Microinsurance for Climate-resilient Bangladesh

"Agriculture is the main pillar of Bangladesh's economy as it ensures basic food security. But the sector has been facing challenges from many natural calamities, such as riverbank erosion, cyclones, flooding and drought, over the years due to climate change. I am happy to note that more than 9 lac Farmers have adopted Crop and livestock insurance through BMMDP programme with support from the Embassy of Switzerland. I am even more impressed to see that these huge numbers of farmers paid for the insurance premium from their own pocket and without any subsidy from Government or from the development partners. It is even more comforting to note that the adoption of such non-subsidized microinsurance service in Bangladesh would reduce the expenditure burden on the Government of Bangladesh (GoB) for climate change adaptation and disaster recovery." said the Chief Guest Mr. Mouhammad Abdul Mannan, the Planning Minister of Bangladesh

PROLOGUE

The closing ceremony of Bangladesh Microinsurance Market Development Programme (BMMDP) 'Deep Dive into Bangladesh Microinsurance Market - Learning and Way Forward.' took place on 22nd June 2023 at Sheraton Dhaka with several distinguished guests in attendance. The Chief Guest Mr. Mouhammad Abdul Mannan, the Planning Minister of Bangladesh, along with Special Guests Mr. Mofiz Uddin Ahmed, Additional Secretary, Financial Institutions Division, Ministry of Finance, Mr. Moinul Islam, Member, Insurance Development and Regulatory Authority (IDRA) and Mr. Md Anwar Hossain, Director, NGO Affairs Bureau, Ms. Corinne Henchoz Pignani, Deputy Head of Cooperation, Embassy of Switzerland in Bangladesh emphasized the importance of microinsurance in addressing the economic losses caused by climate change.

The event proceedings started off with four presentations from the key stakeholders of BMMDP. Mr. Farhad Zamil, Country Director, Syngenta Foundation for Sustainable Agriculture Bangladesh (SFSA-B) presented on weather index-based crop insurance delivery model, associate services, risk coverages, and the key achievements. Mr. Kamrul Hasan, Manager, Palli Karma Sahayak Foundation (PKSF) presented on strengthening resilience of Livestock farmers through risk reducing services offered under BMMDP, the major activities and the challenges that they encountered. Mr. Md. Arafat Hossain Team Leader, BMMDP-Swisscontact presentation entailed the achievements, innovations, sustainability features and key enablers for future development of agriculture microinsurance in Bangladesh. Lastly, Ms. Zinia Rashid PhD, Senior Programme Officer, Embassy of Switzerland in Bangladesh presented on the way forward for BMMDP and the strategic focus of the programme in the new phase.

The presentations were followed by a panel discussion. The discussion was moderated by Jalalul Azim, the Managing Director and CEO of Pragati Life Insurance. The panel was comprised of Mr. Syed Moinuddin Ahmed, Additional Managing Director, Green Delta Insurance Company, Mr. Badal Chandra Rajbangshi, CFO, Reliance Insurance Ltd, Wasiful Haque, General Manager & Managing Director (AC), Sadharan Bima Corporation and Fahad Ifaz, Co-founder and CEO, iFarmer.

During the event, it was highlighted that Bangladesh has suffered significant economic losses of $3.72 billion due to climate change in the past 20 years. The country, ranked as the seventh most vulnerable to climate change globally, has a large population of about 53 million people exposed to "very high" climatic risks. The agricultural sector, crucial for economic growth, is particularly affected by climate change vulnerability.

BMMDP, funded by the Swiss Embassy and anchored by the Financial Institutions Division under the finance ministry and NGOAB under PMO and managed by Swisscontact, focused on piloting and testing different insurance products and distribution channels to identify and develop appropriate crop and livestock insurance products, as well as promote sector capacity development by means of action research, policy research, and use case generation.

The programme, known as Surokkha, has already reached over 1.5 million farmers in 51 districts, providing coverage for 56,000 acres of land under crop insurance.

Officials at the event expressed concerns about the slow growth of microinsurance in Bangladesh relative to the country's expanding economy. Moinul Islam, Member, Insurance Development and Regulatory Authority, emphasized the need for attention to this issue. The event underscored the importance of microinsurance in enhancing the economic resilience of smallholder farmers and micro, small, and medium enterprises in the face of climate change impacts on the agricultural sector.

In summary, the event highlighted the economic losses Bangladesh has incurred due to climate change and the vulnerability of the agricultural sector.

The highlight of the event was to discuss the challenges associated with creating a conducive regulatory environment for microinsurance and how to overcome them by means of a collective effort.

The project experience demonstrated the significance of microinsurance in mitigating these climatic challenges without increasing the burden on government expenditure for climate change adaptation and disaster recovery.

CONTEXT & BACKGROUND

The absence of microinsurance leaves farmers highly vulnerable, perpetuating poverty cycles and hindering investments. To address this issue, expanding insurance coverage is imperative. By offering appropriate microinsurance options, farmers can confidently invest in agriculture, leading to increased productivity and reduced climate-related risks. This approach would alleviate poverty, enhance food security, and fortify the resilience of Bangladesh's agricultural sector.

Recognizing the need to support Bangladesh's microinsurance sector, the Embassy of Switzerland in Bangladesh embarked on a mission to investigate the potential of Microinsurance in reducing farmers' vulnerability to climate-induced risks. Without proper access to insurance, Bangladesh's smallholder farmers' only available strategy for reducing exposure to weather risks is to limit their investment in high-value inputs and diversify into off-farm activities. "Low investment, low return" risk reduction strategies condemn smallholders to remain in or lead a life perpetually on the brink of poverty.

Therefore, The Embassy of Switzerland of Bangladesh recognised there was a need to support the insurance sector in Bangladesh. The Embassy aims to empower farmers to better manage risks and mitigate the adverse impacts of climate change. This initiative holds promise for fostering sustainable agricultural practices, enhancing livelihoods, and creating a more resilient economy for Bangladesh.

PRODUCT INNOVATION:

The BMMDP has been at the forefront of customer-centric product innovation in agriculture, introducing weather index-based crop insurance that triggers payouts for different weather perils for specific crops depending on location and climatic condition. With 22 types of crop insurance featuring consistent terms, farmers across sub-districts gain reliable protection. Besides weather-based insurance, the Area Yield Index Based Crop Insurance (AYII) for selected number of crops was also provided under the programme, compensating farmers for yield losses irrespective of weather or biological factors.

Additionally, BMMDP pioneered cattle health insurance, leveraging muzzle-based identification software for cost-effective cattle identification.

To enhance accessibility, the programme implemented product bundling, combining insurance with agri-input services. The insured farmers also had access to forward market linkage, empowering them to sell crops at better prices and connect directly with large retailers. Moreover, BMMDP experimented with bancassurance, offering comprehensive coverage for liabilities (loans) and assets (livestock), effectively reducing risks for banks and facilitating financing in high-risk sectors through microinsurance tools.

PRODUCTS

Weather index-based crop insurance

SFSA-B developed weather index-based crop insurance and raised general awareness among local insurers. BMMDP facilitated partnerships between insurers and farmers through alternative distribution channels.

Area yield index-based crop insurance

BMMDP piloted area yield index insurance for potato and Boro rice, covering biological and weather-related perils. Collaboration with organizations like Brac Microfinance improved insurance product's acceptability among the rural customers.

Livestock risk mitigation services

BMMDP provided risk mitigation services for small-scale livestock farmers in partnership with Palli Karma Sahayak Foundation (PKSF) and 15 other organizations across 35 districts. Services included vaccination camps, financial literacy training, and financial risk mitigation product that included loan waivers for the mortality of the borrower or the insured cattle and rearing coverage.

Cattle health insurance services

BMMDP pioneered a cattle health insurance service in Bangladesh, partnering with agri-tech and insurance companies. It provided comprehensive coverage, including health services, using innovative technology for cattle identification.

WORKING STRUCTURE

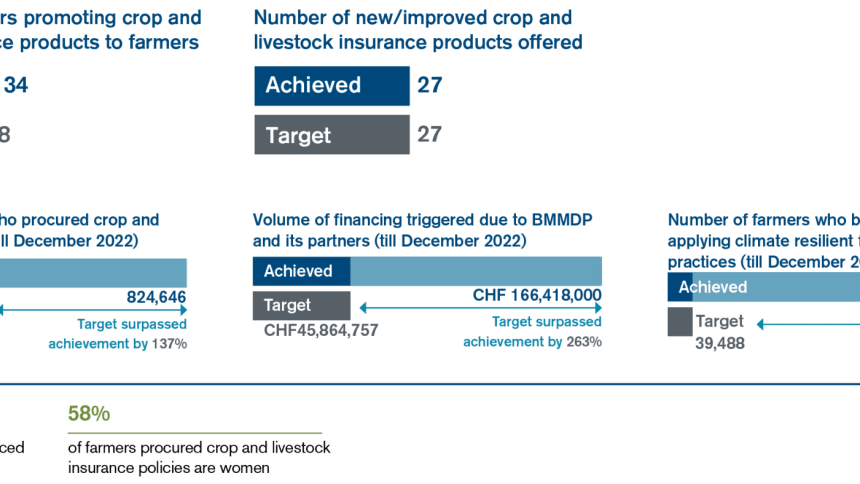

TARGET & ACHIEVEMENTS

Way Forward | Next phase of BMMDP

STRATEGIC FOCUS IN NEW PHASE

Market system development in microinsurance sector

To enhance microinsurance in Bangladesh, key steps include a supportive regulatory framework, strengthened capacity in microinsurance and reinsurance, innovative product development, efficient distribution channels, and widespread awareness campaigns.

Onboarding GoB through inclusion in ADP

The project aims to align its objectives with the government's development priorities and contribute to creating a favourable regulatory environment for microinsurance. For instance, the Government of Bangladesh (GoB) has highlighted the importance of insurance products and services in its 8th Five Year Plan (2020-2025) and other strategic plans and policies. In the 8th Five Year Plan, sections on 'Elements of Poverty Reduction Strategy' and 'Strategies for Crop Sub-Sector' specifically state that farmers need better access to credit, insurance, and agricultural services. The Prime Minister herself has acknowledged the role of microinsurance; Senior Secretary from the Ministry of Finance has committed to a goal of 25% of the total population having microinsurance coverage by 2025. The National Insurance Policy (2014) and the National Agricultural Policy (2018) call for the introduction of crop insurance systems, which will also complement the goals and objectives of the National Disaster Management Policy and the National Adaptation Plan.

VALUE ADDITION

The adoption of a non-subsidized microinsurance service in Bangladesh for climate change adaptation would reduce the burden on the Government of Bangladesh (GoB). This approach ensures that clients pay the premiums, making it financially sustainable. It promotes inclusivity by addressing inequality and aims to leave no one behind (LNOB). Moreover, it demonstrates a clear business case, showcasing its commercial viability in the market. By taking a systemic approach that encompasses the entire insurance value chain, including the demand, supply, and enabling environment, it effectively addresses the key constraints of the market.

GOAL:

Switzerland commits CHF 9.5 million to support Bangladesh for development of climate-sensitive microinsurance service and thereby enhancing resilience, food security, and inclusive economic growth.

OUTCOMES (AND OUTPUTS):

1. Conducive microinsurance policy environment

2. Climate-resilient, client-focused, viable microinsurance products and services

3. Increased demand through mass campaigns

LINE OF ACTION:

1. Conducive policy environment

To facilitate regulatory reform, the project plans to involve the Government of Bangladesh through the TAPP, with an active policy working group chaired by the Financial Institutions Division. It includes dialogue, policy recommendations, a separate donor sub-group, and technical support to the Insurance Development and Regulatory Authority (IDRA).

2. Climate-sensitive, client-centric products and develop support service market

The project includes a pilot catalytic fund and aims to introduce necessary support services in the field of insurance.

3. Mass awareness campaign for demand creation

To ensure broad and targeted communication, the project plans round-table discussions at the national level to sensitize policy actors. It will utilize print and electronic media at the institutional level, and engage with microfinance institutions, local NGOs, and corporate advertising agencies at the grass roots level.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments