Banks just not getting worked up by farm loans

Banks are reluctant to disburse farm loans despite the government's renewed emphasis on keeping crop production unscathed from the devastating impact of the coronavirus pandemic and stimulus packages, deflating the state's efforts towards an economic bounce.

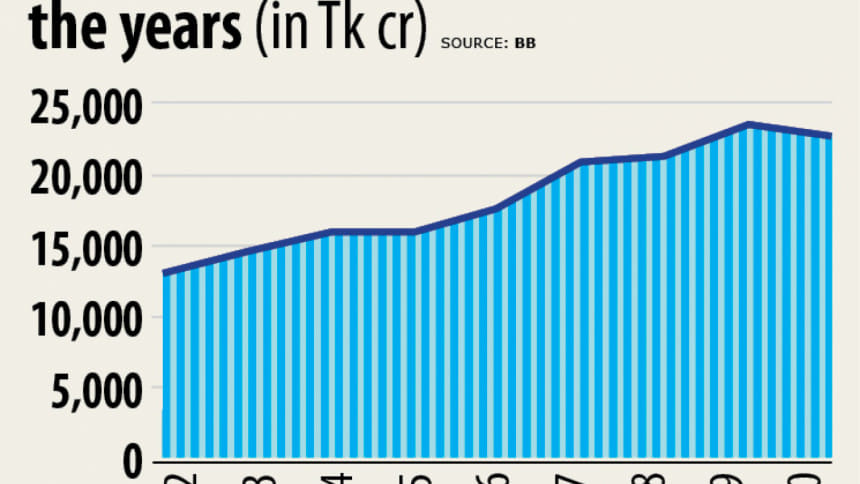

For the first time in many years, banks posted negative growth in farm loan disbursement in the just-concluded fiscal year, further highlighting their reluctance in lending to this key sector of the economy.

Agriculture lending declined 3.67 per cent to Tk 22,749 crore in fiscal 2019-20.

The central bank has already declared subsidies for banks for disbursing farm loans. And yet banks remain disinterested.

The dismal lending scenario is at odds with the government, which has given one of the highest priorities to the agriculture sector to avoid any food crisis.

But the lenders' attitude stands to compromise on the nation's food security.

Bankers blamed the countrywide shutdown from March 26 to May 30 imposed by the government to tame the fast-spreading coronavirus for the lower agriculture lending.

However, central bankers are not convinced. The Bangladesh Bank repeatedly asked them to keep the wheel of the farm loan disbursement moving to absorb the financial shocks stemming from the downturn, they said.

"The central bank even took two separate programmes to give a tempo to farm loan disbursement. But banks have taken an adamant stance that they would not give out loans to farmers," said a central bank official.

The BB announced a stimulus package of Tk 5,000 crore dedicated to small and medium businesses and entrepreneurs in the farm sector. The tenure for the loans will be 18 months, including a grace period of six months at both banks and clients' ends.

Banks will borrow from the refinancing scheme at 1 per cent interest rate and they will lend at 4 per cent.

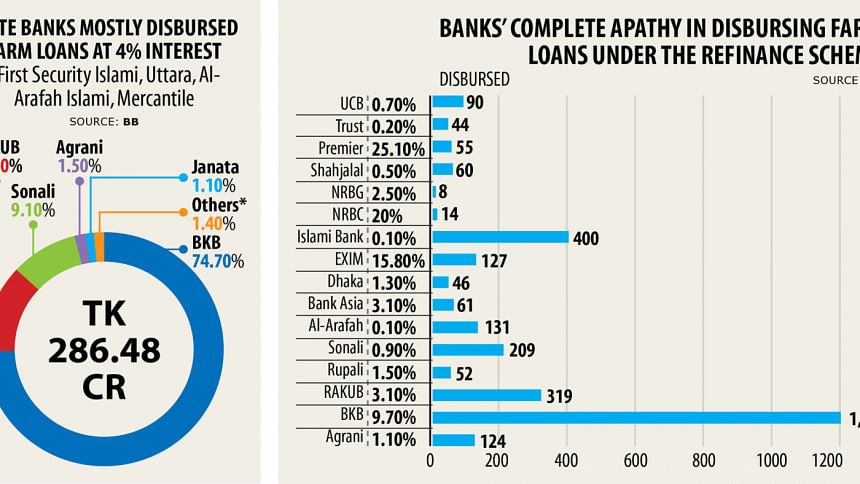

As many as 43 banks signed the participation agreement with the central bank but only 16 gave loans.

As on June 30, Tk 172 crore was disbursed from the refinance scheme.

The central bank has introduced another programme to provide agriculture loans at 4 per cent interest rate.

Under the initiative, banks enjoy 9 per cent interest on disbursed loans, while the BB provides the rest 5 per cent as subsidy. Farmers are entitled to the subsidised loans from April 1 this year to June 30 next year.

But this effort has also not paid off as only nine banks disbursed Tk 286.27 crore in the three months to June.

The central bank has started drawing up the annual farm loan policy since 2009, when the government appointed Atiur Rahman as its governor.

Banks are supposed to disburse at least 2 per cent of their total outstanding loans in farm credit. The farm loan had since maintained an upward trend.

The declining trend of the farm loan is a warning call for the country's food security, said Rahman yesterday.

"Agriculture can protect us to a great extent from the ongoing financial meltdown. A one per cent growth in the farm sector can reduce poverty by 0.39 per cent," he said.

The farm sector is now under tremendous pressure as people have flocked to villages to live their life smoothly and save themselves from the storms of the meltdown in the urban areas.

Both the government and the central bank will have to make a concerted effort to boost the farm loan disbursement to ensure a quick recovery from the recession, the economist said.

The agriculture sector accounts for 48 per cent of the country's total employment. A strong partnership between banks and microfinance institutions is needed to give a boost to farm loan disbursement in the quickest possible time, Rahman added.

The central bank should immediately explore the reasons behind banks' reluctance to disburse farm loans, said Hossain Zillur Rahman, chairperson of Brac.

"The policymakers are not playing their due role in making the farm sector vibrant. And the declining farm loan is one of the reflections of their stance."

The government should widen its dependency on the farm sector to keep the GDP growth sustainable, said the former adviser to a caretaker government.

"The central bank will have to compel lenders to disburse the required farm loans such that the ongoing financial recession doesn't affect the peoples' livelihoods badly," said Salehuddin Ahmed, another former governor of the central bank.

The BB yesterday announced the new farm loan policy for the current fiscal year, setting an annual lending target of Tk 26,292 crore.

Managing directors of three banks on condition of anonymity said that they would take initiatives to disburse farm loan. The loan disbursement will rebound in September and October, they said.

Banks have been in a state of confusion due to the wide-ranging economic fallout caused by the pandemic, putting a negative impact on the farm loan distribution, according to them.

Health, agriculture and employment creation have given priority while allocating resources for the annual development programme in fiscal 2020-21.

Of the development budget, 22 per cent has gone to the overall agriculture sector (agriculture, rural development, water resources and others).

"Ensuring food and nutrition security for the large population in Bangladesh, and protecting the lives and livelihoods of farmers, farm labourers and relevant others engaged in the agriculture sector are the main challenges now for us given the forecast of imminent famine in the post-coronavirus world," Finance Minister AHM Mustafa Kamal said in his budget speech on June 11.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments