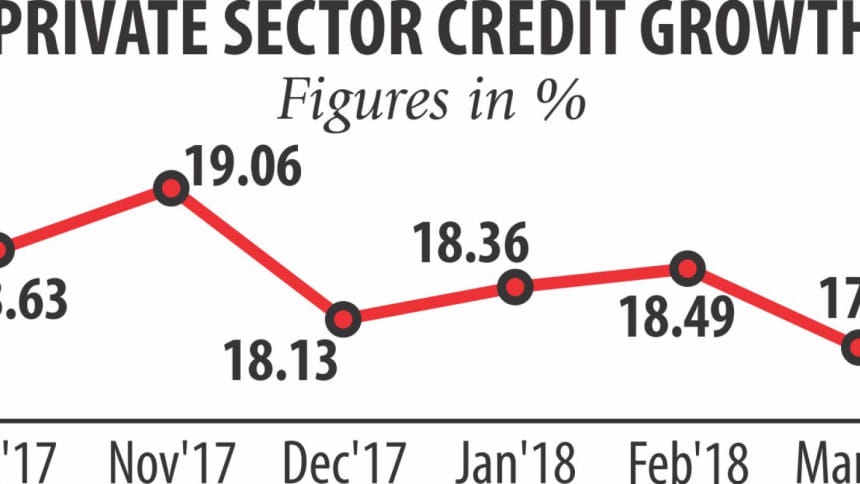

Private credit growth cools down in March

Private sector credit growth finally hit the brakes in March on the back of the central bank's efforts to curb aggressive lending by banks.

In March, the credit growth stood at 17.93 percent, down 0.56 percentage points from the previous month, according to data from the central bank.

The growth though was higher than the central bank's target of 16.3 percent set for the second half of fiscal 2017-18.

At the end of March, the total outstanding private sector credit was Tk 8.71 lakh crore.

Banks have tightened their credit activities to bring down the loan-deposit ratio to lower than 85 percent as per the central bank's directive, said Faruq Mainuddin Ahmed, managing director of Trust Bank.

"But we got here in the first place because banks had lent beyond their limit. This prompted the central bank to fire off the directive."

Following the Bangladesh Bank directive, banks that lent aggressively calmed down, which resulted in the decline in credit growth, he added.

In January, the BB instructed banks to lower their loan-deposit ratio ceiling to 83.5 percent from 85 percent by June.

The move created a severe liquidity crisis, compelling the central bank to extend the timeframe for banks to adjust into the new loan-deposit ceiling to March next year.

Furthermore, in the name of the liquidity crisis, private banks, by way of its directors, particularly those who are politically linked, managed to persuade the BB to lower the cash reserve ratio (CRR) by one percentage point to 5.5 percent in April.

The move poured in an additional Tk 10,000 crore into the banking system.

"Banks adjusted their high loan-deposit ratio after relaxing the CRR instead of expanding their loan book," said a senior executive of a private bank.

Consequently, private sector credit growth will not see a pick-up anytime soon, he added.

The sudden liquidity crisis pushed up the average rate for lending to 9.55 percent in February from 9.42 percent the previous month.

Though the average lending rate is still in single digit, most of the banks are lending in double digits. New banks are offering lending rate above 13 percent, according to central bank data.

Bankers were handed the concession of reduced CRR in exchange of a promise to bring down the lending rate to single digit.

But, it did not pan out that way.

"It will take three to four months to bring down the lending rate to single digit," said Anis A Khan, managing director of Mutual Trust Bank.

The reason being, the deposits that were taken at high rates during the crisis period will have to mature, he added.

The average interest rate on deposit surged to 5.18 percent in February from 5.01 percent the previous month, according to data from the central bank.

On April 26, the call money rate stood at 3.24 percent. Before the slash in CRR, it was above 4.5 percent.

Meanwhile, public sector credit growth continues to flit in the negative territory: in March it was 12.97 percent in the negative, way off the central bank target of 8.30 percent set for June.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments