Tax rebate for factory relocation from Dhaka

Tax rebate for factory relocation from Dhaka

The government has offered tax rebate of 20 percent from the next fiscal year for relocation of industrial units from Dhaka and major cities to economically-lagging regions in a bid to reduce congestion.

The move comes in the face of growing migration of people from rural areas to find income opportunities in the capital and its surroundings, which affected the city's livability.

Dhaka has become the second least livable city in the world, according to the Global Liveability Survey of the Economist Intelligence Unit in 2013.

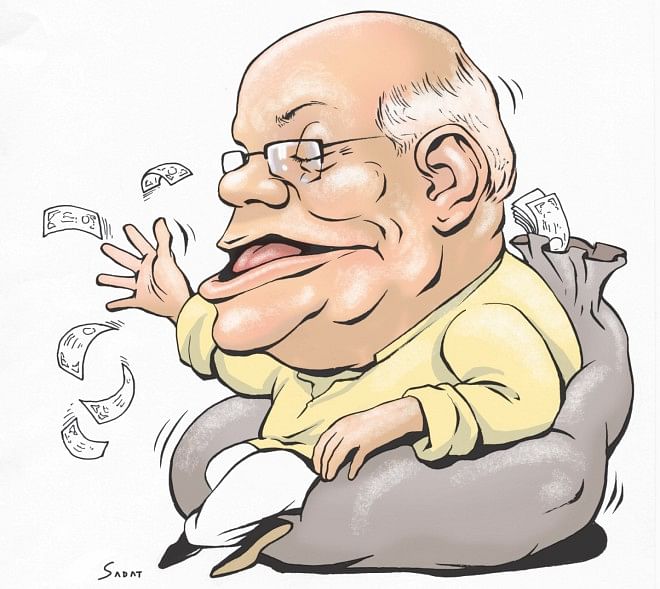

Industrialisation in areas other than the city corporations of Dhaka, Chittagong, Narayanganj and Gazipur would create massive employment berths in the least developed areas, Finance Minister AMA Muhith said during his budget speech yesterday.

The offer will be available for entrepreneurs who will set up industries in the least developed areas between July 2014 and June 30, 2019. They will enjoy the tax rebate facilities for the next 10 years from the date of commencing commercial production.

The finance minister said the facility would be extended to sectors which do not enjoy tax benefits at present.

Atiqul Islam, president of Bangladesh Garment Manufacturers and Exporters Association, said the incentive will tempt many garment factories to shift to the economically disadvantaged areas.

The move will transmit a positive message to the world that the government is serious in relocating factories from the capital, he added. “Plus, the city's environment will improve.”

Dhaka and its adjacent areas house nearly 80 percent of the 4,500 export oriented garment factories in the country.

Meanwhile, the government has extended tax holiday facilities by another three years to the 17 industrial sectors that are already enjoying the privilege.

The sectors are: active pharmaceutical ingredients industry and radio phar-maceuticals industry, barrier contraceptive and rubber latex, chemicals or dyes, basic ingredients of electronic industry, biotechnology, boilers, compressors, computer hardware, energy efficient appliances, insecticide or pesticide, pharmaceuticals, locally produced fruits and vegetables processing and textile machinery.

Meanwhile, to encourage exports Muhith has called for a reduction of tax at source from 5 percent to 3 percent on cash incentive.

He has also proposed tax exemption on interest income from investment on pensioner savings certificates and wage earners' bonds of up to Tk 5 lakh.

There will also not be any deduction at source on local LC of daily necessary consumer items: rice, onion, lentil, turmeric, chilli, wheat, maize, flour, salt, edible oil and sugar.

“The main objective of the autonomous bodies is not to make mere profit but to provide essential services to the citizens,” the finance minister said.

Considering the issue, he proposed reducing the tax rate from 37.5 percent to 25 percent on income of all autonomous bodies inclu-ding: Dhaka Wasa, Chittagong Wasa, Khulna Wasa, Rajshahi Wasa, Rajuk, Bangladesh Telecommunication Regulatory Commission, and Civil Aviation Authority of Bangladesh.