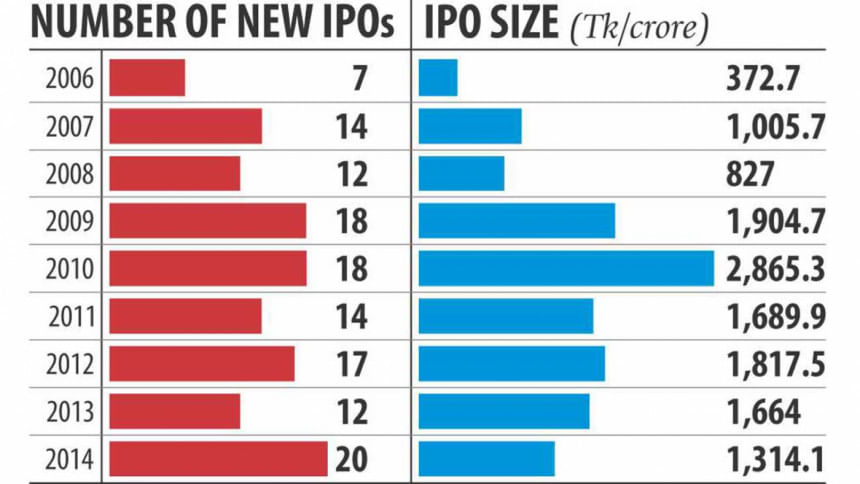

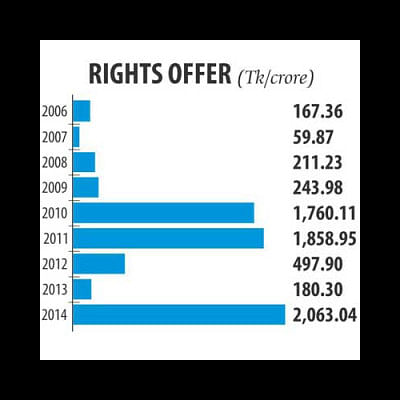

In Bangladesh, companies raise money from the primary market through IPO (initial public offering) and rights offer. In the last nine years, on an average 15 new companies got listed through IPO each year. As of May 2015, a total of 324 companies are listed (including 41 mutual funds) on Dhaka Stock Exchange. In the last nine years, the average yearly capital raised through IPO and rights issue is Tk 1,495.65 crore and Tk 782.53 crore respectively.

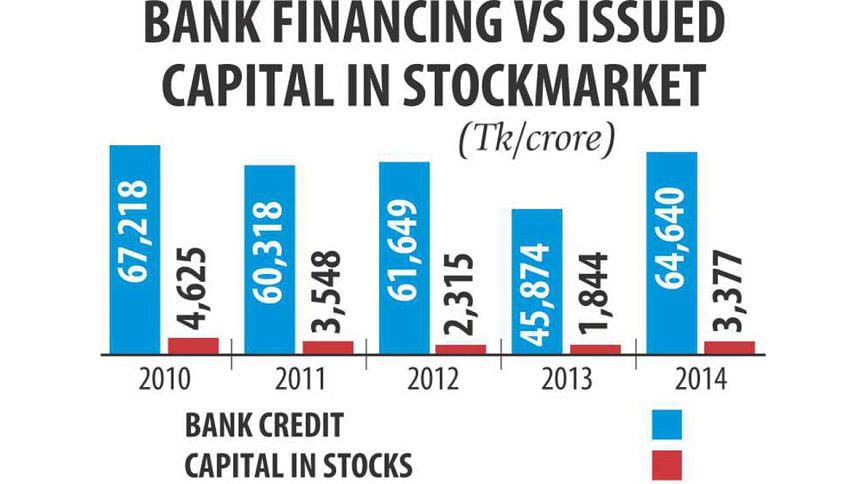

Till date, bank financing has been the major source for companies despite the long-term benefits of fund raising from the capital market. Till 2014, the total issued capital of all listed companies is Tk 47,121 crore, and bank credit outstanding balance is Tk 543,407 crore. Though the capital market can provide equity capital to businesses, which can be an effective way to fetch long-term financing, we could not utilise the platform for public sector investments. There have been several challenges in the primary market and in the process of IPO. One of the challenges is an absence of regulatory measures or incentives to bring new companies in the market with strong fundamentals. Discovery of price also becomes very difficult due to a lack of analysts. Sometimes small companies face difficulties due to large pre-IPO capital rules. Weak activities of merchant banks are also to blame. Distribution in Bangladesh is uneven. Only retail investors can participate in the IPO, whereas, institutional investors and foreign investors can participate in the IPO in fixed price method like general investors. Retail investors hold IPO shares for a very short period of time.

The market finds it difficult to price a security reflecting its fundamental value in both primary and secondary levels. Both 'fixed price' and 'book building' have resulted in huge price anomalies. The fixed price method fails to recognise the future earning potential, while the book building method is alleged to be biased. Rumour influences the price of a security in the secondary market more than the fundamental value of a security. Most of the recent IPOs have noted price jump on the first day of trading followed by a quick fall in prices after five or 10 trading days.

The capital market exposure of banks, the major institutional participant in the capital market, has been capped heavily at 25 percent of core capital (solo basis) and 50 percent of consolidated core capital (consolidated basis) and the deadline for compliance is July 2016. Considering the volume of banks' existing capital market exposure, the timeframe for compliance is short. Single borrower exposure for capital market subsidiaries is another issue as these subsidiaries are heavily burdened with negative equity margin accounts. Regulators should go for a long-term solution to this problem rather than taking short-term measures.

Public confidence in mutual funds is very low due to asset managers' involvement in the gross violations of securities rules and misappropriation of funds money.

Quality of disclosure is not up to the peer standards. Investors find it difficult to assess the portfolio holdings or quality of stated net asset value. Most of the mutual funds are generic rather than style based. Fund managers have selection errors and prefer passive management. While in peer markets open-end funds dominate, there are only nine open-end funds in Bangladesh. Dividend in the form of Re-Investment Unit has not been welcomed by investors due to dilution effect. Fund managers are very reluctant to stick with the redemption of closed-end mutual funds.

Bangladesh's capital market has a very basic equity market. Bond market is non-existent. Although there are eight debentures and 221 treasury bonds listed in the market, these issues do not trade in the market. There are only two corporate bonds listed in the market. We are not aware of any regulatory vision or seldom see any guideline in introducing derivative products/new products. We have noticed fear in the derivative products but no initiative to gain knowledge on these products. Our institutions should increase professional capacity to deal with alternative products.

Bangladeshi regulators should be more proactive in developing derivative and a vibrant bond market. Alternative products like derivatives would not only facilitate us in better risk management but also create job opportunity for growing investment professionals.

High transaction cost in the bourses also hinders the trading of government securities. As the return of bond is fixed and volatility is also low, transaction cost similar to equity securities makes it totally unattractive to the investors. Presently there is 0.05 percent tax in source equivalent to equity securities. Secondary market for bonds is very illiquid. Secondary trading is mostly done over the counter. Road shows or campaigns can be arranged to reduce knowledge gap in bond market. In corporate bonds, private placement is getting popularity. Only two corporate bonds are presently listed on the bourses. For a vibrant bond market and better diversification of individual portfolios, bond listing in the market should be increased.

Despite having favourable economic factors and a positive market outlook, foreign participation in equity market is very low. Permission for brokerage commission sharing by foreign brokers brought in lots of foreign trade in equity market in 2014. Weak corporate governance, less transparent market structure, low level of financial disclosure and a lack of research remain as bottlenecks. Bangladeshi corporate houses are yet to grow a culture of investor meetings. Even, they do not have any formal investor relationship department. While allowing foreigners, local institutions should also build capacity for better investment management.

We are lagging far behind our neighbouring countries in technology in investment management. Although neighbouring countries are adept at technology-based trading, we could not progress in this regard. Trading platforms are very weak for large executions.

For acquisition of more than 10 percent of shares of any company, an approval from the relevant authorities is needed. This is a bottleneck from investment perspective. More often boards acting in Bangladeshi companies are inefficient but hold significant control over their company.

Directors need to hold at least 2 percent shares in listed companies. This is a counter-productive approach. We should seek better corporate governance in the company and independent management to run the company in the long run. Remuneration of independent directors is very low. This is not at all good for the motivation of professional independent directors.

In summary, regulators and institutions operating in the capital market should come forward to address the issues for a better functioning market.

The writer is the managing director of LankaBangla Finance.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments