Garment exports to US may lose out to Africa

Garment exports to US may lose out to Africa

Bangladesh may lose its competitiveness to African nations for exporting garments to the US in the face of discriminatory duty benefits.

With a zero-duty benefit under the African Growth and Opportunity Act (AGOA), the export of garment items originating in different African nations has been on the rise to the US.

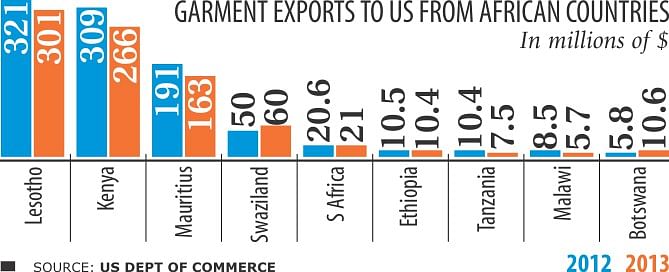

Garment exports to the US from nine leading African countries increased 9.66 percent year-on-year to $926.8 million in 2013, according to data from the US Department of Commerce.

Bangladesh exports apparel worth a little over $5 billion a year to the US, the single largest export destination for the country, by paying 15.61 percent in duty.

Bangladeshi garment exporters paid $828 million in duties to US customs last year and $3.41 billion in the last five years, according to the commerce ministry of Bangladesh.

However, apparel exports to the US from Bangladesh fell 1.12 percent to $2.18 billion in the first five months of 2014 from the same period a year ago, according to the US Department of Commerce.

“Obviously, the number of our competitors will increase, if the African nations grow in exports to the US,” said Abdus Salam Murshedy, former president of Bangladesh Garment Manufacturers and Exporters Association.

“We will lose our competitive edge for a discriminatory duty structure and higher cost of production in the domestic market,” Murshedy said. “African countries have the cotton benefit, which Bangladesh does not have.”

Big companies such as VF Corp and PVH Corp are eyeing the massive continent of Africa as a future site for apparel production that can be exported to the US, duty- and quota-free.

“Africa is prime and ready to go,” said Bill McRaith, chief supply-chain officer for PVH Corp, formerly known as Phillips-Van Heusen, whose labels include Tommy Hilfiger and Calvin Klein, according to a report by the Apparel Magazine.

The company is making a 20-year commitment to the African region with an eye on vertical operations and socially responsible factories.

McRaith, who has been working in apparel sourcing for decades, was speaking at a panel organised by the United States Fashion Industry Association (USFIA) on August 17 at MAGIC Show in Las Vegas. The topic was 'Looking forward: from the Western hemisphere to Africa: pros and cons'.

One of the reasons why Africa is becoming popular is the AGOA, which gives duty-free and quota-free status to apparel items made in more than 45 countries in sub-Saharan Africa.

Already PVH is producing clothing in Lesotho and Kenya but is eyeing a vertical model in which the company would use African cotton for fabric and then cut and sew apparel.

“You hear people saying, 'Where is the next China?' Africa appears to be the next solution for the United States,” the PVH executive said, according to the magazine report.

“The beauty of Africa is low cost,” McRaith said.

In Ethiopia, minimum wages can be as low as $23 a month, he said. A living wage for apparel workers hovers around $100 a month in a country where H&M, Tesco and Primark have been producing garments, McRaith added.

Also, landlocked Ethiopia is becoming a favourite sourcing spot because its energy is powered by geothermal and hydroelectric sources that make its electricity prices one-fifth of those in China.

McRaith has been visiting the continent since 1982 and believes that Africa's trade preferences will boost production in the region for low-cost apparel that does not have to be delivered quickly. He calls it the 'low and slow' alternative, based on the Southeast Asian model.

Julie Hughes, USFIA president, pointed out that even though China is becoming more expensive, it still provided for 41 percent of all imported apparel into the US, 35 percent of textiles, 18 percent of yarn and 67 percent of made-ups, which include sheets, towels, bedspreads, aprons and other home-related items.

But apparel companies are looking for other sourcing venues as prices and wages rise in China, the magazine report said.

A distinctive advantage in the African trade preference is that fabric can come from any country, including places such as China and South Korea, for apparel manufacturing and still receive duty-free status.

That gives Africa an advantage compared to major apparel-producing countries such as China and Vietnam, whose garments are subject to tariffs, the magazine report added.