Cash recycling machines fast coming to the fore

Banks are installing cash recycling machines at a faster pace as part of their efforts to provide deposit and cash withdrawal services to clients under the same platform.

This helps customers reduce reliance on branches and gives them more space to do banking.

The cash recycling machines are now making cash deposit machines obsolete, as the latter only allows injecting cash, and replacing automated teller machines (ATMs), which allow only fund withdrawals.

A cash recycling machine accepts cash, counts the notes, authenticates them, and credits the amount to accounts on a real-time basis, helping banks do away with the manual labour needed to provide the service. The technology is also allowing users to deposit and transfer cash to others' accounts.

A cash recycling machine helps clients avoid queues in front of branches in order to settle transactions in the cash counters as such type of facility is offered by the technology.

Banks in Bangladesh commenced installing cash recycling machines from 2017.

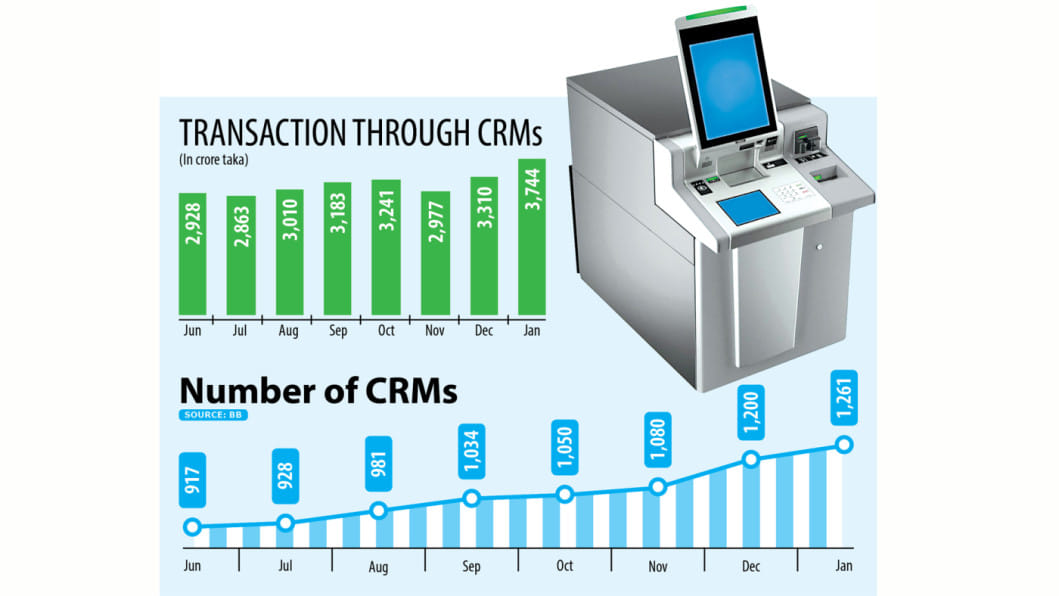

The number of machines stood at 1,261 as of January this year, up 59 per cent year-on-year, showed data from the Bangladesh Bank.

Total transactions through cash recycling machines grew 97 per cent year-on-year to Tk 3,745 crore in January this year. Compared to December, transactions grew 13 per cent in January.

Cash recycling machines are helping banks manage cash in an efficient manner as the notes deposited can be used for the withdrawal of funds by clients. As a result, banks do not need to inject cash into the cash recycling machines frequently.

This means the method helps lenders reduce their cost by providing multiple services to clients through a single platform.

The tool increasingly gained importance during the coronavirus pandemic as banks discouraged clients from engaging in branch-led banking.

The number of cash recycling machines will increase manifold within the next couple of years as many banks have taken initiatives to set up the digital tool.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, said his bank had recently started focusing on setting up cash recycling machines given the potentials of this digital means.

The private bank has set up more than 20 cash recycling machines and it will install more machines in the days to come, he said.

Although the installment cost of a cash recycling machine is higher than that of an ATM, the convenience of the latest technology is excellent as it provides many services like a branch, he said.

This encourage banks to carry out branchless banking as clients can withdraw and deposit funds in tandem through cash recycling machines, Rahman said.

"We have a plan to install more cash recycling machines in the days ahead," he said.

The coronavirus pandemic has given a big boost to popularising the branchless banking riding on the various technology-driven means, a BB official said.

Cash recycling machine is one of the potential tools as clients do not require going to branch to withdraw or deposit funds with banks, he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments