Card use hits all-time high

Use of both credit and debit cards hit an all-time high in December as people continued to fulfil their demand using the digital means, sidestepping the fear of economic losses caused by the pandemic.

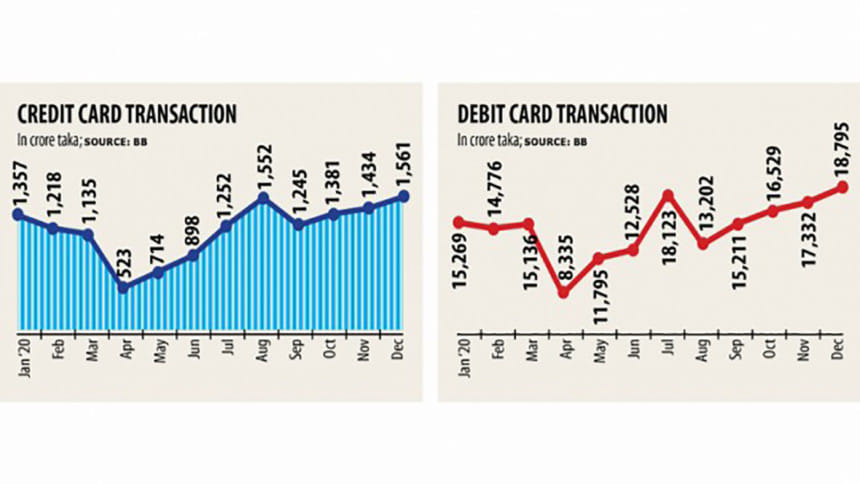

Total card loans held by lenders stood at Tk 1,561 crore in December, which is a fresh record in terms of the lending amount.

The December's figure is up 8.84 per cent from that a month earlier and 23.78 per cent year-on-year, showed Bangladesh Bank data.

Clients also posted another spending record through debit cards, as the figure stood at Tk 18,795 crore, up 8.44 per cent from that a month earlier and 16.51 per cent year-on-year.

The last time credit card loans hit a high was in August 2020 of Tk 1,552 crore while debit card spending last July of Tk 18,123 crore.

The rise in use of credit cards is an indication of a "pent up demand" in the economy as a majority of consumers had held back their spending during the lockdown and the subsequent few months, experts said.

Pent up demand refers to a situation when demand for a service or product is unusually strong.

Economists generally use the term to describe the general public's return to consumerism following a period of decreased spending.

Use of cards drastically went down in the second quarter of 2020 because of the strict restrictions on movement imposed by the government to keep the deadly coronavirus at bay.

People have now started to spend on a large extent as they had purchased little during the lockdown period and in the following couple of months, said Abul Kashem Md Shirin, managing director of Dutch-Bangla Bank.

In addition, people now prefer to purchase goods by way of using the digital means, heavily fuelling card transactions in recent months, he said.

A good number of clients are avoiding use of cash to reduce chances of catching the virus, he said.

Emranul Huq, managing director of Dhaka Bank, echoed him.

Transactions through the cards will go up more in the months to come since festivals of Pahela Baishakh and Eid-ul-Fitr are upcoming.

In addition, a good number of owners of garment industries now pay wages and salaries of workers through banks instead of through cash, he said.

The owners took the initiative when the pandemic spread massively, he said.

"For instance, they opened around 30,000 accounts with Dhaka Bank to pay remuneration to workers. And we provided debit cards to every worker," Huq said.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, however, said people were still cautious about spend money as the pandemic continues to persist.

Card-based transactions have been on the rise in the recent period as people are preferring e-commerce more than ever before to protect themselves from the virus, Rahman said.

The issuance of credit cards was on the increase in December when the outstanding number of bank credit cards stood at 16.78 lakh whereas it was 16.51 lakh the month before.

Similarly the number of debit cards issued by banks were 2.13 crore and 2.09 crore respectively.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments