FBCCI pushes for extending loan moratorium

The Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) has reiterated itsrequest for Bangladesh Bank to extend an ongoing loan moratorium until June.

Moreover, the Bangladesh Association of Banks (BAB), comprising private bank sponsors, has called for exempting provisions for loans, against which instalments are being paid regularly, from the latest central bank directive on keeping an additional 1 per cent provisioning for all unclassified loans.

The rest of the loans making use of the moratorium, or in other words, against which repayment instalments are not being paid, should fall under the purview of the additional provisioning directive, said the association.

Both platforms sought the measures sending separate letters to Governor Fazle Kabir on December 28, reasoning it was in the interest of borrowers and banks given the business slowdown caused by the coronavirus pandemic.

But analysts have opposed the requests, saying it would not bring any good for the country's banking sector and the economy as a whole given the ongoing business trend focusing financial recovery.

The moratorium on bank loans was introduced in the middle of March after the pandemic arrived on the shores of the country and began hammering economic activities for the following three months.

The support was expected to last until the end of June. Later it was extended up to September as the health crisis showed no signs of abating.

On September 28, the central bank extended the moratorium up to this ongoing month of December.

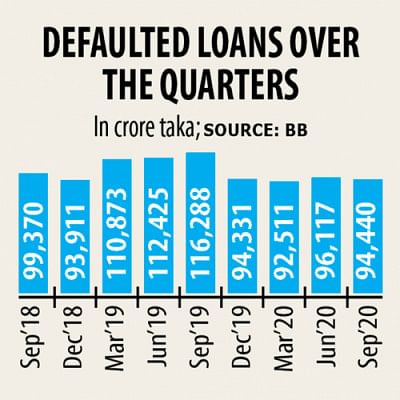

This has helped bring down non-performing loans (NPLs) in the banking sector in the third quarter (July-September) of this year.

The NPLs stood at Tk 94,440 crore as of September, down 1.74 per cent from that three months earlier and 18.73 per cent year-on-year, showed data from the central bank.

Although this moratorium facility adversely impacted the loan recovery of banks, it caused their net profits to go up significantly, since it massively decreased the amount of provision needed to be kept against the NPLs.

As per the banking rules, lenders are allowed to transfer the interest of the loans, which is yet to be realised, to their income books.

This caused the net profit to become enlarged, soaring 33.60 per cent year-on-year to Tk 2,424 crore in the first half of 2020.

Such interest is treated as an accrued interest in banking norms. Banks are allowed to show the accrued interest as income, but such amounts have to be treated as an interest in suspense if loans become defaulted.

Against this backdrop, the central bank asked banks to set aside an additional amount of around Tk 10,000 crore in provisioning to absorb shocks arising from the ongoing financial crisis.

Lenders must keep an extra 1 per cent provision than what they now maintain for all types of unclassified loans, according to a central bank notice issued on December 10.

"We had requested the central bank in September to extend the moratorium until March next year. The latest request is for extension of the support considering the ongoing economic situation," Sheikh Fazle Fahim, president of the FBCCI, told The Daily Star.

The apex trade body of the country has not requested waiving loans or interest but rather to extend the support for another six months, he said.

Both proposals of the platforms are illogical, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

The wholesale moratorium facility cannot be expected further as this will worsen the financial health of banks, he said.

"Banks can offer the moratorium on a case-to-case basis to certain borrowers with prior approval from the central bank," said Mansur, also chairman of Brac Bank.

Salehuddin Ahmed, a former governor of the central bank, echoed him.

Although the second wave of the Covid-19 has already started, borrowers should not be allowed to enjoy the moratorium further, he said.

"We have to run the businesses to keep pace with the deadly flu. Financial health of banks will face deep trouble in case there is a stretching of the deferral support once again," Ahmed said.

The Daily Star also talked to five managing directors of banks, all of whom opposed the FBCCI proposal, reasoning that such an extension would create a roadblock to the gearing up of a cash flow from their borrowers.

However, none of them wanted to go on record due to the sensitivity of the matter.

Mansur and Ahmed said the directive on keeping an additional 1 per cent provisioning against all unclassified loans should be strictly enforced by the central bank.

Banks will have to face more difficulties in the days ahead compared to what was in existing times due to the aftershock stemming from any financial meltdown, they said.

If the provision base in banks is strengthened, they will be able to tackle the situation smoothly.

The BAB, however, in its letter claimed that most banks would face "a very negligible or negative profit after tax" if they were to keep the provision.

"Such in a situation, shareholders, international partners, other stakeholders will lose their trust on banks' risk assessment procedures and also on publicly available profitability information," it said.

In addition, the negative outcome of the financial results will cause a deterioration of the credit rating of banks and overall cost of borrowing by banks will increase due to the higher charged imposed by corresponding international banks, said the BAB.

The five managing directors, however, supported the BAB proposal.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments