Interest rate on deposits rises for the first time in 2.5yrs

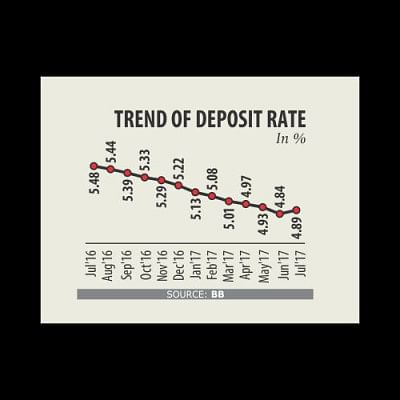

The interest rates on deposit crept up in July, breaking a downtrend of two and a half years on the back of a rising private sector credit demand.

The weighted average interest rate on deposits stood at 4.89 percent in July, up from 4.84 percent in June, according to data from the Bangladesh Bank.

The interest rate had been on a descent since January 2015 -- when lenders provided 7.26 percent -- thanks to a slashing spree of state banks and the new ones.

But in July, most banks revised the deposit rate upwards upon expectation that the demand for money would rise amid growing imports, according to Mehmood Husain, managing director of NRB Bank.

Private sector credit growth hit 16.94 percent in July -- the highest in five years and well above the 16.2 percent target set by the central bank for the first half of 2017-18.

The opening of letters of credit grew 30 percent year-on-year to $5 billion in July. Particularly, the LC opening value for food grains trebled to $334 million in the first month of the fiscal year from a year earlier, central bank data shows.

Husain said the private sector credit growth crossed the 16.5 percent-mark because of pressure from food grain imports by private businesses. Moreover, road repair works following the recent floods will accelerate import expenditure.

"So, banks think that the credit demand will go up in the coming days," Husain added.

MA Halim Chowdhury, managing director of Pubali Bank, hinted that the interest rate on deposit would go up in the coming months riding on the rising credit demand.

Some banks are offering higher interest rate to attract depositors, he added.

In July, the average interest rate on deposits at state banks increased to 4.56 percent from 4.47 percent in June.

At private banks, it rose to 5.2 percent from 5.15 percent.

Of the nine new banks, seven have revised the rate upwards, with Farmers Bank offering the highest of 8.67 percent.

Chowdhury said the lending rate might also go up. Excess liquidity in the banking sector fell 11 percent to Tk 111,910 crore in March from Tk 125,950 crore in December last year.

Deposit growth slowed to 11 percent in June from 13.13 percent in December as banks were reluctant to take money from retail depositors.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments