NBR sets up data forensic lab to catch tax dodgers

NBR sets up data forensic lab to catch tax dodgers

The National Board of Revenue has set up a state-of-the-art forensic lab to mine all data including hidden accounts and records from taxpayers' computers to detect tax and financial frauds.

The move comes in response to the rising trend among businesses to switch to electronic record-keeping from paper-based accounting systems.

So far, many large corporations, including some multinationals and mobile phone operators, have made the switch, handing in soft copies of their transaction records to tax offices.

While convenient and environmentally-friendly, digital record-keeping has created scope to hide actual accounts and other transaction records from taxmen and financial fraud investigators.

Furthermore, due to the option of password protection, tax investigators also face trouble in getting full access to all data from computers seized as part of inquiry.

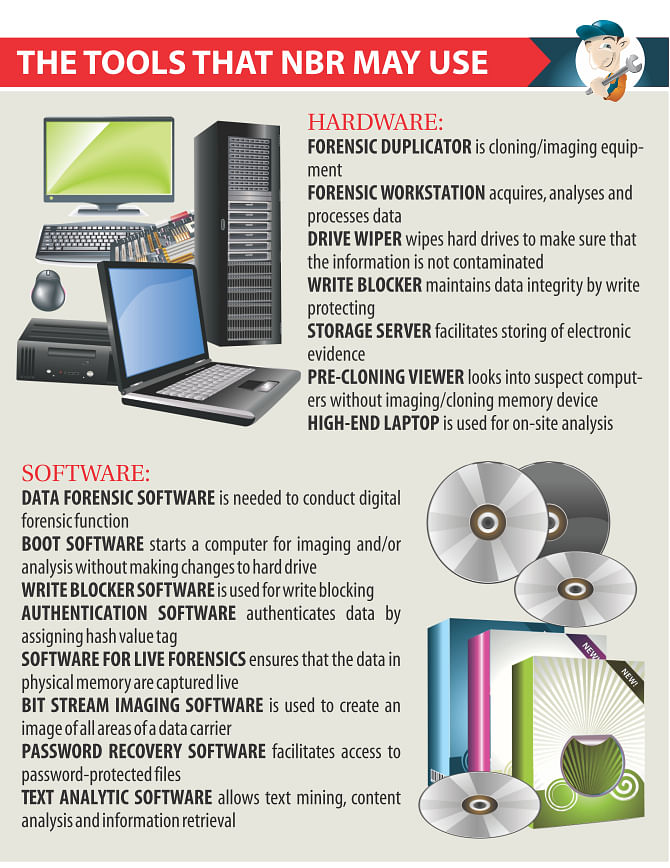

To address the rising issue, the tax authority has procured equipment and software and set up a forensic lab at the Central Intelligence Cell (CIC) in its headquarters, with funds from the Department for International Development, the British government's arm for overseas aid.

The lab, which is expected to become fully functional from next month, will enable taxmen to get full access to all digitised records kept by taxpayers in their computers and IT infrastructure.

It will also enable tax intelligence officials to acquire data from taxpayers' computers and analyse them digitally to investigate suspected tax evasion and financial crimes, said officials.

“This is a big leap for us as tax officials. Our audit and investigation capacity for the paperless environment will hugely increase with the lab. We will virtually have no barrier to investigating digital records,” said a senior official of NBR. “We have state-of-the-art technology for this. We hope it will act as a deterrent to tax evasion and financial crimes.”

Tax dodging is rampant in the country, where less than 1 percent of the population pays income tax, according to NBR's modernisation plan.

Bangladesh will be among the few least developing countries that have state-of-the-art facilities to dig into digital records and analyse data electronically, the official said.

Md Alauddin, a former NBR member, said the lab will be a great help for other government agencies that investigate financial crimes.

But the success of the lab will depend on its proper operation.

“One may have a pen in his pocket but nothing will come out unless the person writes,” said Alauddin, also a former director general of CIC.

Abu Saeed Khan, senior policy fellow of LIRNEasia, a Colombo-based ICT think-tank, said while the lab is a step forward, the financial criminals might already be further ahead.

“Cloud computing is rising globally and one can keep information in it. If anyone keeps data in the cloud, it will be difficult to retrieve those by a third party due to different data protection laws in different countries.”