Experts identify challenges for semiconductor industry

A study has identified several risk factors for the development of the semiconductor industry in Bangladesh.

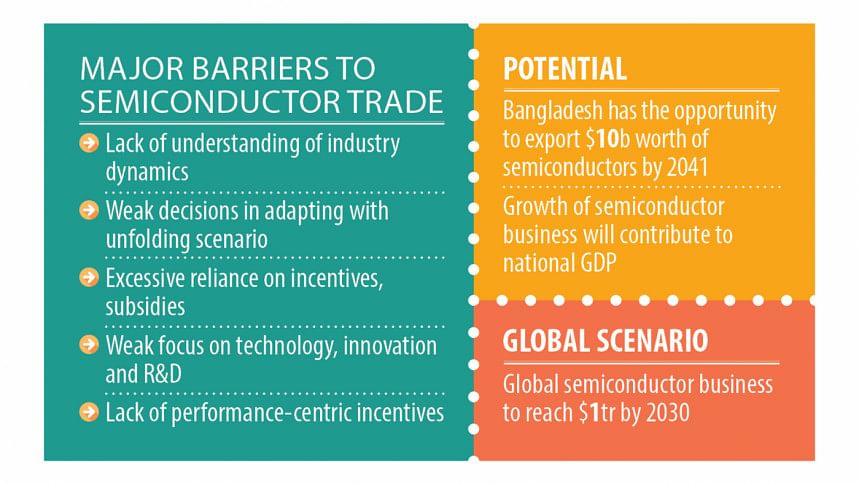

A lack of understanding of industry dynamics, weak decisions in adapting to unfolding scenarios, excessive reliance on incentives and subsidies, and generic human resource development are among the major risk factors.

Also included are the disproportionate dependence on wage differential and infrastructure, lack of synchronisation and synergy in actions resulting in weak specialisation, weak focus on technology, innovation and research and development (R&D), and a lack of performance-centric incentives and disciplinary actions.

The better performance of competing countries was also outlined as one of the risk factors in the study, titled "Developing Semiconductor Industry in Bangladesh", which was made public by the Metropolitan Chamber of Commerce and Industry (MCCI) in Dhaka yesterday.

It recommended offering education and training with the assistance of industry experts to existing students and graduates in electrical engineering, computer science and engineering, and physics to increase the supply of chip designers.

It also asked to offer research and development grants as well as fellowships at the master's and PhD levels to support the development of microchip design-related intellectual properties, process node migration, and prototype microchips.

The study also advised to offer incentives to local producers, particularly in the apparel, shoes, and farming sectors, for pursuing microchip-led incremental innovation for their products and processes and support linkage with academia and chip design entities.

Bangladesh has the opportunity to export $10 billion worth of semiconductors by 2041 and take the sector's contribution to the GDP from the current 0.3 percent to 4.5 percent.

Semiconductors are the fourth most-traded products in the world after crude oil, motor vehicles and their parts, and refined oil.

Global semiconductor industry sales totaled $526.8 billion in 2023, a decrease of 8.2 percent compared to $574.1 billion a year ago, the highest ever, according to the Semiconductor Industry Association.

The semiconductor business is projected to become a $1 trillion industry by 2030, which presents a huge opportunity for Bangladesh.

The country can utilise its supply of talent to create high-earning prospects for graduates and diversify foreign earnings as a shortage of skilled manpower in this sector has been projected.

For instance, by 2030, experts estimate there will be a shortage of 67,000 workers in this industry in the US alone.

Currently, there are three firms in the chip design segment in Bangladesh. These companies employ around 400 chip designers, generating over $6 million in revenue.

The only chip testing firm is Luna Lighting, which is fully owned by a Japanese company.

Zunaid Ahmed Palak, state minister for the Ministry of Posts, Telecommunications and Information Technology, Md Shamsul Arefin, secretary to the Information and Communication Technology Division of the Ministry of Posts, Telecommunications and Information Technology, were among those present.

Farooq Ahmed, secretary-general and CEO of MCCI, moderated the event, where Kamran T Rahman, MCCI president, and Simeen Rahman, MCCI vice-president, also spoke.

Yusuf Haque, chief technology officer and co-founder of eXo Imaging Inc., presented the keynote paper.

M Rokonuzzaman, a professor of the department of electrical and computer engineering at North South University, gave a presentation.

Habibullah N Karim, senior vice-president of MCCI, said the report would serve as more than an academic guide for the semiconductor industry because it also provides guidance on mobilising investment, policy framework, and resources.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments