Non-banks' cost of funds falls on poor demand

Non-banks' cost of funds falls on poor demand

Direct deposits also play a role

The cost of funds of non-bank financial institutions fell by more than 10 percent in one year due to surplus money in the market and a poor demand for loans from businesses.

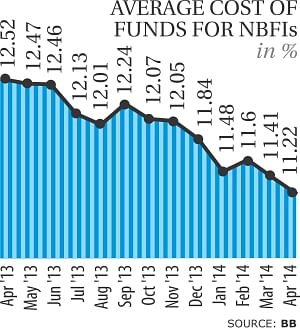

The weighted average cost of funds for non-banks came down to 11.22 percent in April this year, from 12.52 percent in the same month a year ago, according to Bangladesh Bank data.

“Direct deposit collections by NBFIs have played a big role in lowering the cost,” said Asad Khan, managing director of Prime Finance and president of Bangladesh Leasing and Finance Companies' Association.

The cost of funds is the interest rate paid by the non-banks for the funds they collect as deposits from individuals and institutions. Lower cost of funds generates better returns for a financial institution.

The NBFIs had to rely on banks for funds till two years ago. They used to borrow from banks at market rates and lend those to businesses for a profit. Later, almost all the non-banks started collecting deposits directly from the market to reduce their costs.

“Direct deposit collections and a poor demand for credit have lowered our costs,” said Selim RF Hussain, managing director of IDLC Finance, which meets 85 percent of its total demand for funds from direct deposits.

However, the non-banks are not being benefitted from the fall in the costs as the demand for money has gone down significantly. Industry players said poor investor confidence coupled with infrastructure deficiencies is taking a toll on business activities.

“New industries are not coming up due to a gas crisis,” Hussain said. “Massive investments in infrastructure could boost business confidence.”

Shamsul Arefin, managing director of Uttara Finance, said banks also reduced their lending rates for the NBFIs as the demand for money has fallen in the last one year.

“We are thinking to reduce our lending rates further to 14.5 percent as the demand for loans is going down,” Arefin said.