Four graft-ridden branches control most business of BASIC Bank

Four graft-ridden branches control most business of BASIC Bank

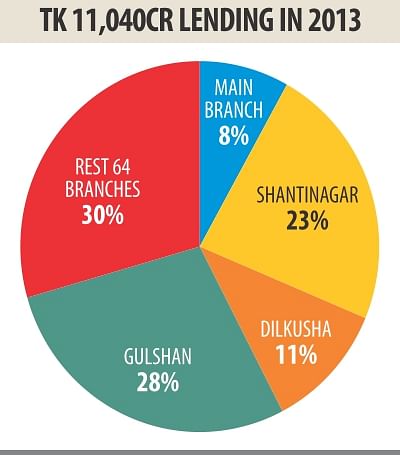

Troubled BASIC Bank has doubled its branches to 68 in the last five years, but 70 percent of its business activities are controlled by graft-ridden four branches.

Of the four branches, loan activities have recently been suspended in three --Dilkusha, Gulshan and Shantinagar -- by the central bank on charges of loan frauds. The fourth one is the bank's main branch.

The bank had only 32 branches in September 2009 when the incumbent board of directors was appointed by the government. The number of employees has more than trebled ever since.

Despite rapid expansion, the bank has failed to diversify its business and attract small and medium enterprises to its services.

According to BASIC Bank data, its 68 branches lent Tk 11,040 crore in 2013. Of the amount, nearly Tk 7,791 crore was given by the four branches.

Bangladesh Bank investigations detected massive financial irregularities involving around Tk 4,500 crore of loans in the three branches between 2009 and 2013.

The Gulshan branch alone lent more than Tk 3,111 crore last year against its deposit of Tk 695 crore only. Loan-deposit ratio (LDR) reached a whooping 427 percent, meaning it has lent Tk 427 against a deposit of Tk 100.

The permissible ceiling of LDR is 85 percent.

The Shantinagar branch loaned more than Tk 2,563 crore against a deposit of Tk 1,177 crore, pushing the LDR to nearly 204 percent. The Dilkusha branch gave Tk 1,224 crore against Tk 979 crore in deposits, with the LDR at more than 118 percent.

“A huge amount of money was embezzled in the name of giving loans. The bank's board did not try to tap business potential in other areas,” said a deputy managing director of the bank, requesting not to be named.

The BB inspection found that the Gulshan, Shantinagar and Dilkusha branches gave loans to nonexistent companies and approved loans instantly after the clients had opened accounts.

Moreover, the bank's board sanctioned loans even before the respective branch sent loan proposal to its headquarters.

The board granted loans without assessing borrowers' creditworthiness, documents and mortgages.

The BB said it would not be possible to recover many of these loans.

The main branch of the bank lent around Tk 891 crore against deposits of around Tk 926 crore last year. The LDR at the branch was 91 percent.

In violation of banking rules, the bank also showed interests as income against many loans that had not been paid. Also, borrowers diverted their funds at will, but the board and management did not take any action.

Officials said the branches having huge business potential include Khatunganj, Agrabad, Khulna, Rajshahi, Narsingdi, Babubazar, Chittagong EPZ, Dhanmondi, Rangpur, Gazipur, Kushtia, Savar, Keraniganj and Zindabazar.

The bank's latest data as on April 30 this year showed that LDR remained less than 50 percent in Khatunganj branch and 42 percent in Khulna branch, meaning these branches have failed to invest money against deposits.

Agrabad, Rajshahi, Narsingdi, Gazipur, Savar and Keraniganj branches were also hugely under-utilised.

The central bank last week advised the government to take action against the board of the state-run bank, as the governing body was found guilty of committing large-scale irregularities in approving loans, and in recruitment and promotion.

BB Governor Atiur Rahman sent a letter to Finance Minister AMA Muhith to take actions against the board after all efforts to discipline the once good-performing bank went in vain.