NBFIs' cost of funds falls to record low

The cost of funds for non-bank financial institutions has dropped to a record low, due to excess liquidity and poor demand for money, said industry insiders.

They attributed the low demand for credit to sluggish economic activities as new businesses are struggling to get gas and electricity connections.

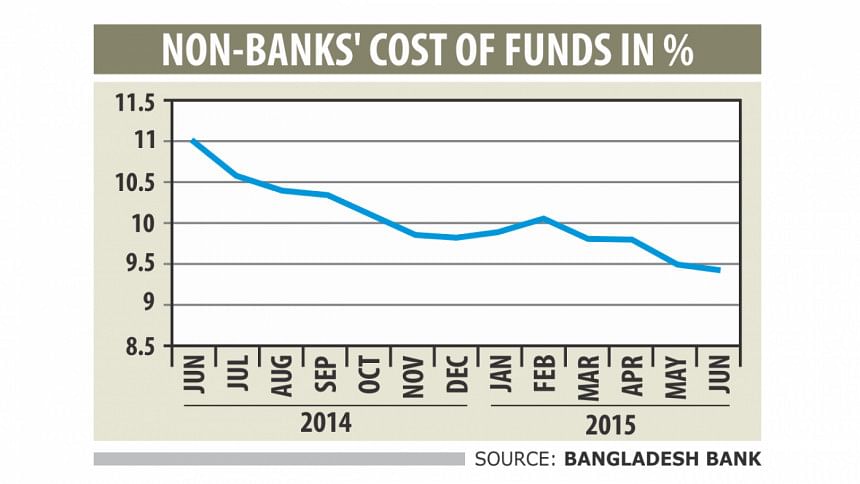

The average cost of funds for the non-banks dropped by more than 14 percent in June from the same month last year, according to Bangladesh Bank data.

The cost of capital was 9.41 percent in June, down from 10.99 percent in June last year. It was 12.46 percent in June 2013, a drop by nearly 25 percent in just two years.

The poor demand for money has also discouraged banks from taking deposits from customers. Banks are now offering less than 7 percent for a three-month fixed deposit, down from around 10 percent a year ago.

“The market has high liquidity because of low investment demand,” said Selim RF Hussain, managing director of IDLC Finance.

The situation is worse for many other NBFIs as they cannot diversify business or the sources of funds, unlike IDLC Finance.

Non-banks extend lease, loans and asset management services and their clientele base is anywhere from small and medium enterprises to large corporates. The 31 NBFIs operating in Bangladesh have to compete with 56 banks for business.

However, NBFIs' sources of funds are banks, individuals and corporate bodies. A majority of the non-banks still rely on banks for their funds; IDLC and United Finance (formerly ULC) collect around 80 percent of their funds directly from individual depositors.

“The demand for credit is sliding,” said Asad Khan, managing director of Prime Finance.

Even though political uncertainties have subsided, the demand for credit by the businesses is still low due to a crisis of gas and electricity, said Khan.

“I know a paper mill that is ready for operations, but it cannot do so, as it does not have gas and electricity connections.”

The situation is pushing the cost of doing business up for NBFIs as they have to pay back the depositors with interest, but they cannot invest the money. However, industry insiders said economic activity, which was badly affected by the political unrest in 2013 and in the first quarter of the current year, has improved in recent months. The demand for money by small and medium enterprises and retail consumers has been increasing in recent months, although it is still sluggish for the corporate sector, they added.

Income from stockmarket operations, a core area for many NBFIs, also improved substantially.

“I am hoping for better business in the months to come,” said Khan, also the chairman of Bangladesh Leasing and Finance Companies' Association.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments