Stocks fall for seventh straight day. Here’s why

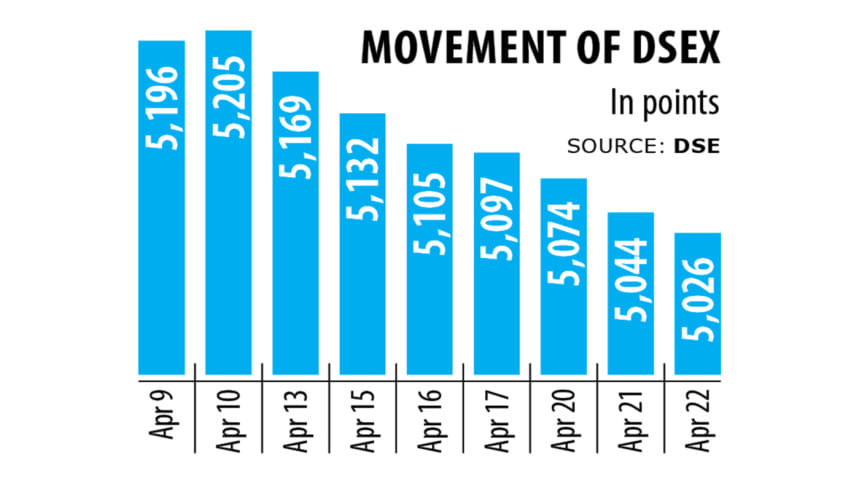

Stocks fell for the seventh straight trading day at Dhaka Stock Exchange (DSE) yesterday as cautious investor sentiment continues to drive the market downwards amidst a confidence crisis.

The benchmark DSEX index opened the day on a positive note, gaining 4.17 points, or 0.08 percent, till 10:30am.

However, the momentum did not sustain, and the index eventually dropped 18.27 points, or 0.36 percent, from that on the day before to close at 5,026.

The Shariah-based DSES index declined 0.41 percent to end at 1,121, while the DS30, which comprises blue-chip stocks, fell 0.18 percent to 1,859.

At Chittagong Stock Exchange, the CSE All Share Price Index declined 0.49 percent to 14,065.36.

Turnover at the DSE, meaning the total value of shares changing hands, a key indicator of market activity, declined 3 percent to Tk 340 crore yesterday.

Of the 395 issues that were traded, prices of 119 advanced, 214 declined, and 68 remained unchanged.

MBL 1st Mutual Fund was the top gainer of the day, surging 9 percent, while shares of Beach Hatchery lost 9 percent — the highest fall.

Abdul Mannan, an investor, said the stock market has remained downbeat as investors are not seeing any hope of getting good news from the listed firms amidst the prevalence of a challenging environment for businesses.

Many listed firms have already published lacklustre financial reports for recent quarters. So, it has had an impact on their share prices. However, most of the listed banks showed handsome operating profits this year.

Still, the high operating profits could be eaten by their bad assets and high non-performing loans, apprehend investors.

Investors are losing confidence as they sense a lack of coordination within the Bangladesh Securities and Exchange Commission (BSEC), said Saiful Islam, president of the DSE Brokers Association of Bangladesh (DBA).

So, it is not showing the right direction regarding stock market-related issues, he said.

For instance, brokerage houses have been seeking directives for the last couple of months regarding adjustment of their negative equity issues. For this, they have been unable to prepare their financial reports, he claimed.

The deadlines for allowable provisioning against negative equity and unrealised loss expired last December 2024 and February 2025 respectively.

This would compel brokers to maintain full provisioning or write-off of negative equity against margin loan accounts in order to comply with accounting rules of International Financial Reporting Standards (IFRS).

Full provisioning against unrealised losses in dealers' portfolios would compel almost all brokers in the industry to recognise substantial and unsustainable losses at once although some part of it is actually contingent upon market sentiment.

Yesterday, top officials of 20 leading brokerage houses were finally able to meet the BSEC top brass at the latter's office in the capital in order to discuss the negative equity issue.

A clear message came only yesterday, said Md Saifuddin, vice-president of the DBA.

The BSEC ordered submission of a plan on how the loss will be written off with full details of time schedule considering capital, capacity, and loss size of every dealer, he said.

"To me, it is the right decision because the capacities of all the houses are not the same. Other brokers also did not disagree with it," he said.

So, they will inform how and when they will write those off. After getting their suggestions, the BSEC will review it and allow them so that this problem gradually ceases to exist, he added.

"We had failed to get a direction on this issue though we sought it several months earlier on whether the deadline would be extended or not," said Islam, president of the DBA.

"On the other hand, investors think that the BSEC is not functioning well. So, no new good companies came in the last 7-8 months through initial public offerings though the market lacks good companies," he said.

The government is also not focusing on the stock market. So, investors are losing confidence in the market, which kept them on the sidelines, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments