Cheers for black money holders

Cheers for black money holders

Muhith makes U-turn, allows whitening by investing in real estate sector

The government has allowed unquestioned legalisation of black money in real estate, a move that reflects the finance minister's apparent U-turn and surrender to the pressure of corrupt politicians, bureaucrats and influential realtors.

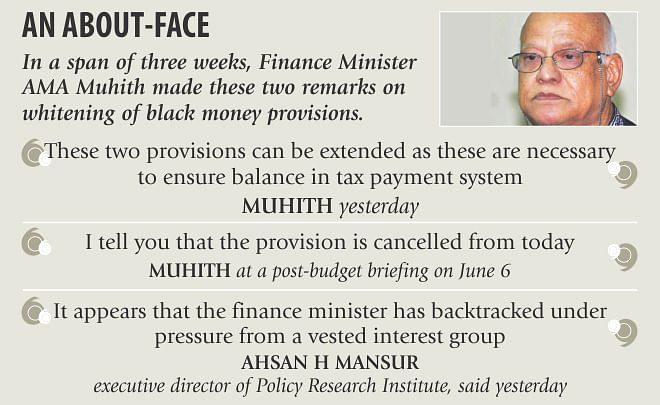

The decision comes three weeks after AMA Muhith publicly vowed to discontinue “all sorts of scope for legalising black money” from the next fiscal year.

"I tell you that the provision is cancelled from today," the finance minister said at a crowded post-budget press conference on June 6.

However, Muhith backtracked on his position, and said yesterday that the facility would be available in the next fiscal year in two ways -- investments in homes by paying tax, and legalisation of undisclosed income by paying a 10-percent penalty on top of normal tax.

This scope has been withdrawn only in case of investments in treasury bonds.

"These two provisions can be extended as these are necessary to ensure balance in the tax payment system. It can be mentioned that money obtained through terrorism and corruption cannot be shown to get the privilege," Muhith told parliament defending the move.

He said the provision for unquestioned acceptance of investments in flats by paying a certain amount of tax is part of efforts to simplify the tax payment system.

But his explanation that money obtained through terrorism and corruption cannot be shown to get the privilege contradicts the allowing of “unquestioned” acceptance of investments in real estate.

Muhith's latest stance goes against his own views that he shared at a post-budget briefing on June 6.

At the briefing, he said real estate is the biggest source of investments of black money because of difference between the registered price of land and its real price.

"This is how the major portion of black money is generated," said Muhith. "We have to think how we can stop the generation of black money. But we have not progressed much on the issue."

At several discussions over the last one month, Muhith repeatedly spoke of scrapping the provision for whitening black money in fiscal 2014-15.

The scope is given almost every year in the face of pressure from vested groups though it never brought the government any substantial revenue.

The National Board of Revenue received only Tk 26 crore between July last year and April this year by offering the facility in real estate.

Between fiscal 1971-72 and 2012-13, about Tk 13,808 crore was whitened. During the period, the NBR received taxes of Tk 1,455 crore, which is less than 1 percent of the revenue collection target for fiscal 2014-15.

“It appears that the finance minister has backtracked under pressure from a vested interest group," said Ahsan H Mansur, executive director of Policy Research Institute (PRI), opposing the scope in real estate sector.

"Ultimately, corrupt public servants and corrupt politicians will take the benefit. And the offer is given almost every year to allow them to legalise money on the excuse of sluggish business in the sector."

The privilege creates scope for accumulation of black money. "The source of black money is corruption. But instead of addressing the source of corruption properly, we are making arrangements so that black money can become white," Ahsan said.

The amnesty pushes up land and apartment prices. "As a result, owning a home goes beyond the purchasing capacity of common people. It does not help ensure social balance," he said.

Zaid Bakht, research director at Bangladesh Institute of Development Studies (BIDS), said the amnesty doesn't bring any good to the economy; it only benefits black money holders.

He said undeclared or black money remains in the economy even if there is no scope for legalising it. The money is kept in banks and invested in real estate under fake names.

"But the opportunity to legalise money benefits corrupt people. It is against economic justice," said Zaid.

It wouldn't be possible to identify whether the money is earned through illegal means or crimes, as there is no scope in the tax law for questioning the source of the investment, he said.