Liquidity crunch dictates new monetary policy

The Bangladesh Bank yesterday unveiled a loose monetary policy for fiscal 2019-20 as it looks to pump money into the economy to alleviate the banking system’s prolonged liquidity crunch.

For instance, it has set net domestic asset target of 16 percent for fiscal 2019-20 in contrast to 12.3 percent in June.

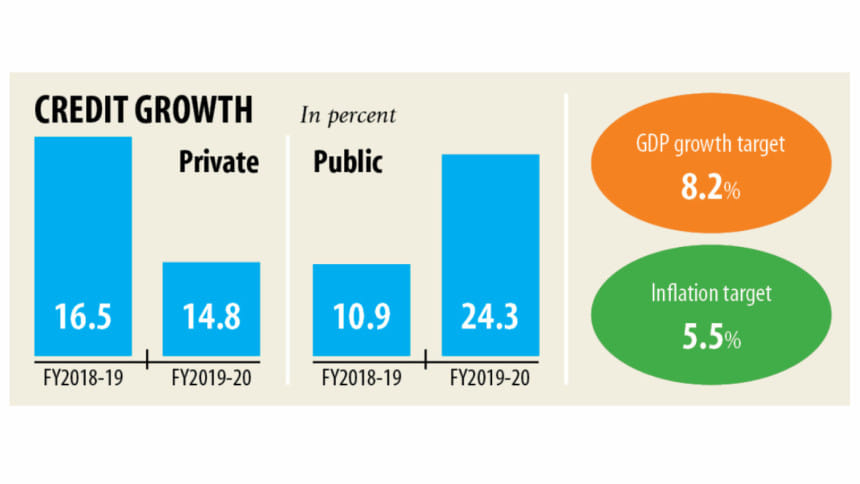

It has also set a public sector credit growth target of 24.3 percent, up from 21.1 percent last month.

“This is not a tight monetary policy at all. Rather, the central bank has taken a relaxed policy given the existing crisis in the money market,” said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

The slower-than-expected remittance and exports earnings growth in comparison to GDP has compelled the central bank to take the stance.

“The liquidity crunch in banks will ease for the time being because of this. But there will be a downside risk and it may create a balance of payment crisis,” Mansur said, adding that the economy will face inflationary pressure.

But BB Governor Fazle Kabir had a different opinion.

“The new monetary policy is cautiously accommodative like the previous ones as it will help achieve 8.2 percent GDP growth and contain inflation at 5.5 percent,” he said while unveiling the monetary policy yesterday.

And in a departure from the past, he unveiled a monetary policy for the entire fiscal year instead of the previous practice of unveiling one every six months.

In the year-long monetary policy, the private sector credit growth target has been set at 14.8 percent although the growth rate dropped to a six-year low of 11.29 percent last fiscal year.

The central bank governor though blamed the low private sector credit growth on banks straightening out their lending practices.

“Some overenthusiastic banks have been forced to scrap their questionable stance in disbursing loans because of our intensive monitoring,” he said.

This has helped bring down the private sector credit growth to a logical level when compared to the emerging economies of South and East Asian countries, he said.

“The public sector credit growth looks higher than the private sector. But in terms of funds, the credit volume of the private sector is at least 7.3 times higher than the public one.”

He went on to express satisfaction about the ongoing situation in the money market as the net foreign assets (NFAs) increased last fiscal year, mitigating the liquidity crunch in banks.

The central bank has projected the NFAs will register a 0.3 percent growth this fiscal year, whereas it grew 2.2 percent last fiscal year.

Kabir, however, said the implementation of the new VAT Act and crop damage due to recent floods may create inflationary pressure. The central bank also announced it will be switching to short-term interest rate-based monetary policy in keeping with global best practices. It has started preparations for the switch with the South Asia Regional Training and Technical Assistance Centre (SARTTAC), a collaborative venture between the International Monetary Fund and its six member countries of South Asia.

But economists expressed doubt about the success of the new policy in the absence of a vibrant bond market.

Given only the call money market to rely on it will be tough for the central bank as the developed nations depend on the yield of bond to set and reset the policy rate, said Mansur, also a former economist of the IMF.

Zahid Hussain, a former lead economist of the World Bank’s Dhaka office, echoed the same.

This will require establishment of a stronger link between the policy rates and financial market prices, which in turn will require a more competitively behaved banking system and development of a bond market, he said.

“The central bank will need to work much harder on these fronts before switching to an interest rate targeting-based monetary policy regime.”

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments