No syndicate in rice market: BIDS study

There is no syndicate in the rice market but 50 large mills have the capacity to influence the supply and prices of the staple food, finds a study of the Bangladesh Institute of Development Studies (BIDS).

“We have to really think about the big auto rice millers,” said BIDS Senior Research Fellow Nazneen Ahmed.

“There are very big auto rice mills and some of them have 400-500 tonnes of daily processing capacity,” she said while presenting the findings of the study on the rice market in Bangladesh and the role of key intermediaries at the Research Almanac 2019.

The BIDS organised the two-day event to present the findings of various researches at the Lakeshore Hotel in Dhaka. Former finance minister AMA Muhith inaugurated the event in the morning.

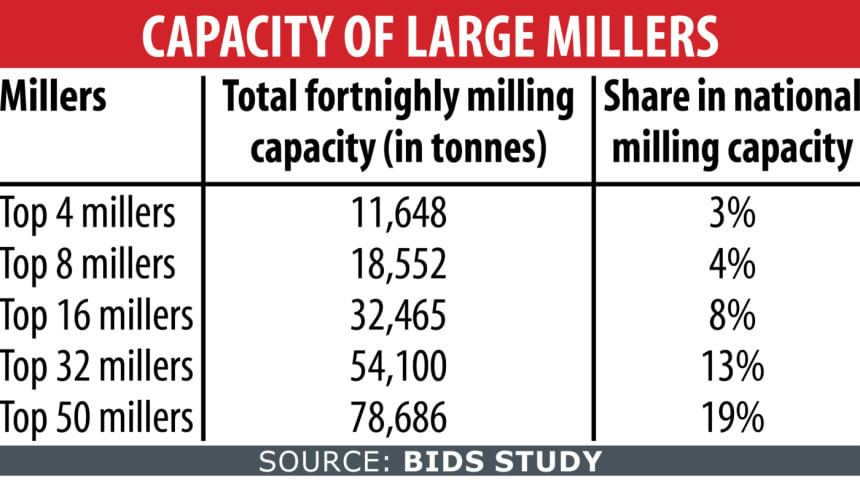

Nazneen, citing food ministry data, said the top 50 rice mills out of 949 auto rice mills have around 20 percent of the total fortnightly rice milling capacity in the country.

“We don’t know whether they are engaged in any syndication but what we are trying to say is that they are very big and they can store high quantity of rice legally,” she said, suggesting monitoring of the activities of the large mills.

“It is not that they are doing syndication but if they retain rice for two more days or up to 20 days instead of 15 days during any crisis, they can naturally influence the price,” said Nazneen.

She said rice and paddy could be retained by auto rice millers who are part of large corporates. “They are the ones who have natural capacity to have some influence over the market.”

The study was carried out among 88 traders in four major rice districts -- Dinajpur, Bogura, Kushtia and Naogaon. In addition, wholesalers in four major rice markets -- Badamtoli Babubazar, Karwan Bazar, Mohammadpur Krishi Market, and Cantonment Kochukhet Bazar in Dhaka city -- were interviewed. Secondary data were also used for the study.

Co-authored by BIDS Research Fellow Mainul Haque and Research Associate Nahian Azad Shashi, the paper said traders known as middlemen play a major role in moving paddy from farmers to millers or stockists or commission agents.

It found the dominance of millers who procure paddy mostly during the harvesting season when prices remain low and store the grains to continue milling for several months until the next harvest takes place.

Mills, as per laws, can store paddy five times their milling capacity for 30 days and rice twice their fortnightly milling capacity.

So, if a mill stores grains as per law, the person can’t be called hoarder legally, Nazneen said. She, however, added that they found during their field visits to 16 mills that 12.5 percent mills had higher storage capacity compared to their milling capacity.

“We have also found that very big millers have grain in the hands of aratdars (stockists or commission agents) and other actors in their chains. Very big mills can afford this, small and medium-sized millers can’t.”

The researchers analysed the trend of wholesale and retail prices of fine, medium and coarse rice since 2006 and found seasonality as one of the major factors for variation in rice prices.

The researchers found that the gap between wholesale and retail prices widens during the slack season, meaning prices go up prior to harvesting of paddy.

“At that time, it is natural that prices would go up because of low supply. So, if prices increase at that time, apparently it would not be right to think there is anti-competitive behaviour or collusion in the market,” said Nazneen.

There is competitive behaviour among the actors in the market. “Apparently there is no syndicate. We can’t say strongly that there is anti-competitive behaviour,” she said.

The study found the link of the price hike with the low stock of grains at public warehouses and suggested the government monitor food stocks in public godowns.

Prof Shamsul Alam, a senior secretary and member of the General Economics Division under the planning ministry, said the study findings show there is no market concentration. No certain group can influence the market alone.

“In broader sense, what I can say is that the rice market works competitively,” said Alam. He recommended taking timely measures to provide objective data on demand, production and import.

He said the market would function properly if price, supply and demand are forecast timely. A price commission can be formed, said Alam, who was also critical about production and demand estimates of rice and onion.

At the opening session, Prof Alam said Bangladesh should have 50-60 lakh tonnes surplus rice if the production estimates were accurate.

He said production and demand estimates of onions are done by government agencies. If production is 22 lakh tonnes and demand is 24 lakh tonnes, why aren’t prices falling even after large imports?

“We need to do some soul-searching before blaming businesses,” he said.

In his speech, Muhith said the current pace of economic growth of Bangladesh would continue for two-three years.

“But we have to be careful about international developments,” he said, suggesting following the economic situation in India as developments in the neighbouring country can influence Bangladesh economy.

Muhith stressed maintaining the achievements in the social sector and increasing national savings. “Our savings are very low, one of the lowest in the world.”

Former Finance Minister M Syeduzzaman and Planning Division Secretary Md Nurul Amin also spoke in the opening session, which was chaired by BIDS Director General KAS Murshid.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments