Why businesses must lead the war on climate change

Technically, on Saturday, the US War on Terror came to an end.

According to the Brown University "Cost of War" study, since 9/11, the US will have spent USD 4.7 trillion waging war by the end of 2022, excluding the interest on debt used to finance the wars (USD 1.1 trillion) and war veteran care costs (USD 2.2 trillion). The human cost was 929,000 people killed and 38 million displaced. Look how the US Treasury debt ballooned from USD 5.8 trillion—or 54.9 percent of GDP—in September 2001 to USD 28.4 trillion—135.7 percent of GDP—by August 2021.

Such financial and human costs of the War on Terror may be trivial compared to the coming climate change costs on the whole planet. War costs only add to climate warming. The Brown University study showed that "the US Department of Defence is the largest institutional consumer of fossil fuels in the world and a key contributor to climate change. Between 2001 and 2017, the years for which data is available since the beginning of the war on terrorism with the US invasion of Afghanistan, the US military emitted 1.2 billion tonnes of greenhouse gases."

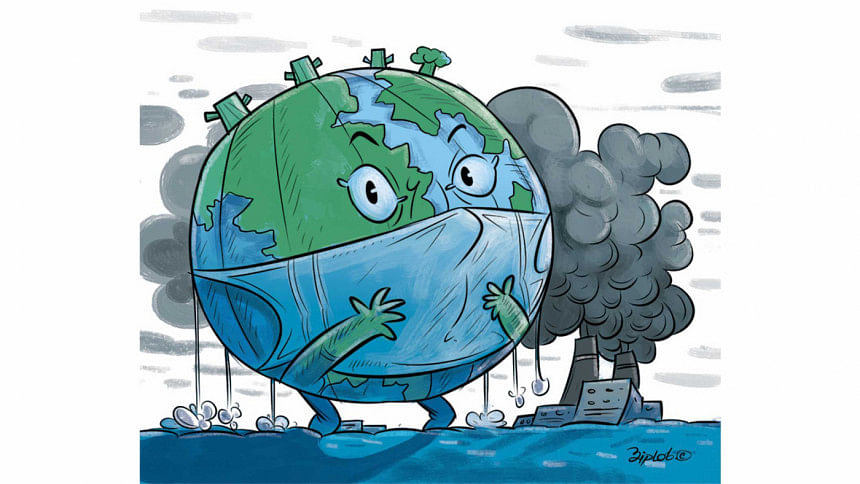

Today, the IPCC 2021 Sixth Assessment has warned that the planet is running out of time to deal with climate change. This is an existential crisis not just for one country, but the whole of mankind. Like the pandemic, we need a "whole of government" and "whole of society" approach to act decisively in the war on climate change.

The European Union has got its act together with a Circular Economy Plan. It sees the problem clearly: "There is only one Planet Earth, yet by 2050, the world will be consuming as if there were three. Global consumption of materials such as biomass, fossil fuels, metals and minerals is expected to double in the next 40 years, while annual waste generation is projected to increase by 70 percent by 2050."

The world spent USD 2 trillion on military expenditure in 2020—four times the amount spent on energy transformation. The first can only add to global carbon emission and more human and natural destruction; the other addresses our common fate.

So why should business take the lead in this war on climate change?

The simple answer is that the business community makes almost all the products that the world consumes, including weapons of war. Just 100 of these private and state-owned companies were responsible for 71 percent of the global greenhouse gas (GHG) emissions that caused global warming since 1998, according to the Carbon Disclosure Project (CDP). Up to 80 percent of the products' environmental impacts are determined at the design phase, so the business sector can re-tool these green products fast. That is the profit opportunity.

Another reason is that governments or politics simply do not have their act together. Harvard strategy guru Michael Porter, in his 2020 book "The Politics Industry," put it this way: "Most people believe that our political system is a public institution with high-minded principles and impartial rules derived from the constitution. In reality, it has become a private industry dominated by a textbook duo… incapable of delivering solutions to America's key economic and social challenges." Put climate change in that basket of problems.

Michael Porter recognised that there are no scientific or business model barriers to finding solutions to tackle climate warming. Guess what? There is also no shortage of money with central banks providing all the money to tackle the pandemic and financial crises. We have an existential crisis where the rich are getting richer, whereas the people at the bottom half of society are paying for the climate change disasters through loss of habitat, jobs and lives.

This is neither sustainable for politicians nor for businesses.

In 2012, billionaire businessman Richard Branson claimed: "Our only option to stop climate change is for industry to make money from it." After the pandemic and this year's hurricanes, forest fires and floods, businesses around the world are waking up to the fact that there is no alternative to embracing climate change in their business models. The "business as usual" of denial has shifted quickly to adaptation and mitigation.

One reason for the change of mind is that the finance industry has realised that climate change imposes huge financial risks. They created the Task Force on Climate-Related Disclosure (TCFD) to pressure the industry to act on climate change through financial disclosure. In its first report, the TCFD reported that USD 640 billion costs were incurred from climate-related natural disasters and that up to USD 43 trillion financial assets would be at risk by 2100.

If politics is toxic, the only group of people who can lead action on climate change is the corporate sector. Of course, corporate captains are not themselves the owners of these corporations, since many are owned by institutional funds. The top 500 asset managers control over USD 104 trillion of assets, with the top 20 controlling 43 percent. So, convincing a small number of key corporate owners to act will make a serious difference on climate action.

One example suggests that serious climate action by the global rich is not just possible, but feasible.

Thanks to Brazilian President Jair Bolsonaro and his profit-driven business allies, the Amazon Forest is disappearing rapidly. The Amazon forests and biodiversity-rich soils store the equivalent of four or five years' worth of human-made carbon emissions, up to 200 gigatonnes of carbon. At USD 50 per tonne for carbon, the real Amazon is worth USD 10 trillion to everyone in the world. By comparison, Amazon.com's market cap is now USD 1.8 trillion. The top one percent of the world's rich people owned USD 173.3 trillion in 2019—almost double the world GDP.

Can some friendly billionaires club together to buy the real Amazon from Brazil, whose total external debt is currently USD 548 billion?

This may sound like a joke, but climate warming is a deadly serious business. If business is not serious about the climate war, then start scrambling to get on the next space flight organised by Richard Branson or Jeff Bezos.

Andrew Sheng from Malaysia is adjunct professor at Tsinghua University, Beijing and University of Malaya. He was formerly the chairman of the Securities and Futures Commission, Hong Kong. He is a columnist for the Asia News Network.

Courtesy: Asia News Network

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments