Legal and Policy implications on Commerce and Investment during Pandemic

The COVID-19 pandemic is affecting the economy around the world. The IMF has identified three areas of the Bangladesh economy that have been hugely impacted by this pandemic. Firstly, the domestic businesses are being severely hit due to the lockdown measures; secondly, the export sector, particularly in the RMG sector has also seen a sharp decline; and thirdly, the sources of foreign remittance from migrant workers has significantly fallen down. On the other hand, as more European businesses shift their focus from China, Bangladesh, as a budding investment hub, has the opportunity to improve its favourability in receiving more foreign investment.

To discuss these issues from legal and policy perspectives, Law & Our Rights, The Daily Star organised the webinar on 'Legal Implications on Commerce and Investment during Pandemic' on 14 July 2020. Mohammad Golam Sarwar, from Law Desk and also a Lecturer in Law, University of Dhaka moderated the webinar.

Dr. Rumana Islam, Professor of Law, University of Dhaka

Bangladesh is a party to 32 BITs (numbers differ between 31 and 33 as well) but unfortunately not all the BITs are accessible. Bangladesh has signed multilateral and regional treaties as well, such as the SAFTA, the BIMSTEC, the MIGA, and notably, the ICSID which is the Convention relating to the settlement of investment disputes. Bangladesh is also a party to the WTO and the WIPO treaties and has signed some double taxation agreements as well. In March, an online service was launched to improve the ease of obtaining services digitally. In the past decade, attraction of foreign investment has been a top priority which is reflected in the UNCTAD report of 2018 showing that the foreign direct investment (FDI) flow has gone up by 68%. Dedicated EPZs have also been created as incentives. Foreign investors can invest in almost every area except four – the regime is liberal and there are also tax holidays provided as incentives. The fact that Bangladesh is a party to the ICSID Convention and the New York Convention, enforcement of awards is a big advantage in attracting foreign investment.

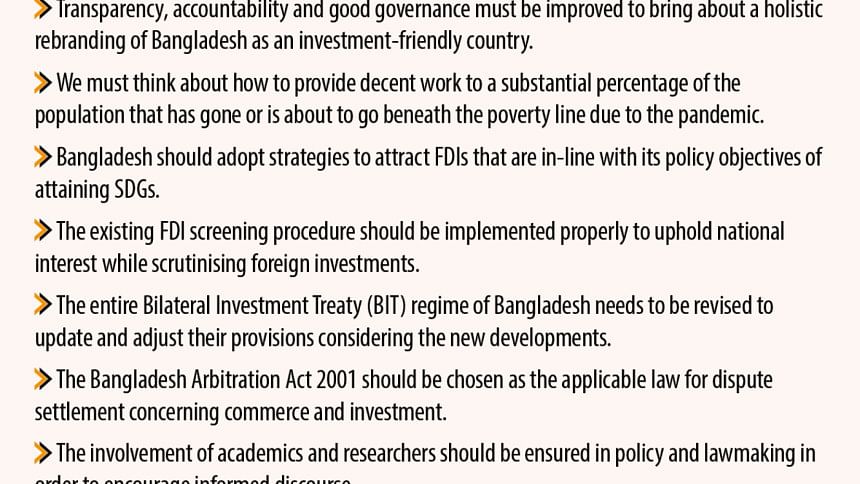

However, it is often argued that the entire BIT regime of Bangladesh needs to be revised; for example, India has undertaken a nationalistic approach and has adopted a model BIT in 2016. This is an instance we can take note of, because in the post-pandemic world, Bangladesh will need sufficient regulatory space with regard to its foreign investors. The current framework may lead to disputes against Bangladesh as most of the treaties do not envision public health emergencies like the present one.

Professor Dr. Mustafizur Rahman, Distinguished Fellow, Center for Policy Dialogue (CPD)

Once Bangladesh graduates from its LDC status, it will no longer receive some of the market access and preferential treatment, including in the RMG sector. This is a vital concern at present, specially with regard to the impact of the pandemic. Although more initiatives are being undertaken to attract FDI in recent times, we have been falling short of meeting the goals. For example, we received 12 billion dollars in foreign investment against the expected 30 billion dollars envisioned in the 7th Five Year Plan. This means that despite the legal and policy incentives, we are unable to attract the expected amount of FDI inflow. It is also seen that the rate of re-investment is higher compared to new investments which means that we are not attracting enough new investors. If we look at the example of Vietnam whose GDP is close to that of ours, we will realise that they have a substantially larger FDI inflow, mostly from the export-oriented businesses facilitated through their special economic zones.

We are going through a three-dimensional risk including health risk, economic risk and humanitarian risk. Without addressing our health risks, we cannot really proceed with economic revival. A good idea might be to incorporate foreign investment in the development of our infrastructure including power and health sectors. Now is the time for us to confluence many positive opportunities; we must act soon to utilise this window of opportunity. We can prioritise sectors which are strategically important to our policy objectives, specially relating to sustainable development goals (SDGs), and work to attract foreign investment in these areas.

We must also think about how to provide decent work to a substantial percentage of the population that has gone or is about to go beneath the poverty line due to the pandemic. They will have to be given employment opportunities in the industrial sector. Furthermore, we must look beyond the RMG sector and explore other industries for diversification.

Md. Sirazul Islam, Executive Chairman, Bangladesh Investment Development Authority (BIDA)

BIDA is progressing in a planned and calculated manner in order to ensure the improvement of ease of doing business. The International Finance Corporation of the World Bank is providing assistance to the BIDA. This year, an additional indicator has been incorporated in the World Bank's ease of doing business. We hope that a substantial improvement will be seen in the coming days. 23 reforms in 7 of the 10 indicators have been submitted. As per the guidance of the Hon'ble Prime Minister, BIDA will be consulting with the relevant ministries and government agencies to discuss the plans of action and possible reforms.

The framework on which the World Bank measures the ease of doing business is quite narrow – an improvement in the index might not necessarily improve the FDI inflow. So, the government is working in other areas as well. One stop service (OSS) platform is specially pertinent in the post-pandemic 'new normal' as it aims to digitise the relevant services. The platform is providing 19 services relating to NID, Tax certificate, registration, etc. Although government offices were closed, online services have been provided to businesses. Last year, we signed MoUs with six organisations and this year, we signed with six more. Ten more MoUs are under consideration. A business needs 150 services from about 35 government agencies and we hope to incorporate all these services within the OSS platform. We are aiming to provide at least 50 services online by the end of the year. Moreover, BIDA is conducting an entrepreneurship and skills development project to incentivise the youth to participate in business ventures.

The next two years will be years of survival and attracting foreign investors should be our priority during these times. But at the same time, we must ensure that our national interests are safeguarded, for example, FDI should be used to improve employment opportunities for our people.

Shah Monjurul Hoque, Advocate, Supreme Court of Bangladesh

Most of the laws specifically addressing foreign investments are recent and as such, they have not been tested out before courts. However, a strong infrastructure has been built in the meantime. Foreign investors prefer to take their arbitration outside the country. Unfortunately, arbitration procedures are long-drawn and costly in our legal system. All domestic laws are relevant for foreign investors, so merely reforming investment laws will not suffice. Investors looking to acquire lands may face many difficulties due to bureaucratic hurdles. These areas should be addressed.

On a different note, The FDI screening procedure should address various factors including health, environment and most importantly the security issues of the host country. India, for example, has recently changed its policy protecting their national interest. As per the new policy, all investments from border sharing countries of India will require the prior approval of the Indian Government.

Furthermore, we should ensure that the Bangladesh Arbitration Act 2001 is chosen as the applicable law for dispute settlement. Laws relating to foreign exchange, loan recovery, money laundering are also pertinent in this context and should be properly implemented.

Barrister Anita Ghazi Rahman, Advocate, Supreme Court of Bangladesh

Foreign direct investments comprise three types of transactions: equity finance, reinvestment of earnings and intercompany loans. Bangladesh Bank has recently issued circulars widening the scope of intercompany loans. It has also issued a circular to ease the process of repatriation of sale proceeds to foreign residents in order to attract more foreign investments. This is in contrast with other countries imposing more stringent measures. This is a window of opportunity for us and the government has taken excellent initiatives.

Although Bangladesh has been home to some of the largest social enterprises, the legal framework has not been updated to accommodate them. Bangladesh has a two-tiered system where for-profit and not-for-profit ventures have to operate separately. In contrast, countries like the USA allow for a joint entity that can have both for-profit and not-for-profit activities. Social enterprises can be brought within the scheme of 'alternative investment' as laid down by the Bangladesh Securities Exchange Commission rules, but the law does not provide a proper definition of such investment. A third entity between a company and non-profit should be recognised now. Although the ICT division is providing grants to non-profit organisations, it should also provide the same to social enterprises which may even help them gain revenue.

The event report is prepared by Law Desk, The Daily Star.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments