Inflation inches up in July, driven by food prices

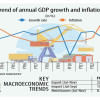

Inflation edged up in July on declining in the preceding three months, driven primarily by rising food prices, according to government data, renewing concerns over mounting pressure on consumers amid persistent supply side challenges.

In July, overall inflation stood at 8.55 percent, up from 8.48 percent in the previous month, according to the Bangladesh Bureau of Statistics (BBS).

Food inflation climbed to 7.56 percent in July, up from 7.39 percent a month earlier.

Food inflation has increased on falling for seven months since November last year, when it stood at 13.8 percent.

In July 2024, food inflation hit a record 14.10 percent, the first time in 13 years.

However, non-food inflation remained almost unchanged, inching up to 9.38 percent in July from 9.37 percent in June this year.

It has stood above 9 percent for the past two years.

Economists and analysts warn that relying only on the monetary policy would not bring down inflation, as other loopholes need to be addressed timely.

"Without addressing the underlying supply side issues, inflation won't come down sustainably only through the monetary policy," said Selim Raihan, a professor of economics at the University of Dhaka.

This happens as the seasonal relief, enabled by the ample market supplies which had reduced the prices, over the past few months has passed, he said.

"We were cautiously optimistic about inflation easing. But now we're seeing early signs of a reversal. Without fixing the fundamentals, that downward trend won't hold," added Raihan.

"Now, unresolved structural issues, especially supply-side bottlenecks, are causing prices to rise again, particularly of food items like rice," he said.

"Tackling inflation requires a coordinated effort between monetary policy, fiscal policy, and domestic market management," said Prof Raihan, also the executive director of the South Asian Network on Economic Modeling (Sanem).

"You can't isolate one and expect long-term results," he said.

"One of the biggest problems is we don't even have reliable data on supply and demand. Without that, how can we manage the market effectively?" he questioned.

Raihan said when there is a shortfall in domestic production, imports are not made in time.

"Our import processes are so complex that goods reach the market too late and by then, prices have already spiked," he said.

"When a supply crisis hits, some businesses exploit the situation. And in an uncertain business environment, this kind of behaviour becomes even more widespread," he said.

Prof Raihan said another crisis was looming.

"We're now entering the rainy season…and flooding is a possibility. This season usually brings additional inflation pressure," he said.

"We've also consistently pointed out the imperfections in the market. So, just raising interest rates alone cannot be considered the only, or even the most effective method of reducing inflation. That's something we've been repeatedly saying," he said.

However, Ashikur Rahman, principal economist at the Policy Research Institute (PRI) of Bangladesh, believes inflation would not rise by that much of an extent.

"The general inflation in July saw a modest rise, but this movement does not indicate a major reversal in the broader disinflationary trend," he said.

"Inflationary pressures are still expected to ease gradually over the next four to five months, thanks to stabilising global commodity prices and relatively subdued domestic demand," he added.

Commenting on the Bangladesh Bank's policy stance, which was to limit inflation within 6.5 percent for FY26, he said, "It's prudent that Bangladesh Bank has chosen to maintain the policy rate at 10 percent."

"This signals a cautious but consistent approach—anchoring inflation expectations while supporting broader macroeconomic stability," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments