The home financier

The home financier

Owning a home is the great dream for most. But, it was an unattainable aspiration for many in the country until Delta Brac Housing Finance Corporation (DBH) came to the scene in 1997.

With a start-up capital of Tk 2.5 crore and the sole aim to promote home ownership in the country, the company founded by Shafat Ahmed Choudhury, AMA Muhith, Fazle Hasan Abed, Nasir A Chaudhury and Faruq Chowdhury went on to change the fortunes of the real estate sector.

Back then, the concept of home ownership by way of flat purchase, so prevalent now, was an unfeasible option, as the lone state-owned company that provided housing finance—Bangladesh House Building Finance Corporation—only gave out loans for self-construction and that too to government employees.

“There was a vacuum in the market,” said Quazi M Shariful Ala, managing director of DBH, who has been leading the company since inception.

The prospect of “doing good” for the society at large was another overriding incentive for the company, he says.

“Home ownership helps create a more stable and stronger society as it gives individuals a physical stake in the country. It fosters the development of the wider community as the owner feels a sense of belonging.”

The company not only extended loans for flat purchase, the young team put together by Ala revolutionised the custom of home finance: the clients got fast response, there was no need for speed money and the security creation formalities were less stringent as registered mortgage was not required.

But what turned out to be a game changer was its move to disburse loans for under construction flats by way of a tripartite agreement between the buyer, developer and DBH. Today, the procedure is employed by all institutions.

Its decision to go for the repayment capacity-based lending model instead of the traditional security-based one was a smart move, too.

The loan officers had detailed counselling with the customers and designed solutions that not only fit their requirements but also ensured smooth repayment of the loan from their monthly income.

As a result, the company's non-performing loan level, even after 16 years of operation, has remained below 0.50 percent, with hardly any loan write-offs. The feat has helped the company get awarded the highest credit rating of AAA for eight consecutive years.

“Our business strategy has always been to balance our growth objectives with a disciplined approach to risk and cost management. As a result, we have the lowest level of non-performing loans in the financial sector,” says Ala, who has an economics degree from the prestigious London School of Economics.

To date, DBH has disbursed over Tk 5,000 crore in home loans and has created home ownership among 46,000 families in Dhaka and other major cities of the country.

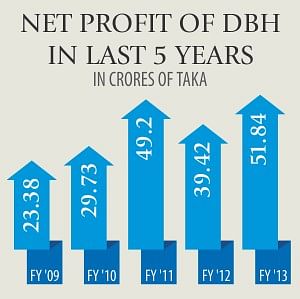

Listed since 2008, the company has been growing at an average rate of 30 percent in every year since inception, with its net profits last year increasing 31 percent year-on-year to Tk 51.84 crore. DBH also disbursed 25 percent cash dividend for the year.

The local Delta Life Insurance Company, BRAC and Green Delta Insurance Company have 17.34 percent, 18.39 percent and 15.31 percent stakes respectively in the company, while the Indian Housing Development Finance Corporation and International Finance Corporation, the private sector financing arm of the World Bank Group—each with 12.22 percent stakes. The general public owns the remaining 24.52 percent.

The company, which has an employee count of 280, has “one of the lowest” operating costs in the financial sector, due to which it can compete with the banks even though it is a non-bank financial institution (NBFI), he says.

It is the first NBFI to have mobilised large-scale deposits from retail and corporate customers, with its present deposit portfolio standing in excess of Tk 2,000 crore.

“It helps us reduce the cost of financing. Plus, our AAA credit rating for eight consecutive years also provides the highest level of safety and security to our clients.”

Presently, DBH has five branches—three in Dhaka and one each in Chittagong and Sylhet—with plans to expand to Rajshahi, Bogra and the outskirts of Dhaka such as Narayanganj, Savar and Gazipur.

About the current state of the housing sector, the DBH chief said the efforts of private sector developers and financers would not be adequate to bring the price level within the reach of middle- and lower-income groups.

A coordinated effort from all stakeholders is necessary to realise the true potential of the sector, he said.

As for the company's future, Ala said: “Rather than being involved in all types of financing, we want to focus on our core business as the exclusive and specialist housing finance institution and contribute to the growth of the sector and move forward with our ultimate mission to strengthen the society by continually expanding home ownership.”