Bankers, directors to be kept out of Shariah board

No bankers and directors will be able to hold any post in the Shariah supervisory committee of banks as the Bangladesh Bank changes rules to make lenders more compliant and curb irregularities.

The central bank has finalised the revised Islamic banking guidelines and it will be issued soon.

The Shariah supervisory committee plays a vital role in framing policies in strict adherence to Islamic principles.

The central bank is also working to set up a separate department to supervise Shariah banking after many lenders became financially weak due to loan irregularities.

According to the new guidelines, the Shariah supervisory committee will have to be formed with individuals experienced and knowledgeable in Islamic jurisprudence. Bankers and directors of a bank will be prevented from sitting in the board even if they possess such knowledge.

The central bank is revising the guidelines at a time when a majority of Islamic banks and the Islamic banking windows of conventional lenders are found to be not following Shariah principles properly.

What is more some are facing a huge liquidity shortage due to loan irregularities although Islamic banking has expanded massively in recent years.

"Bankers and board of directors hold posts in Shariah supervisory committees. This is a conflict of interest," said Mustafa K Mujeri, a former chief economist of the BB.

He said that all members of the committee will have to be conversant in Islamic laws.

"Only revising the guidelines will not be enough -- the central bank will have to take strict action against anyone if he or she violates the guidelines."

Mujeri, also the executive director of Institute for Inclusive Finance and Development, says the financial health of most Islamic banks is worsening day by day because they are not following rules.

The minimum number of members of the committee will be three while it will be a maximum seven, according to central bank officials who are involved in the process of revising the guidelines.

Currently, some banks have more than seven members in the body.

A number of senior bankers have opposed the provision that would bar them from becoming a part of the board.

Mirza Elias Uddin Ahmed, managing director of Jamuna Bank and a member of the bank's Shariah supervisory committee, told The Daily Star that he was yet to see the revised guidelines.

He, however, said: "Bankers are needed in the Shariah board."

Zafar Alam, managing director of Social Islami Bank, said he had received the draft copy of the revised guidelines and sent his opinions on some points to the central bank.

He also said: "The supervisory committee should be formed with bankers and persons knowledgeable in Islamic laws."

He argued in most cases, bankers have no knowledge about Islamic jurisprudence. At the same time, persons who are knowledgeable in Islamic jurisprudence have no practical knowledge about banking.

As per the revised guidelines, Islamic banks and Shariah-compliant branches and windows of conventional banks will not be able to transfer their interest incomes, including fines, to their income account of the balance sheet. The central bank will determine the part that will include the interests, said BB officials.

All of their products must comply with Shariah compliances and banks will be asked to submit reports about their Islamic banking activities to the central bank every two months.

Md Main Uddin, a former chairman of the Department of Banking and Insurance at the University of Dhaka, said the central bank will have to ensure that Islamic banks follow rules.

"It is a regulatory violation if Islamic banks don't have people who are expert in Islamic laws. And if an Islamic bank does not follow Shariah compliance, it is just like cheating customers."

He suggested the central bank resolve Shariah boards or committees if they are not formed in line with the guidelines.

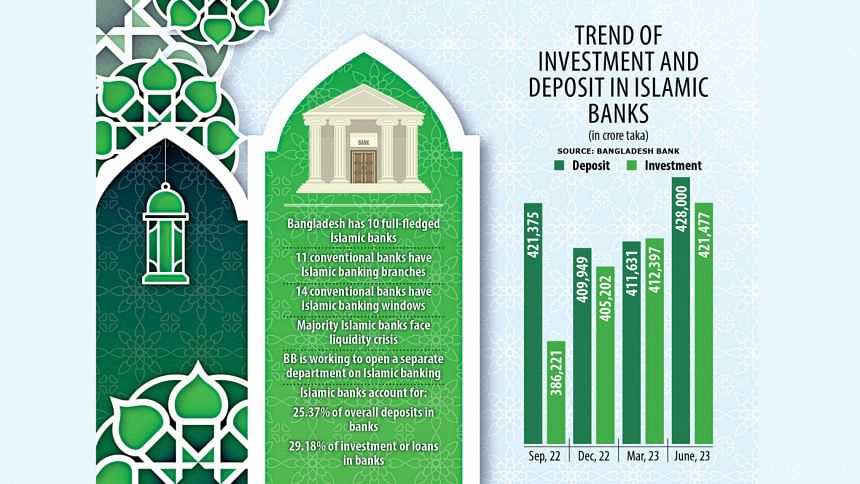

There are 10 full-fledged Islamic banks in the country: Islami Bank Bangladesh, Social Islami Bank, Al-Arafah Islami Bank, Exim Bank, Shahjalal Islami Bank, First Security Islami Bank, Union Bank, Standard Bank, Global Islami Bank, and ICB Islamic Bank.

Besides, there are 23 Islamic banking branches of 11 conventional banks and 588 Islamic banking windows of 14 conventional banks, central bank figures showed.

In terms of deposit mobilisation, Islamic banks hold 25.37 percent share of the banking sector. In terms of investments, their stake is 29.18 percent.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments