Old interest rates on postal savings from Mar 17

The government yesterday walked back on its decision to slash the interest rates on ordinary and fixed deposits in Post Office Savings Bank, with the previous rates to return from next month.

"The previous rates of interest will be applicable from March 17 when we complete the automation of post offices," Finance Minister AHM Mustafa Kamal told reporters yesterday at his office in Dhaka.

The disclosure came two weeks after the finance ministry slashed the interest rates on the three-year tenure fixed deposit in postal savings banks to 6 per cent from 11.28 per cent -- a move that sparked outcry from various quarters.

Termed as Post Office Savings Bank, there are more than 50 lakh deposit accounts in this bank and marginal and low income people from rural and suburban areas mostly park their savings here, said officials of the Bangladesh Post Office earlier.

The finance ministry reduced the interest rate amid mad dash from a section of wealthy people to open accounts in postal savings bank to deposit money after the government tightened rules on investment in the high interest-bearing national savings certificates to prevent abuse of the benefit given by the state to pensioners and middle-income families, Kamal said yesterday.

The rules, which were stiffened last year, stipulated that savers would have to submit taxpayer identification number (TIN) to buy national savings certificates.

The instruments carry interest rates as high as 11.76 per cent, which is way higher than what banks offer.

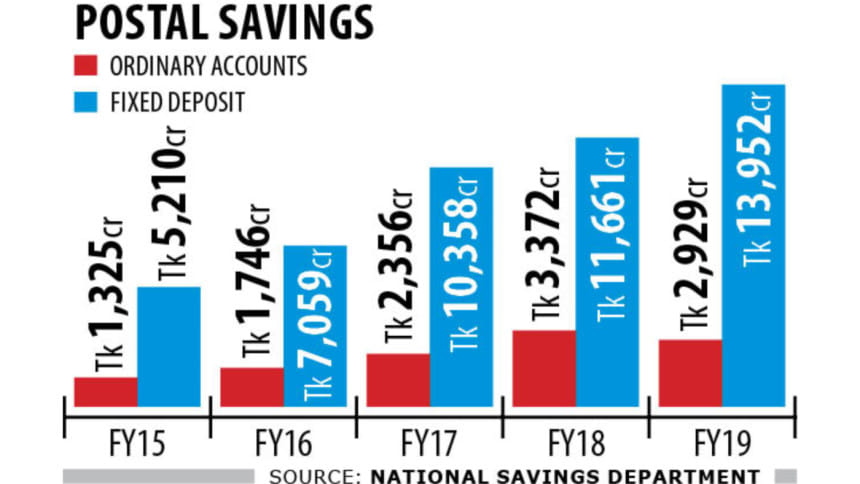

As a result, fixed deposits in postal saving bank soared 66 per cent year-on-year to Tk 11,730 crore in the first half of the fiscal year, according to data from the BPO.

At the same time, investment in savings certificates sold by post offices plummeted 88 per cent to Tk 1,870 crore.

"When we saw all were running to post offices, we had to think of controlling the rush. And the interest rate cut was one of the tools," Kamal said.

As the automation of post offices is underway and is likely to complete by March 17, Kamal said depositors in postal savings accounts will see the previous rates of interest.

"We will ask for the national identification number and TIN after the automation. We want to know the persons who are keeping money there. This is to prevent the misuse of the benefit," he said, adding that the ceiling for the highest deposit by an individual would remain unchanged at Tk 30 lakh.

The government, however, will not want to see documents of the savers keeping up to Tk 2 lakh in deposits and they will get more than 11 per cent interest rate.

The exemption will be given considering the condition of many people, including the elderly, he said.

The government offered higher interest on savings certificates for the benefit of marginal people.

"But the scope was misused. Those who were entitled to the benefit were not getting it. Instead, others benefitted."

The automation has already taken place at banks. This has cut the scope for misuse.

"None will be able to exceed the investment limit in savings certificates," he said.

The ceiling for the highest investment in savings certificates doubled to Tk 50 lakh for individuals and Tk 1 crore under joint names. The investment ceiling for pensioner savings certificates will double to Tk 1 crore.

When asked why people retiring from private jobs have been discriminated in favour of people retiring from public services, the finance minister said: "We will not be able to afford all of them."

Prior to the briefing of Kamal, the Directorate of National Savings (DNS), which oversees savings certificates and deposits in Post Office Savings Bank, clarified that the interest rates for savings certificates have not been reduced.

The interest rates on the ordinary and fixed deposits in postal savings bank have been cut in line with a government directive, which is seeking to bring down the lending rates at banks to single digit with a view to encouraging investment.

The deposits in the Post Office Savings Bank were more than a fifth of Tk 83,630 crore of investment made by people in various types of savings certificates, bonds and government schemes in fiscal year 2018-19, data from the DNS showed.

The deposits accounted for 14 per cent of the government's accumulated liabilities as of June 30 last year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments