Realtors cut apartment prices to boost sales

Realtors cut apartment prices to boost sales

Realtors slashed apartment prices by about 11 percent year-on-year on average to reinvigorate the depressed property market.

They are now selling each square foot of a flat at Tk 9,091 on average, down from Tk 10,182 in Dhaka in 2014, according to a recent study of Sheltech, a leading real estate company.

Now is the right time to buy apartments as the sector has gone through a major price correction in the last three years, said Toufiq M Seraj, managing director of Sheltech.

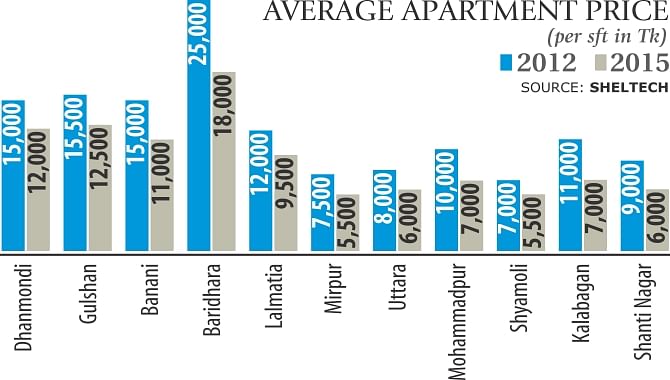

Apartment prices in Dhaka are 25.92 percent cheaper now than three years ago, when they were at their peak.

In 2012, each square foot of a flat in Dhaka sold for Tk 12,273 on average. It came down to Tk 11,136 in 2013 and Tk 10,182 in 2014, according to the study.

Sheltech, which conducted the study after taking data from leading real estate companies in the country, also found that Dhaka has now around 20,000 units of flat available for sale. The highest numbers of unsold flats are in Uttara, followed by Mirpur.

Banani saw the highest fall in apartment price from the previous year, by 15.38 percent, followed by Uttara and Shantinagar at 14.28 percent, and Mohammadpur and Kalabagan 12.5 percent, according to the study.

At present, flats in Mirpur and Shyamoli are the most affordable: they have an average price of Tk 5,500 per sft. Baridhara is at the other end of the spectrum: the average price for per sft of a flat is Tk 18,000.

The Sheltech MD said the fall in apartment prices in the past couple of years has brought the real estate sector down to its bare minimum level of profitability. If the price falls any further, the realtors will incur losses.

The real estate sector has been passing through a tough time as apartment sales have declined significantly over the last two years. The sector's sales fell as much as 60 percent in 2013 and the situation is not any better now, according to Real Estate and Housing Association of Bangladesh.

The slump can mainly be attributed to buyers' lack of access to low-cost home loans and abnormal rise in apartment prices between 2011 and 2012, industry people said.

Land price in Dhaka also fell on an average 14.12 percent year-on-year, according to the study. Land owners are now selling each katha at Tk 1.94 crore on average, down from Tk 2.26 crore in 2014. Baridhara has the highest price -- Tk 4.5 crore per katha, while Badda and Basabo have the lowest price -- Tk 35 lakh.

Realtors find it challenging to build low-cost apartments in the capital due to an abnormal rise in prices of land and construction materials, said Seraj, also a former president of REHAB. Working on economies of scale is the only way to bring down the apartment prices, he added.

“To reduce apartment prices, we have decided not to undertake any small projects. We now prefer projects where we can build more than 50 apartments at one site -- we are trying to get economies of scale.”

Big projects help minimise construction costs as developers can source materials at bulk rate and utilise the resources more efficiently, he added. Dhaka is now growing at an unprecedented rate, accommodating over 600,000 people per year. More than 120,000 household units are required to house the added population in Dhaka.

In this situation, the supply of housing in the city is only around 25,000 units, of which 15,000 are catered by private sector players like real estate development companies.

Currently, REHAB has around 1,200 members that build, on average, 15,000 units of apartment annually.

But top 20 companies hold 80 percent of the market share, Seraj said. The real estate sector now contributes around 7 percent to the country's gross domestic product, employing around one lakh skilled people and another 35 lakh in linkage industries, according to industry people.

suman.saha@thedailystar.net