Not a large budget: WB

Not a large budget: WB

The budget for fiscal 2014-15 is not large if the country's vast development needs are taken into account, the World Bank said yesterday.

Zahid Hussain, lead economist of the multilateral lender's Dhaka office, said Tk 250,506 crore-budget is consistent with countries that are in similar stages of development.

“There are also the vast development needs,” he said while presenting the development partner's analysis of the budget at WB's office in Agargaon.

On the other hand, the economist said the size is large as the government's expenditure targets are often missed because of under-utilisation of the annual development programme (ADP), whose size has grown by 33.9 percent in the upcoming fiscal year.

In his presentation, Hussain showed how the country fared with respect to its targets for expenditure, ADP, revenue generation and external financing since fiscal 2009-10.

During the period, the National Board of Revenue was able to reach its goal for revenue generation only once in fiscal 2010-11 and domestic financing target was reached on only two occasions.

“Besides, there is also a consistently large gap in external financing. As a result, the domestic financing overshoots when external financing undershoots.”

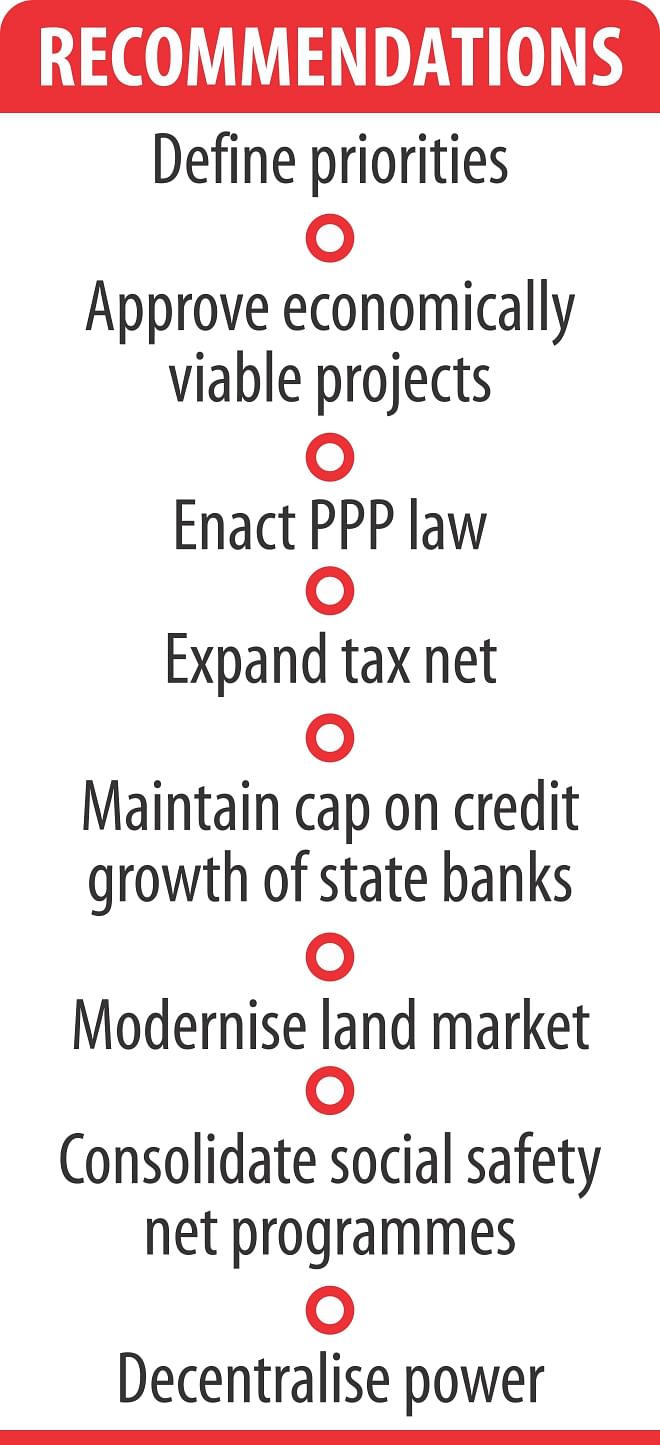

The budget can be implemented if the priorities are rightly defined, he said, adding that the government should maintain surveillance over both the implementation of budget and its consistency with inflation target.

While the budget made some commitments aiming to cut extreme poverty and achieve higher economic growth, it lacks clear commitments on the garment sector, migration, the number of new taxpayers and the troubled financial sector.

On the GDP target of 7.3 percent in fiscal 2014-15, Hussain said, instead of debating over the targets, the discourse should be aimed at how the country could better its current growth rate.

“The average 6 percent GDP growth is satisfactory. We will be happy if the country achieves 6.5 percent GDP growth in the upcoming fiscal year," he said, adding that the GDP would expand in the next fiscal year upon stable political scenario.

The stubbornly low private investment, which has been hurting total investment as well as GDP growth for quite a long time, is still weak, meaning the barriers that have been putting off investors still exist. The WB said the budget though has rightly identified constraints such as infrastructure, electricity, land and skills.

The share of the industrial sector to the GDP should be raised to 40 percent by 2021 from the existing 28 percent to make the economic growth sustainable, said Hussain.

On the macroeconomy, the WB said the budget deficit of 5 percent of GDP is consistent with macroeconomic prudence.

The budget's dependence on ambitious development spending target without adequate revenue or foreign assistance is a risk though, the WB said.

The revenue-to-GDP ratio should be around 23 percent from 13.3 percent in fiscal 2012-13 and the expenditure-GDP ratio 30 percent from 18.3 percent, according to Hussain.

The rise in non-development expenditure, which is mainly spent on recapitalising the loss-making state-run banks and providing funds to the subsidiaries of Bangladesh Petroleum Corporation, is a matter of concern.

“This is not good news for the whole economy,” said Hussain.

He said the government should look at the administrative capacity and economic viability before approving any project under the ADP.

The WB suggested the government should employ seasoned and competent technical staff at the office of the Public Private Partnership.

The government should also immediately enact a proper legal framework providing internationally attractive guidelines and incentive policies to woo in investors to secure financing for large infrastructure projects.

“Without these essential reforms, the ambitious $11 billion for PPP projects will not materialise,” Hussain said.

The Washington-based lending agency highlighted areas which are likely to boost revenue generation such as surcharge on the wealthy and high-income groups and transfer of shares, tax at source and green tax.

It also pointed out areas which are likely to cause revenue loss such as rate reduction of supplementary and customary duties and advance income tax at source, minimum turnover tax and extended tax holiday for new industrial ventures.

The WB went on to urge the government to expand tax nets to boost revenue generation.

About amnesty to black money, Hussain said although the finance minister has publicly stated that the facility will not be extended in the upcoming fiscal year, the required amendment to the finance bill is yet to take place. Johannes Zutt, WB's country director, welcomed a number of attractive features of the budget.

He said the budget presents an opportunity to improve the effectiveness of public expenditures through rebalancing the composition in favour of growth and equity, provided that the challenges are met in the areas of revenue mobilisation, external financing and budget implementation, particularly the implementation of ADP.

He highlighted promising initiatives that include ongoing tax reforms, new economic zones, skill development training programme, land management system and the government's intention to delegate more power to local governments.

The WB, however, said decentralisation would be the most challenging reform, adding that many development partners are willing to provide technical assistance to implement this critical reform.

Zutt also said political and policy stability is important, as businesses are reluctant to invest in environments where policy is unpredictable.

Less red tape, a level-playing field and fight against corruption are also important factors to woo in investors, he said.

The WB is the leading development partner of Bangladesh. As of June, its disbursement stood at $760 million, which was $650 million in the same period last year, said Zutt, adding that he hopes the fund release would go over $1 billion before the end of the year.

The lender has committed to financing eight new projects this year totalling $1.9 billion, in contrast to $1.56 billion last year.