RMG exports: Is decoupling on the cards?

RMG exports: Is decoupling on the cards?

IN order to attain high growth rates, double digit manufacturing sector expansion is a must in Bangladesh. The manufacturing sector consists largely of exports where Readymade Garments (RMG) industry has been the driving force since 1980s. The performance of the RMG industry is a consequential part in attaining economic growth each year.

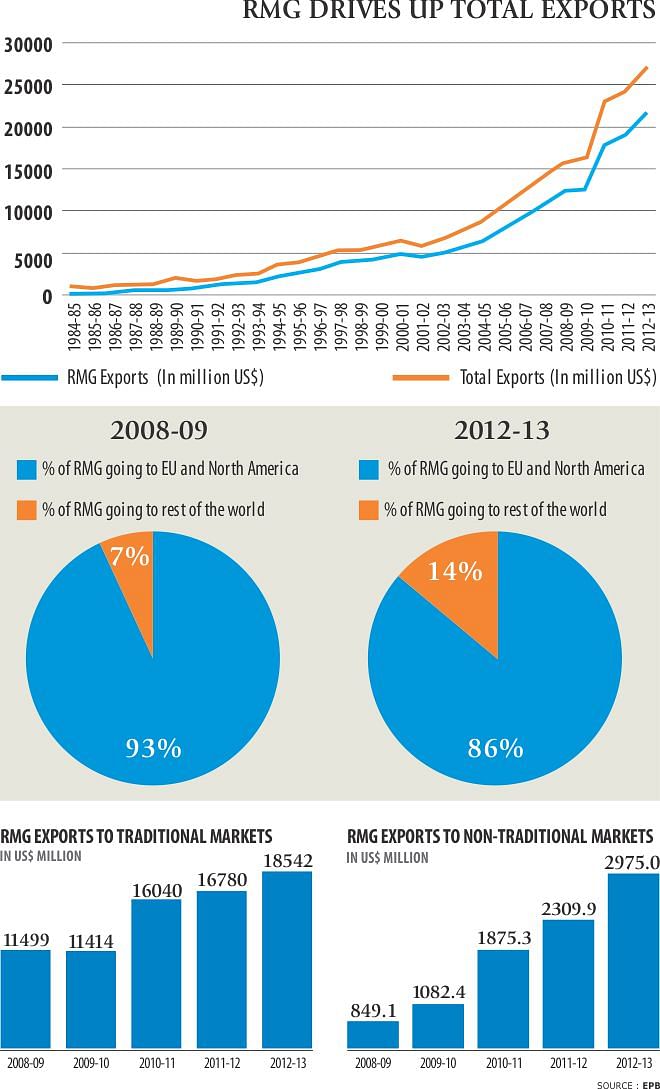

In fiscal 2009, 88% of our RMG exports made its way into the European Union and USA; add Canada's share of 5% and we can see that 93% of Bangladesh's RMG exports went into what is known as the 'traditional markets.'

The substantial amount of exports to the traditional markets over the years clearly indicates the sheer size of the market, feasibility and good linkages with the buyers. However, high dependency on EU and North America also implies that the effects of the business cycles in those advanced countries can be easily transmitted into Bangladesh.

Can there be ways around this problem? Many East Asian countries are said to have started the process of 'decoupling.' The phenomenon of decoupling often refers to a weakening of the impact of demand and supply shocks emanating from the advanced countries on the economic performance of East Asian economies. This is achieved by lowering dependency on advanced economies and promoting intra-regional trade and domestic demand. To some, decoupling is considered a reality while others perceive it as somewhat unfeasible. Truth, however, can be found in both schools of thought. Globalisation has embedded Bangladesh to EU and North America; it is not feasible for the country to only reap the benefits from the two giants and completely bypass the adverse effects that come along with their financial crises. On the other hand, countries like Bangladesh cannot afford to have a slowdown in economic growth rates.

Let us take the case of the US financial crisis and the Eurozone debt crisis. Bangladesh's RMG growth rate plunged to 1.2% in fiscal 2010 from 15% a year before. The blow received from the Eurozone debt crisis can be seen as RMG growth rate declined to 6.6% in fiscal 2012 from a robust 43% just a year before. One may question the relevancy of this, as growth rates are still positive. However, the country's exports constitute 20% of GDP and the effects of slow RMG exports can weigh the economic growth rate downwards. For Bangladesh, it is more essential to increase the growth rates especially to tackle the problems of unemployment and poverty; each year 1.8 million people enter the job market and, without adequate expansion, the economy would be unable to absorb all the new people coming into the labour force. A decline in growth rate also implies that many people are being deprived of a chance to move up the poverty line.

The country's RMG exports were shielded from the financial crises partly because the industry was mostly producing basic wears which are income inelastic, i.e. a fall in income does not affect the demand for those garments. In addition, the government gave cash incentives to RMG industry (5%, 4% and 2% for 2009-10, 2010-11 and 2011-12, respectively) for exporting to new destinations. This incentive scheme triggered the process of export decoupling which can be seen when we look at the market composition: in fiscal 2009, the traditional market (EU, US and Canada) consumed 93% of RMG exports whereas in fiscal 2013, this declined to 86%. A 7% decline in market share in a span of 4 years shows that the industry has been responsive towards the cash incentives and exports to non-traditional markets have swelled 3.5 times from $ 850 million to almost $ 3 billion between fiscal 2008 to fiscal 2013. The contraction in market share may also imply that the country's dependency on advanced economies has slightly decreased.

Lowering dependency on the advanced economies will be a medium to long-term event; however it must be done in order to partly protect itself from foreign shocks. East Asian economies have used intra-regional trade to help them lower dependency on advanced economies and partially insulate themselves against Western financial shocks. South Asian countries can do the same to mitigate the effects of foreign shocks as well.

The writer is the head of research, The Daily Star.

E-mail: faaria.ts@gmail.com