Steel sector still in a shakeout

Steel manufacturers registered around 40 per cent less turnover last year compared to 2019 as they were forced to sell finished products at lower prices in the face of low consumption, according to industry insiders.

The millers even had to offer additional commission for the dealers in order to make sure that they had enough liquidity to survive the ongoing coronavirus pandemic.

During the pre-pandemic period, the production cost of 60 grade MS rod stood at about Tk 58,000 per tonne.

"But in the April-June quarter, the millers had to sell it at Tk 50,000 to Tk 52,000 per tonne due to low demand, which prevailed until September-October," said Md Shahidullah, secretary general of Bangladesh Steel Manufacturers Association.

The millers were compelled to sell their finished steel for lower than the production cost in order to ensure liquidity.

Meanwhile, previously imported stocks of raw materials were exhausted after demand picked up in July, when construction on all the government projects resumed, said Shahidullah, also managing director of Metrocem Steel.

Besides, the price of scrap steel and other raw materials used in the industry rose $100 to $120 per tonne in the international market due to a disruption in the global supply chain caused by Covid-19.

Millers now import scrap for about Tk 40,000 per tonne while it was Tk 30,000 during the pre-pandemic era, he added.

Manufacturers need to spend Tk 20,000 per tonne on an average to produce finished products, taking the production cost to Tk 60,000.

Against this backdrop, the manufacturers have no scope to make profit as they are dependent on imported raw materials.

The annual requirement of scrap steel is about 8 million tonnes, of which only 25 per cent is collected locally while the remaining 6 million tonnes is imported.

But despite the price increase, demand is yet to gain momentum, Shahidullah said.

Echoing the same, SM Khorshed Alam, president of the Bangladesh Association of Construction Industry (BACI), said the price of MS rod increased 25 to 30 per cent in November-December last year.

"So, the government should include a provision to adjust the price with the current one in public procurement rules," he added.

Besides, the price could be reduced to a reasonable amount by adjusting tariff, value-added tax and advance income tax, according to the BACI chief.

Shahriar Jahan Rahat, deputy managing director of KSRM Group, said the steel industry had witnessed sharp growth amid fierce competition during the pre-pandemic period.

The heightened competition was a result of investment without market research and the installation of additional production capacity, which surpassed total consumption in the local market.

Manufacturers also sold their finished products at a great discount in order to make enough money to repay bank loans and keep their factories operational during the two-month "general holiday".

Between March 26 and May 30, the government imposed a complete lockdown of all economic activities, including its development projects, in a bid to curb the spread of Covid-19.

This led to unhealthy competition in the domestic market as everybody wanted to sell off their stocks, Rahat said.

Companies had to offer commissions of up to Tk 1,500 per tonne to their dealers while it was Tk 1,000 to Tk 1,200 per tonne during normal times, he added.

According to the deputy managing director, the industry will need at least three to four years to recover from the losses faced in 2020.

The KSRM plans to set up its own captive power plant to reduce energy and operational costs while also building efficiency within its existing manpower.

It will invest Tk 500 crore to set up the 56 megawatt power plant, Rahat said.

Small-scale steel mills suffered the most from the ongoing crisis due to a lack of orders and subsequent capital shortage.

Annual consumption rose 15 to 20 per cent from 2017 to 2019 while it was 10 per cent per year before that. Rod consumption reached about 6 million tonnes in 2019 while the sector has an installed annual production capacity of about 110 million tonnes.

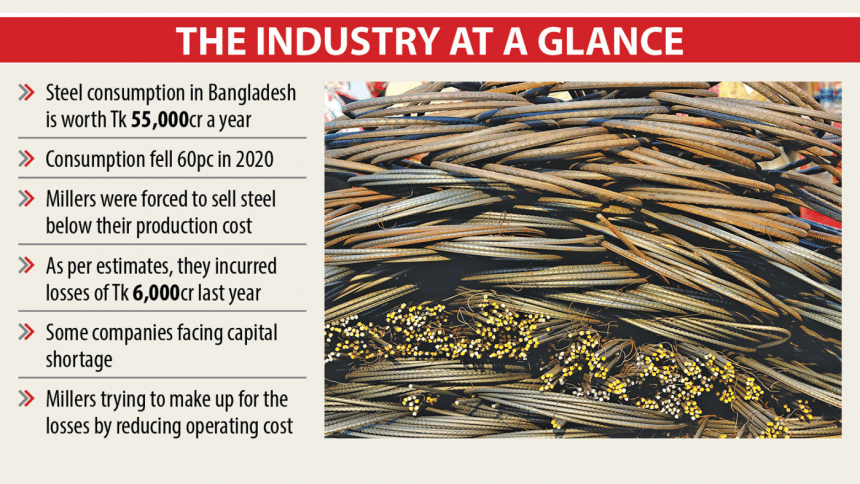

The steel industry in Bangladesh is worth Tk 55,000 crore.

There are about 40 active manufacturers with a combined capacity to produce nine million tonnes of steel a year. Of them, Abul Khair Steel, GPH Steel, BSRM and KSRM meet more than half of the annual demand of eight million tonnes.

"Like other sectors, the steel industry did not witness good times in 2020 as it was tough for the manufacturers to achieve 50 per cent of the sales target by the end of the year," said Manwar Hossain, president of Bangladesh Steel Mills Owners Association (BSMOA).

"Personally, I would be happy to have reached 50 per cent of the target," he added.

According to Hossain's estimates, the sector's turnover will likely fall to Tk 33,000 crore this year while the market size was Tk 55,000 crore in 2019.

Total consumption in 2020 was about 3.6 million tonnes while it was around 6 million tonnes in 2019.

The manufacturers also faced losses for having to run al lower than their capacities.

Most factories had to operate at below 50 per cent production capacity due to low demand, industry insiders said.

Besides, the manufacturers are now facing a shortage of raw materials as suppliers could not supply steel scraps when the peak season started in November.

"The steelmakers' losses for the year amounted to around Tk 6,000 crore," Hossain said.

Tapan Sengupta, deputy managing director of Bangladesh Steel Re-Rolling Mills, said the steel sector was connected to the country's overall economy.

The economy faced a serious crisis due to the Covid-19 fallout while a second wave of infections has prevented development works from returning in full swing.

"So, the steel sector will get better when the country's economy will be better," he added.

The government's infrastructure projects account for 35-40 per cent of the total steel consumption in Bangladesh, up from 15 per cent a decade ago.

If a steel factory can run at 60 to 70 per cent capacity, it should be able to maintain a break-even point.

Sengupta also said the price could increase further as the price of steel scrap is on the rise.

According to him, scrap is selling at $480 per tonne now while it was $270 in April.

"The price of steel scrap rose as China is importing steel whereas the country had exported finished products before the pandemic. If China imports the scrap, nobody can say how much the price will increase," he said.

Manufacturers had to adjust the cost, causing the price to go up. However, the price is still at a tolerable level in Bangladesh compared to other countries, Sengupta added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments