Foreign investment in DSE jumps manifold in April

Foreign investment in DSE jumps manifold in April

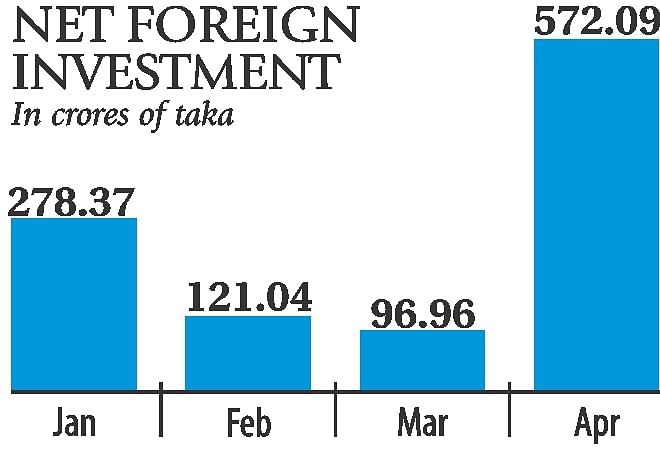

Net foreign investment in the Dhaka stockmarket rose to a record Tk 572 crore by nearly six times in April from the previous month, as overseas investors injected fresh funds into multinational companies.

Foreign investors bought shares worth Tk 876.44 crore and sold shares worth Tk 304.35 crore in April, according to data from Dhaka Stock Exchange.

Local stockbrokers said two international merger news of cement makers—Lafarge and Holcim—and drug makers—GlaxoSmithKline and Novartis—prompted foreign investors to take position in the companies that are listed on the Dhaka market.

Lucrative dividends declared by other multinational companies also encouraged the investors to park money in the securities, they said.

The foreign investors were also on a buying spree as they found it to be an ideal time to take position in securities, said Wali Ul Islam, chief executive officer of LankaBangla Securities, a leading stockbroker.

“The foreign investors are seeing the Bangladesh outlook very positively,” he said, adding that favourable macroeconomic indicators and easing of political tension increased investor confidence.

Besides, he said aggressive overseas marketing by local stockbrokers is also attracting the foreign investors to the Dhaka stockmarket. Also known as portfolio investment, foreign investment accounts for around 2 percent of DSE's total market capitalisation, which was Tk 291,362 crore as of yesterday.

Banks were initially the foreign investors' preferred sector, but non-bank financial institutions, power and energy, pharmaceuticals, multinationals, telecoms and IT also caught their attention.

During January-April period, foreign investors bought shares worth Tk 1,811.91 crore and sold shares worth Tk 743.45 crore to yield a net investment of Tk 1,068.46 crore, according to the DSE.