Cotton import grows despite pandemic

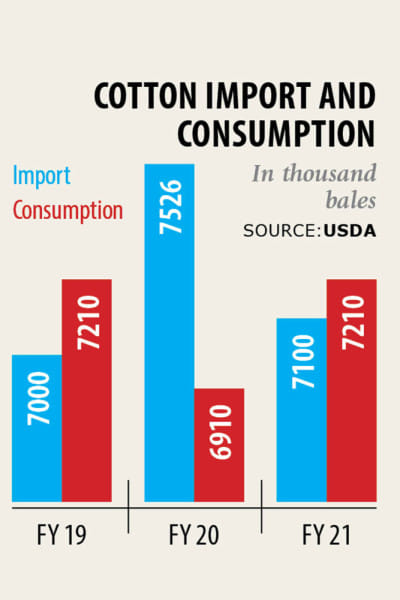

Bangladesh's cotton imports grew by about 9 per cent to 75 lakh bales in the 2019-20 marketing year (MY) despite the ongoing coronavirus pandemic, according to data from the United States Department of Agriculture (USDA).

The cotton marketing year begins in August and ends in July and one bale equals to 480 pounds.

The high demand for cotton during the first half of the year combined with the country's success in combating Covid-19 has allowed the garment sector to maintain operations despite a few short-term disruptions.

US cotton exports to Bangladesh in MY2019-20 reached 1.06 lakh bales, up 28.9 per cent from MY2018-19. The US cotton market share was approximately 14 per cent in MY2019-20, which is second to India's 23 per cent market share.

For MY2020-21, cotton imports will slightly decrease to 71 lakh bales given the uncertainty in global demand and relatively low import in the first months of the year, the report said.

"Cotton imports continued even amid the ongoing crisis since many consignments were signed earlier but imported later," said Monsoor Ahmed, secretary to the Bangladesh Textile Mills Association (BTMA).

Sales in the primary textile sector were disrupted during the Covid-19 outbreak in April-May but when the markets reopened, the sales started to peak up again.

This was especially the case for the weavers and spinners that serve local markets, he added.

The ongoing pandemic has disrupted Bangladesh's textile and apparel industry, resulting in a sharp decline in the sector's exports to major markets, including the US and EU. Preliminary data from the Bangladesh Export Promotion Bureau shows that the export value of apparel in the first 10 months of 2020 dropped 19 per cent year-on-year to $22.4 billion.

However, this decline was lower than the forecast made by the industry experts in May 2020 as Bangladesh's success in combating Covid-19 has allowed companies to maintain operations despite a few short-term disruptions.

The decline in apparel exports is a result of a depressed global demand, increased competition from Vietnam and heightened production and safety standards in Bangladesh's garment industry.

The sector's export value dropped 85 per cent in April and 62 per cent in May year-on-year in 2020.

Bangladesh's yarn production is recovering following an extended period of market disruption as well.

According to the Trade Data Monitor (TDM), the value of Bangladesh's cotton yarn exports in the first 10 months of 2020 dropped 27 per cent year-on-year to $11.3 million.

With Bangladesh's domestic yarn demand rebounding over the past 3 months, the local spinning industry expects cotton yarn production will continue to see positive growth as a result of the increased demand for knitwear exports.

Bangladesh's yarn exports fell 27 per cent in 2020, the report said, adding that the price of yarn has increased substantially over the August to October timeframe because of an uptick in garment demand before the upcoming holiday season in the EU and US.

Through the first nine months of 2020, the value of cotton yarn imports was above 12 per cent at $692 million compared to $617 million in 2019.

China alone has exported over $148 million worth of cotton yarn to Bangladesh the past calendar year and over $225 million in 2019.

In a report, the BTMA said there were more than 433 spinning mills operating in Bangladesh in 2019 with a combined production capacity of 2.9 million tonnes of yarn per year.

Despite the large domestic spinning capacity, Bangladesh imported more than $850 million worth of cotton yarn in 2019.

Bangladesh has import duties of 5 per cent for man-made fibre, 25 per cent for fabric, and 10 per cent for yarn.

While seemingly high, export-oriented garment factories can import yarn and fabric under a duty draw back incentive, which reimburses all customs duties paid on imported yarn and fabric, except taxes such as the VAT and advanced income tax.

The draw back incentive programme enables Bangladesh to go for large imports of cotton yarn and fabric from India and China.

Previous forecasts showed that the country's cotton consumption would drop sharply in the second half of MY2019-20 and continue to decline in MY2020-21 due to the Covid-19 fallout.

However, Bangladesh's cotton consumption, reflected by cotton imports and domestic demand for cotton yarn, has remained strong due to Asia's overall success in combating Covid-19.

Domestic consumption of apparel and textile products has been mildly impacted by the cancellation of large events like Pahela Baishakh, the first day of Bangla new year, and the Eid festivals that often promote clothing sales.

But overall, the negative impact of Covid-19 has been lower than forecast, the report said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments