9-digit BINs a must for businesses from Jan

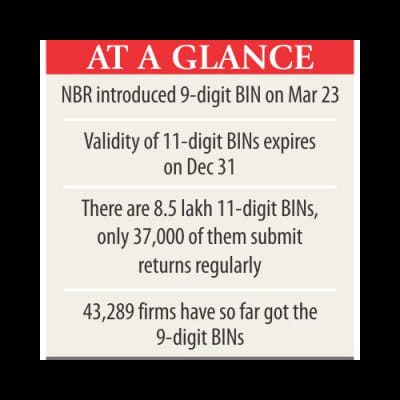

Firms have to re-register to get electronically generated 9-digit business identification numbers by December 31 this year, the date when the validity of the existing 11-digit BINs expires, the NBR said.

And firms which have already got 9-digit BINs will continue using the numbers, the National Board of Revenue said in a notice yesterday.

On March 23 this year, the 9-digit BIN was introduced, as part of an effort to implement the VAT and Supplementary Duty Act 2012.

The notice was issued to clear confusion which arose after the government postponed the implementation of the VAT law for two years.

The online registration for value added tax was introduced to clean NBR's database, which now has 8.5 lakh manually-issued 11-digit BINs. Of them, only 37,000 submit returns regularly.

The tax collector now suffers from many non-existent entities and insignificant number of returns.

About 43,289 firms have so far received 9-digit e-BINs. Many of them termed the online registration system business-friendly, the NBR said.

“Online registration is no way linked with the new VAT law,” the NBR said.

Firms having many units that are now doing business by completing central registration with 11-digit BINs will also have to sign up for the 9-digit e-BINs.

Firms that operate businesses from various places and have separate BIN for every unit or branch will also have to obtain 9-digit BINs for each of the units, the NBR said.

If a firm has a single taxpayer identification number (TIN), each of its units will have to use the same TIN to submit VAT returns and carry out business, it said.

The firms with separate BINs for every unit will also be allowed to apply for central VAT registration, the NBR said.

“Central registration is optional under the VAT Act 1991. A company can get that if it wants to,” a senior official of the NBR said seeking anonymity.

The NBR also said it would go for a revision to make the online system compatible with the VAT Act 1991.

Recently, a mission of the World Bank, which provides a majority of funds for the Tk 550 crore VAT online project, suggested for continuation of the VAT system automation to increase domestic revenue collection.

VAT, also known as consumption tax, is the biggest source of revenue for the state.

The NBR fetched Tk 66,891 crore as VAT from local businesses in 2016-17, which was 36 percent of the total collected revenue.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments