Banks to come under risk-based supervision: BB

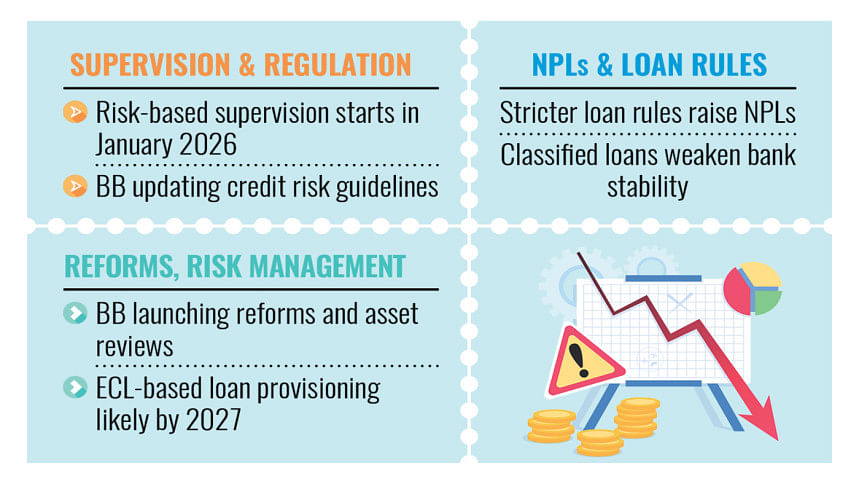

Banks will come under risk-based supervision (RBS) from January 2026, the central bank said yesterday, as it aims to bring qualitative changes to the monitoring and regulation of banks.

The BB said consistently high levels of non-performing loans (NPLs) are a major challenge in the sector.

"The surge in NPLs has raised growing concerns for the banking sector. This sharp increase is primarily attributed to the implementation of stricter loan classification guidelines, which took effect on 30 September 2024," it said.

The observations come from the Bangladesh Bank (BB) in the monetary policy statement for July-December 2025, which was unveiled yesterday.

The banking regulator said the introduction of comprehensive loan classification and provisioning guidelines from April this year, along with the non-renewal of large loans and the non-repayment of rescheduled ones, has worsened the situation.

The rising volume of classified loans is weakening banks' capital adequacy, profitability, and lending capacity, it added.

The BB said it has launched significant reform initiatives to address the rising NPLs in order to avoid a crisis and ensure long-term economic stability.

The central bank said it will be in a position to restore good governance and bolster stakeholder confidence in the banking system through the effective implementation of ongoing initiatives, coupled with robust resolutions for distressed banks based on the findings from an Asset Quality Review.

The BB is revising the core risk guidelines, including those on credit risk management for banks, for the implementation of RBS.

To further strengthen the banking sector's resilience, the BB has announced a roadmap to implement expected credit loss (ECL)-based loan provisioning by 2027, aligning with the International Financial Reporting Standard (IFRS) 9, which sets out how an entity should classify and measure financial assets and liabilities.

Under Phase I, scheduled banks are currently complying with the BB's directives and have submitted time-bound action plans, it said.

These plans include pre-assessment reports detailing the transition from the existing rule-based model to the ECL model, anticipated challenges, and the necessary actions for full implementation of IFRS 9.

"Once fully operational, the ECL-based provisioning system will benefit banks, regulators, investors, and the public by promoting early recognition of credit risks, enhancing financial transparency, and ensuring banking sector stability."

"It will support proactive risk management, adequate supervision, and increased confidence among investors and depositors, while reducing the likelihood of financial shocks."

The BB said it is also developing an emergency liquidity assistance framework to address the issue of liquidity shortfalls due to unexpected and substantial deposit withdrawals.

"This framework, currently under review, will outline the application process, interest rate, collateral requirements, duration, maximum limit, approval mechanisms, and execution procedures for providing liquidity support to banks facing such challenges."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments