Private investment falls for second year

Private investment falls for second year

Private investment dropped for the second year on the back of political uncertainty.

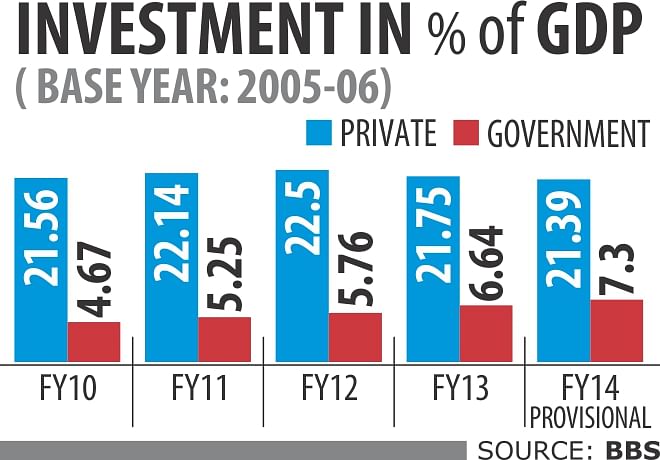

In fiscal 2013-14, private investment as a proportion of gross domestic product stood at 21.39 percent, down 0.36 percentage points, according to a provisional estimate from the Bangladesh Bureau of Statistics.

The private investment-GDP ratio declined for the first time last fiscal year.

Public investment, on the other hand, rose 0.66 percentage points to 7.30 percent, to take the overall investment-GDP ratio to 28.69 percent, up 0.30 percentage point year-on-year.

A big portion of private investment comes through bank finance, and related banking data shows that investment is still in a stagnant situation.

Between June 30 last year and February 28 this year, the amount of excess liquidity in the banking sector swelled 78 percent to Tk 1,35,436 crore, according to data from the central bank.

Another indicator of the languishing investment situation is that industrial term-loan disbursement declined 7.73 percent year-on-year during the January-March period.

Meanwhile, according to the latest 'enterprise survey' of the World Bank and International Finance Corporation, the private sector sees political instability as the biggest obstacle for the country's business environment. In 2007, the biggest obstacle was electricity and access to finance.

Zahid Hussain, lead economist of WB's Dhaka office, said while the disrupting political unrest has dissipated for now, the risk of it making a comeback hovers around.

“This time the post-election situation is different from those in the last four polls. In such a situation, without a political understanding among the major parties the uncertainty prevailing among the investors is unlikely to go away.”

He went on to recommend setting up of special economic zones to insulate the economy from the effects of political turbulence, as production there would be conducted in a secure environment.

Hussain said the economic zones have been identified and there is also an Economic Zone Authority, but the process of opening up the economic zones to investors is not progressing fast enough.

Zaid Bakht, research director of Bangladesh Institute of Development Studies, said there is “a sense of unease” among the investors over the possibility of a mid-term election.

Also the director of the largest commercial bank, Sonali Bank, Bakht said: “We are now getting no proposal for new investment. The branch managers are being pressurised in various ways but they say the entrepreneurs are not showing much interest.”

Moreover, after the Hall-Mark scam banks are being extra cautious in giving out loans, which may have had a part to play in the falling private investment.

Bakht too urged the government to lay urgent emphasis on implementing the special economic zones in the next budget, as many cannot invest for lack of land.