“People's trust on mobile banking is growing gradually”-Atiur Rahman

“People's trust on mobile banking is growing gradually”-Atiur Rahman

The exclusive interview of Bangladesh Bank Governor was taken by Suman Saha of The Daily Star

Bangladesh will be a role model for Mobile Financial Services globally if the present trend of growth continues, said Bangladesh Bank Governor Atiur Rahman.

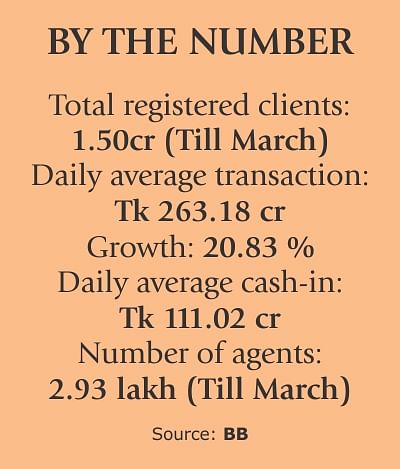

Mobile banking now registers more than 20 percent growth in cash transaction in a month thanks to the growing popularity of the services, he said. On average, around Tk 263 crore is transacted a day through mobile banking services, which was only Tk 121 crore in April last year, according to Bangladesh Bank data.

There is a lot of enthusiasm with mobile banking, as the banking regulator is promoting commercial banks to develop the financial service, said Rahman. As of March, the country had more than 1.50 crore mobile banking subscribers, up 2.77 percent from the previous month.

"A rising number of people are now taking mobile financial services as it gives them a hassle-free transaction at an affordable cost," said Rahman.

The central bank has allowed mobile banking systems to provide almost all services from disbursement of inward remittances to cash in and out, person to business payments, business to person payments, person to government payments, government to person payments and person to person payments, he said.

BB is opting for bank led-model in promoting mobile banking as this model minimises settlement risks arising in the payments system from such transactions, said the central bank chief.

Regulations of mobile financial services (MFS) make banks responsible for full anti-money laundering or counter financing of terrorism due to diligence and performance oversight on their agents, said the BB Governor.

He further said that the central bank has also set caps on mobile banking daily transaction in term of size and frequency in a bid to minimise risk. "So, People's trust on mobile banking is growing gradually," he added.

The BB Governor said mobile financial services have also played a significant role in reducing the cost of remittances in Bangladesh. The cost of remittances in Bangladesh is one of the lowest in the world mainly because of strategic use of MFS and strategic partnership developed among banks, telephone companies and micro-finance institutions. MFS and strategic partnership help keep the remittances cost lowest in Bangladesh, he said.

BB Governor also said that the impact of remittances has been both equitable and poverty reducing. The annual remittances of $14-$15 billion have been helping in boosting domestic demand in rural Bangladesh. This has helped Bangladesh cope with fallouts of Global Financial Crisis better than many of its peers. The value of mobile banking transactions stood at Tk 7,895.53 crore in March this year, up from Tk 6,534.45 crore in February, according to the BB data.

It is observed that person to person money transfer—'cash in' and 'cash out'—are the most popular types of transactions. The total number of agents providing such services across Bangladesh stood at 2.93 lakh until March 31, up from 1.88 lakh until December 31, according to the BB data.

As part of the government's financial inclusion programme, the central bank allowed 28 banks to provide mobile-banking. To date, 19 have launched the service. BRAC Bank's bKash, Dutch-Bangla Bank's mobile banking, Islamic Bank's MCash, United Commercial Bank's UCash, Trust Bank's mobile money, ONE Bank's OK mobile banking are now the key players in MFS in the country.

Last year, Mobile banking registered 186 percent growth in cash transactions and 262 percent in the number of subscribers.

The writer is Business Correspondent, The Daily Star.