The Story of bKash

The Story of bKash

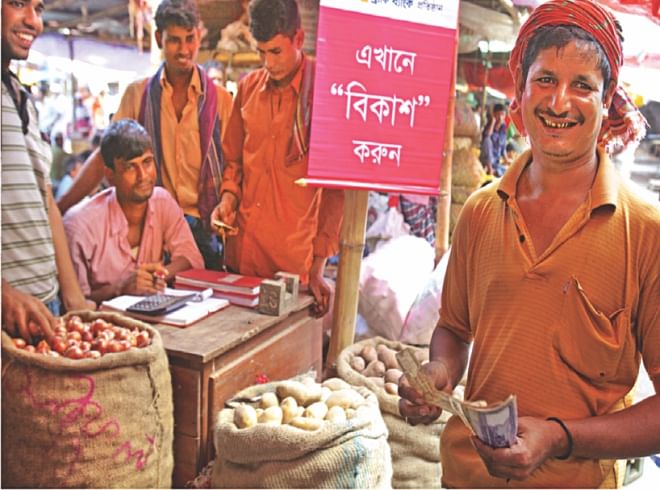

bKash, a subsidiary of BRAC Bank, provides safe, convenient and easy ways to make payments and money transfer services via mobile phones to both the unbanked and the banked people of Bangladesh. Through partnerships with all major mobile operators of Bangladesh, bKash's technology allows 98% of the country's mobile users to access its service via very basic handsets.

Bangladesh, home to 165 million people, represents a unique opportunity for a mobile money platform: universal wireless network coverage, widespread personal ownership of mobile phones, a cash economy, poor physical infrastructure, and a favorable regulatory environment for a bank-led initiative. bKash presents a compelling business plan and social uplifting agenda which capitalizes on these factors to dramatically expand access to formal financial services for the people of Bangladesh, less than 10% of them so far have encountered any formal banking facility.

Reasons for the poor penetration of the banking sector are partly due to Bangladesh's weak infrastructure, conventional banking practice of not catering the poor, and lack of technology that could reach the poor. While these factors have created a fertile environment for microfinance, they have left little incentive for formal banks to venture out of the large cities. As such, poor and rural populations rarely encounter the formal banking sector.

A bKash mobile walletis customer's financial account, into which money can be deposited and out of which money can be withdrawn or used for various services. Customers are able to receive electronic money into their bKash accounts through salary, loan, domestic remittance, and other disbursements and eventually cash-out the electronic money at any of bKash's vast of agent network of 90 thousand retail points.According to CGAP, the World Bank group that works on access to finance, by March 2014, 22% of Bangladesh's adults use mobile money and a significant part of such mobile money adopters use bKash.

One of the reasons for bKash's success is its focus on serving the poor. It was important to come up with a simple interface that can be accessed by the cheapest (i.e. $15) handset. Smartphones would make it easy to implement mobile money, but the service would then be limited to only affluent customers and would defeat the purpose of reaching the unbanked and poor. bKash opted for USSD that allowed anybody to access bKash platform by dialing an access code, regardless of the sophistication of the handset.

Registering for bKash and cashing-in services are free of charge. For person-to-person (P2P) transfers, customers pay a flat fee of BDT 5 (or $.06) irrespective of the size of the transaction. In case a customer wants to cash-out, there is a flat fee of 1.85% on the amount withdrawn. For example, if a user wants to cash-out BDT 50, the cash-out fee is BDT 0.92 (or $.01). Many bKash customers have such small tickets, but their large volume compensates for the apparent small ticket size. bKash's focus on reaching the poor distinguishes it from services that have fees for cash-in or minimum cash-out fee.

Considering the size of the potential customer base, bKash adopted a highly scalable electronic payment platform outsourced from VISA that offers the global standard of financial data processing and security.

bKash has built its foundation capitalizing the unique resource base of its four stakeholders--BRAC Bank, Money in Motion, International Finance Corporation and the Bill & Melinda Gates Foundation. BRAC Bank, a SME focused private commercial bank in Bangladesh, works closely with its parent organization, BRAC, which has grass-root presence in every corner of Bangladesh. Money in Motion, besides bringing entrepreneurial leadership brings together investors and initiators of successful mobile network, mobile money and mobile commerce operators. IFC and Gates Foundation, along with the capital, bring global governance practices and knowledge on Financial Inclusion.

The writer is Chief Executive Officer, bKash Ltd.