SME loans on a roll

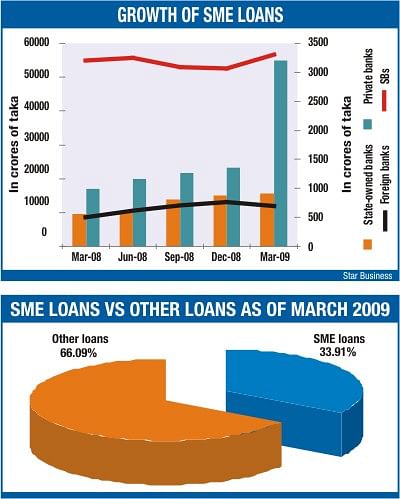

Loans to small and medium enterprises (SMEs) increased by 140 percent in just one year between March 2008 and March 2009, Bangladesh Bank (BB) data shows.

Total SME loans rose by Tk 44,243 crore to Tk 75,770.66 crore at the end of March 2009 compared to Tk 31,527.65 crore in the same month a year ago, mainly because of private commercial banks' aggressive lending to SMEs.

Thirty local private commercial banks disbursed Tk 37,892 crore during the time, while the SME loan portfolio stood at Tk 54,822 crore showing the figure at Tk 16,930 crore in March 2008. The growth rate was an amazing 224 percent between the periods.

“Diversification of loan portfolio, higher earning, urbanisation and above all central bank's motivational pressure have helped boost private banks' SME credit,” said Helal Ahmed Chowdhury, managing director of Pubali Bank.

AEA Muhaimen, managing director of BRAC Bank that lends on an average 8,000 SME customers a month, said: “Earlier, banks have failed to brand SME. Now they are coming up realising that the sector is the engine of growth.”

Prime Bank Managing Director M Ehsanul Haque said less demand in corporate lending prompts private banks to go for SMEs.

“Many banks are now redefining SMEs,” said Haque.

Prime Bank's SME loan increased by 27 percent in the last one year.

According to BRAC Bank's MD, SME loans account for the bank's 65 percent of the total loans, said Muhaimen.

Other banks such as state-owned, foreign, specialised and non-bank financial institutions are also marching fast to lend to SMEs.

The SME loans provided by state banks increased 62 percent to Tk 15,561 crore in March 2009 from Tk 9,604 crore in March 2008.

Foreign banks' SME loan has also marked a 36 percent rise in March this year from the corresponding month a year earlier. Outstanding SME loans of nine foreign banks stood at Tk 690 crore in March this year from Tk 506 crore in March 2008.

SME loans provided by non-bank financial institutions also rose by 8.11 percent to Tk 1,391 crore in March 2009 from Tk 1,287 in the same month of the previous year.

The lowest growth was for the specialised banks only 3.31 percent. Four specialised banks' SME loan portfolio stood at Tk 3,306 crore at the end of March 2009 from Tk 3,200 crore in March a year ago.

Bangladesh Economic Review released last week during announcement of the budget proposals for the next fiscal year said the BB has refinanced nearly Tk 646 crore to 15 banks and 20 non-bank financial institutions till March 2009 under its own refinance scheme. Around 6,236 SMEs have so far been refinanced under the scheme.

The central bank has a scheme of Tk 600 crore revolving fund to refinance the institutions lending to SMEs.

Besides its own fund, the central bank also refinanced Tk 206 crore and Tk 265 crore from two separate schemes funded by World Bank and Asian Development Bank respectively.

[email protected]

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments