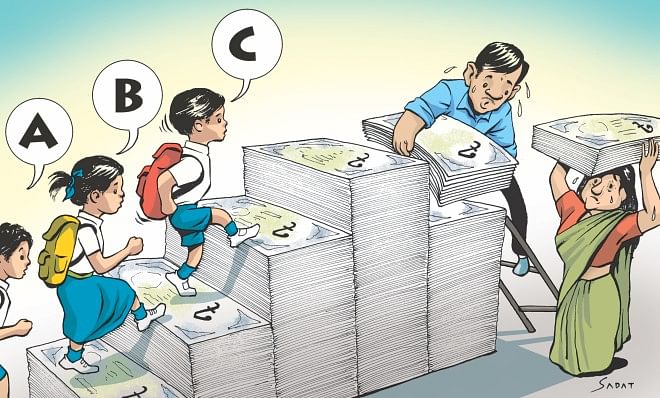

More burden on shoulders

More burden on shoulders

Middle class families to find it difficult continuing kids' education in English medium schools

Sabbir Ahmed, an executive of a private company, left office for home early to watch the budget speech on TV yesterday.

He expected the next budget to leave more disposable income in hand. But, unfortunately, the finance minister proposed little incentives for middle-class families like that of his.

The tax-free income threshold was left untouched for general taxpayers. But this will hardly benefit the middle-income people as living costs have gone up over the last few months. The overall inflation rate stood at 7.46 percent in April.

The government also proposed increasing VAT on fees and services in English medium schools to 7.5 percent from 4.5 percent.

“It means my children's educational expenses will certainly go up,” said Sabbir, the lone earning member of his family.

Like him, guardians and teachers voiced worries, saying educational expenses at the schools had already shot up three to four times in the last few years.

If the tuition fees go up further, it would be a huge burden on many families, they said.

"When the price of an educational material goes up, the other related materials also follow suit," said Sayed Ahmed, father of a student at Sunnydale School.

Another guardian whose child studies at Scholastica School said, "It is we who will ultimately pay the price.

"Many people have a notion that increasing the fees does not make any difference to those who send their children to English medium schools. But most of them do not know how many middle-class families send children to these schools," he said.

According to officials at the National Board of Revenue, the VAT will not be imposed on government-approved English version schools that follow English textbooks published by the National Curriculum and Textbook Board.

The proposed budged seems to have dashed the hopes of many middle-income people for owning a house in the capital.

Over the last 10 years, Sabbir, who lives in a rented house in Mirpur, has dreamt of buying an apartment in the sprawling city. Now it will be even more difficult for him to turn the dream into reality.

This year, the government proposed increasing significantly registration fees of apartment and land in Dhaka and Chittagong. The finance minister also suggested doubling the net VAT on building construction sectors to 3 percent.

Sabbir said he expected that the government would provide a low-cost financing scheme for apartment buyers. But that didn't happen.

Sabbir and his family members usually eat out at least twice a month. It will cost them more as there will be an increase in service tax on food items served even in non air-conditioned restaurants.

LPG prices will also increase, as the government proposes raising import duty on LPG cylinders to 25 percent from 5 percent.

“I have to depend on LPG for cooking due to low pressure in gas supply,” said Sabbir.

He has a plan to replace his mobile phone with a 3G enabled handset by this year. However, he has to pay more for that too. The government proposes imposing 15 percent VAT on mobile handsets at the import stage.

But Sabbir's salary remains almost the same. If all these proposals are approved, his monthly savings will fall by at least 8-10 percent, compared to that of last year.