Govt to offer incentives to China, Japan investors

Govt to offer incentives to China, Japan investors

A draft will be finalised soon

Amid growing interests from Japanese and Chinese entrepreneurs to invest in Bangladesh, the government has prepared the draft of an incentive package for attracting foreign investment in special economic zones.

A high-level meeting with Finance Minister AMA Muhith in the chair discussed the draft last week and it will be finalised after Prime Minister Sheikh Hasina returns from the USA.

The Prime Minister's Office has prepared the draft incorporating around 20 types of incentives -- mostly customs, VAT and income tax-related -- after consultation with Japanese investors, Board of Investment, and Bangladesh Economic Zones Authority.

A presentation on the draft was given at the meeting at the finance ministry, offering the investors tax holiday for 10 years. The draft may be revised, making a provision of 100 percent tax holiday for five years and gradual decrease of the benefit in the next five years.

The investors will be allowed to repatriate 100 percent of their profits while the existing rule does not allow this.

The incomes of the experts who will work in the economic zones will also be tax-free. Industry owners can import a jeep and a microvan without paying tax. Electricity to be consumed by factories will be tax-free as well.

The investors can bring 20 percent of their workforce from their countries, while 80 percent workers will have to be recruited from Bangladesh. Those who will develop the economic zones will also enjoy various incentives.

The government plans to give foreign investors the same incentives or more as the neighbouring countries or the competitors of Bangladesh give to their foreign investors.

During her visit to China and Japan, Sheikh Hasina had urged the entrepreneurs of these countries to invest in Bangladesh.

While Bangladesh eyes a considerable amount of investment from Japan, the Asian economic giant has identified some investment barriers and wants these to be removed.

Before Japanese Prime Minister Shinzo Abe visited Dhaka early this month, the Japanese side briefed the Bangladesh government about the problems.

Finance ministry officials said decisions will be taken soon to remove the bottlenecks, and select the lands to be allocated to the Japanese and Chinese investors.

Besides the Chinese and Japanese investors, the government plans to provide lands to investors from other countries who are interested to invest in Bangladesh.

The government has identified five economic zones on 8,816 acres of land in Mongla, Sirajganj, Gohira in Anwara upazila, Mirsorai in Chittagong, and Moulvibazar in Sylhet. Apart from these, 13 more economic zones will be set up under public-private partnership.

The officials said China expressed its interest to invest in the economic zone in Mirsorai, while Japan wants a separate economic zone near Dhaka, but the government has proposed to give them lands in Chittagong.

Zahid Hussain, lead economist at the World Bank's Dhaka office, said both Chinese and Japanese investors are looking to locate out of China, primarily because of rising wages there. Minimum wages in garments currently range between $134.5 and $293.1 per month in China. Also, as China moves to cleaner energy and reduces energy subsidy, energy prices are projected to rise.

Minimum garment wage in Bangladesh is now $68 per month. In addition to low wage, Bangladesh has a strategic location with access to sea through which it is possible to serve vast markets, particularly Japan, China, India and many emerging economies, he said. “Nearly 50 percent of the world's consumers live within 3,000 miles of Bangladesh,” Hussain said.

He also said Bangladesh lacks competitive infrastructure and industrial land is a major constraint. To get around these constraints, Japan and China want economic zones dedicated to their investors. East Asia has successfully used these models in their industrialisation process.

Bangladesh needs to learn and adapt these models. "At the same time we need to make sure our own investors get the same facilities and policy support. We need to create an environment enabling healthy competition between all investors," Hussain said.

"We need to move fast. The opportunities opened by rebalancing and industrial restructuring in China are time-bound. If we do not grab it quickly, others will,” the World Bank economist said.

Investment from Japan rose three times to $94.37 million last year, compared to the previous year, according to Bangladesh Bank statistics. Chinese investment also more than doubled to $39.98 million during the period.

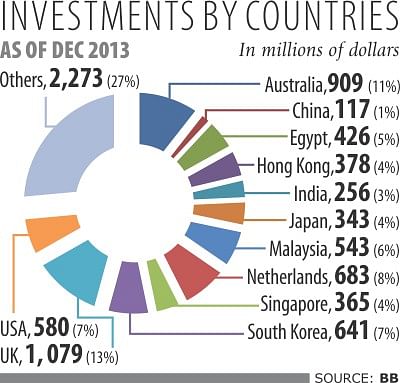

In 2013, the total foreign investment in Bangladesh was $1.6 billion. Though investments from China and Japan marked a rise, the amounts were much lower than those from other countries.

In December 2013, the amount of total foreign direct investment was $8.6 billion, of which China's share was $116.98 million and that of Japan $342.77 million.