Foreigners come under NBR's greater scrutiny

Foreigners come under NBR's greater scrutiny

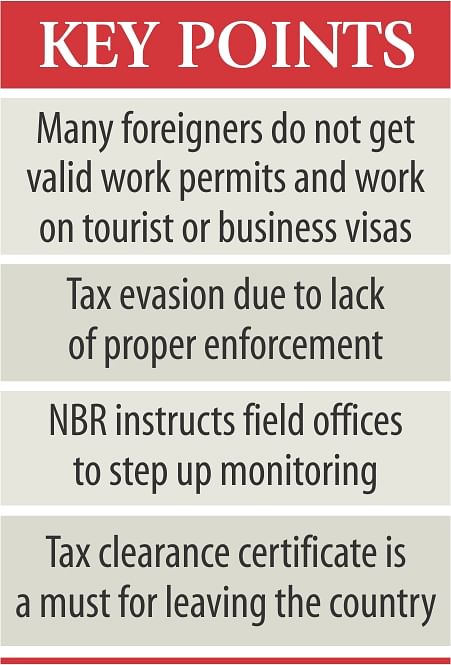

The National Board of Revenue has asked its field offices to increase vigilance to ensure tax collection from foreigners working in Bangladesh.

“We have come to know of tax evasion by foreigners working here. Many of them come to Bangladesh on a tourist or business visa but engage in jobs,” said a senior official of the NBR, seeking to remain anonymous.

Subsequently, the tax authority instructed its field offices to properly determine the incomes of foreigners working here and impose taxes in line with the laws.

It also requested the other government agencies to ask the foreigners to get income tax clearance or exemption certificates from the tax offices and submit the documents when they leave the country.

The NBR also instructed the employers to inform their foreign employees about their obligation to pay tax on their earnings.

Foreign nationals are subjected to 25 percent tax on their incomes, with the rate set to go up to 30 percent in the next fiscal year after the passage of Finance Bill 2014 in parliament.

But taxmen said the actual amount of tax does not come to the state coffers mainly because of under-reporting of income and non-compliance with tax rules in absence of proper enforcement.

Nearly two lakh foreigners are residing in Bangladesh at present, according to an estimate of the Special Branch of Police, with many gainfully employed in the garment industry and the services sector. Indians, Sri Lankans, Chinese, Pakistanis, Koreans and Filipinos make up the majority of the numbers.

But there is no actual data of how many foreigners are working in Bangladesh, due to lack of coordination between government agencies that issue work permits and visas.

The Board of Investment, Bangladesh Export Processing Zones Authority and NGO Bureau separately issue work permits for foreigners. At present, there are more than 10,000 valid work permits in circulation, according to data from the BoI and BEPZA.

But taxmen said not all the foreigners residing in Bangladesh with valid work permits comply with tax rules due to inadequate vigilance.

In addition, liaison offices of foreign companies also cause revenue losses for the state: to evade taxes, they take permission for liaison offices but they function as branch offices, said taxmen.