Lending through agent banking rises 41%

Loan disbursement through agent banking outlets rose by a massive 41.27 percent year-on-year as of March this year mainly thanks to the easy processing system, low transaction cost and comparatively lower interest rates.

The country's 15,835 agents handed over Tk 16,482.5 crore agent banking loans as of March this year, up from Tk 11,667 crore in March last year, according to Bangladesh Bank's January-March quarterly report on agent banking.

Mohd Ziaul H Molla, deputy managing director of Bank Asia, a leader in agent banking in Bangladesh, credited the growth in agent banking loan disbursement to its easy, customer-convenient and cost-effective process.

"To avail a loan from an agent banking outlet, customers do not need to visit a bank branch which is far away from their home," said Molla, who is also the head of channel banking and chief anti money laundering compliance officer of Bank Asia.

The alternate delivery channel of banking services introduced by Bangladesh Bank in 2013 is also gaining popularity as agent banking deposits posted a 16.52 percent year-on-year growth as of March this year, he told The Daily Star.

Deposits through the 2.2 crore agent banking accounts, around four-fifths of which belong to people in rural areas, hit Tk 36,810 crore at the end of the third month of 2024, up from around Tk 31,641.5 crore in March 2023.

"People love to use agent banking as they can withdraw money by using just their fingerprint on a biometric machine at the outlets," Molla said.

Depositing money has also been made safe as they receive a printed copy and a text message against every deposit, he added.

Meanwhile, agent banking accounts received Tk 149,916 crore worth of inward remittance as of March this year, posting growth of 23 percent year-on-year, and around 90.22 percent of the total went to the rural population.

In the January-March quarter, the amount of inward remittance rose by 4.75 percent over the December 2023 quarter.

This increase in inward remittances through agent banking is supposed to be a positive outcome of the government's initiative of providing 2.5 percent cash incentive on inward remittances, the report read.

Islami Bank Bangladesh PLC received the highest amount of inward remittance, accounting for 52.94 percent of the total.

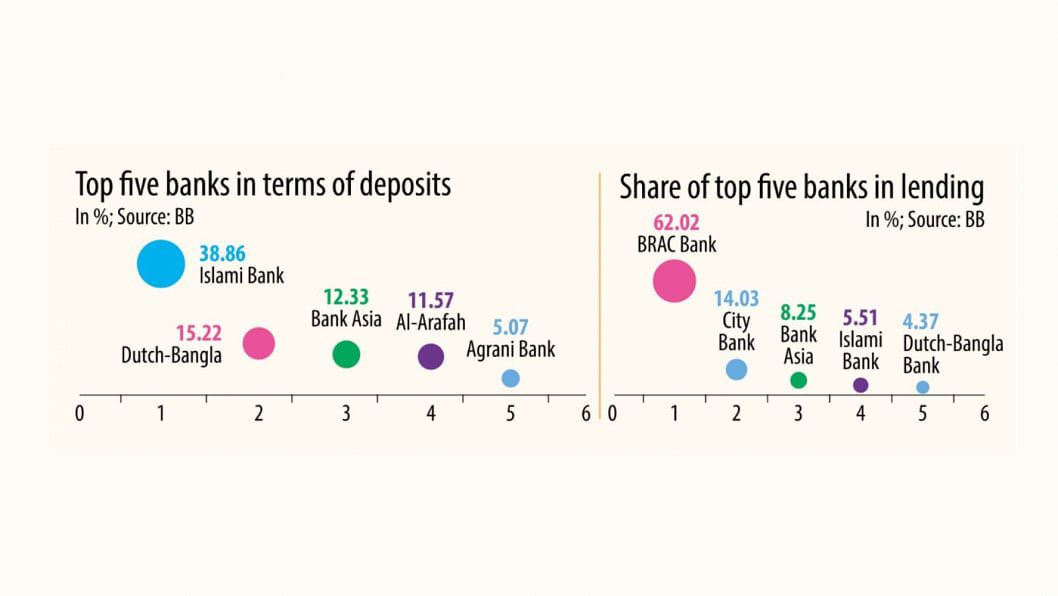

The top five banks have established 73.44 percent of the total agent outlets as of March 2024, with Dutch-Bangla Bank PLC having the highest number with 6,057 outlets.

Bank Asia PLC has the highest number of agent banking accounts, occupying 29.66 percent of the total.

Around 38.86 percent of the agent banking deposits were made in Islami Bank Bangladesh PLC, the highest among all banks.

In case of lending through agent banking, BRAC Bank PLC topped the list, disbursing 62.02 percent of the loans out of the combined Tk 16,482.5 crore.

Meanwhile, the agent banking outlets' loan to deposit ratio -- the percentage of loans an outlet gave in comparison to the deposits it received from customers -- has also seen a spike.

The loan to deposit ratio in agent banking was only 44.7 percent in the January-March quarter of 2024, up from the previous quarter's 42.38 percent.

An increase in loan to deposit ratio compared to the last quarter indicates that investment through agent outlets is gradually gaining momentum, the central bank report read.

However, the ratio is still low, according to industry insiders.

In the first three months of this year, only 22 banks out of 31 distributed loans through agent banking.

The low lending to deposit ratio indicates that the agent banking window is serving banks' purpose more on deposit collection than lending.

Again, the loan to deposit ratio in rural area was 36.79 percent, which indicates that rural people are still getting less loan facilities against their deposits compared to those in urban areas, the report read.

The coverage of agent banking operations in terms of the number of agents and outlets has increased remarkably.

As of March 2024, the number of agent banking outlets reached 21,613 and over four-fifths of them are located in rural areas.

Both the numbers of agents and outlets have been growing at a steady rate, Bangladesh Bank said.

Of the agent banking accounts, around 49.71 percent belong to female customers, who have continued to surpass their male counterparts (49.06 percent) in account opening.

Some 1.1 crore of the accounts belong to female customers and 1.09 crore to males.

As of this March, around 57.61 percent of the deposits were made in male customers' agent banking accounts and 35.71 percent female.

The Bangladesh Bank report said the decrease in deposits from women has widened the gap between the volume of deposits by male and female customers.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments