Ensure governance, stop violence to attract funds

Foreign investors at a conference yesterday urged the interim government to ensure good governance, accountability, transparency, and policy continuity in the economy, as well as to prevent violence in order to draw more funds from abroad.

"To make the industry grow and go to the next stage, they will need more long-term capital, which is equity capital, where investors like us can play a role," said Takao Hirose, managing director of Contextual Investment LLC.

"However, we need to make sure that you have the proper framework, accountability, and governance in place. Please work on it, and we will support you," he said.

Hirose was taking part in a panel discussion titled "Bangladesh Capital Market, an unsung story of growth and opportunities" at the Foreign Investors Summit 2025, organised by BRAC EPL Stock Brokerage at Sheraton Dhaka.

"While foreigners can come into your market, be careful what you wish for, because when foreigners come to this market and foreign direct investment pours into Bangladesh, then that could be a turbocharger of your growth," he said.

But at the same time, it could be "a tremendously disruptive negative force" because one sign of instability can send them back, he said.

"We are fast money, we're greedy money, and we are aggressive, but we are capricious. In order to keep us in your market, you shouldn't be doing things like violence. So, no violence, please," said Hirose.

"There may be differences of opinion, talk it over and work out the differences, because you're being watched by international investors. So don't scare them off," he said.

The investment adviser suggested developing stock trading apps and "aggressively" deregulating the wealth creation process so that many people can benefit from it.

Once the market opens up, growth may be accelerated, but in return, "you may be surrendering your own control of capital markets and that's a very dangerous thing", said Hirose.

"To counter that kind of capricious money, you need to develop a very sound and robust domestic investor base, and the depth of the market should be deeper," he added.

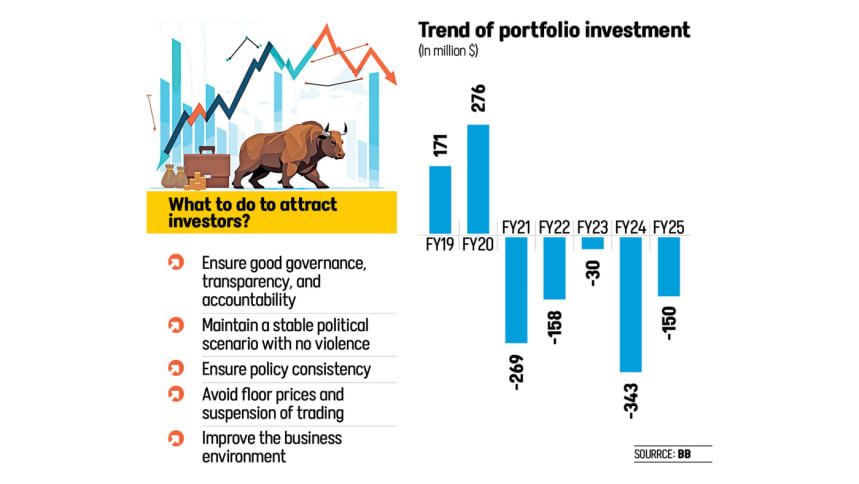

Another fund manager, Ruchir Desai of Asia Frontier Investments Ltd, cited the example of a policy change through which Bangladesh Bank set a limit to banking interest rates, which detrimentally affected foreign investors' confidence.

Eventually, when the pandemic struck, the stock exchange was shut for over one month in 2020. "So, investor confidence took a hit," he said.

Moreover, the market once suffered from regulatory measures on an entity which had significant influence on the market, he said.

There are some issues in the banking sector, but there are companies in the consumer segment with very stable fundamentals. Bangladesh has great companies and there is a lot of potential for pharmaceuticals, infrastructure, consumers and a large young population, said Desai.

"If you can't create stability and confidence within not just foreign investors but within your own domestic economy, the economy won't take off," he said.

"What will really drive more confidence among investors is once the elections happen or there's more political clarity next year," he said.

"That could potentially be a turning point…not only for the stock market, potentially for the country as well," he said.

The next five to six years should be good for Bangladesh if there is a stable environment of politics and policy because the platform has been set, he added.

M Masrur Reaz, chairman and CEO of the Policy Exchange of Bangladesh, gave a detailed presentation on the Bangladesh economy, reforms and its prospects.

Its strategic geographic location makes it a doorway to a wider South Asian market, so investors can take advantage of it, he said.

Bangladesh proves it is a shockproof country which knows how to navigate turbulence, and its smart labour indicates that it is a sweet spot for manufacturing for the coming decades, he said.

Its economic recovery and reform activities to improve governance are giving encouragement to investors, added Reaz.

There are many countries which experienced revolutions, and afterwards their output or gross domestic product slumped and inflation soared, said Anisuzzaman Chowdhury, a special assistant to the chief adviser.

However, Bangladesh saw resilience as inflation dropped recently after the fall of the previous government, he said.

He gave examples of Sri Lanka, Indonesia, the Philippines, Iran, Russia and Nicaragua, where the GDP fell and people experienced high inflation.

However, Bangladesh stands alone by not having to experience a decline in output and high inflation. So, this shows the remarkable resilience of this country, said Chowdhury.

Bangladesh is investable, the opportunity is here, its capital market is getting ready to support and absorb long-term productive investment, and these are not just hollow claims, he told the inaugural session as chief guest.

BNP Standing Committee Member Amir Khasru Mahmud Chowdhury said Bangladesh's economy was recovering very fast, as the economy's foundation was very strong.

It lays emphasis on the private sector, and they are the only ones who can drive the economy. This was the faith of economic planners of Bangladesh, and that has paid dividends, with the private sector coming up in droves, he said.

The reform policies towards deregulation also pay dividends, he said.

Bangladesh's social indicator is about the best in South Asia now, which reflects how the economy has also taken care of the people, said Chowdhury.

"Believe me, we are all focused on the economy right now. And for the economy, the capital market is inevitable. I can assure you, a turbocharger is going to be in place in Bangladesh," he said.

"We are fully committed to addressing all the issues of the capital market because we didn't have enough blue-chip companies," he said.

The stock market does not have institutional investors in proper numbers. So, the depth of the market is not what it should be, said Chowdhury.

In the last decade, the economy was dependent on debt and the printing of money, which is not sustainable, he said.

"Now, it needs to move from the debt-based economy and printing money into an investment-based economy; we are ready to work on it," he added.

Zahid Hossain, a former lead economist of the World Bank's Dhaka Office, invited foreign investors to invest in the stock market and to retain the investments for long periods.

"You can invest, but it should be kept for three to four years," he added.

Saiful Islam, president of the DSE Brokers Association of Bangladesh, moderated the event.

Mohammad Mohsin Chowdhury and Md Saifuddin, commissioners of the Bangladesh Securities and Exchange Commission (BSEC), Mominul Islam, chairman of Dhaka Stock Exchange, AKM Habibur Rahman, chairman of Chittagong Stock Exchange, Meheriar M Hasan, chairperson of BRAC Bank, and Ahsanur Rahman, CEO of BRAC EPL Stock Brokerage, also spoke at the event.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments