Black money flying abroad

Black money flying abroad

Govt's amnesty draws very little response

When money laundering is as easy as slicing a cake and the money is safe abroad, why anyone would want to legalise his black money is a question that seems to have no answer. And even if one wants to do so, he is discouraged by the complex legal structure and the vengeful political culture in the country.

This is evident in the black money holders' lukewarm response to the government's repeated declarations of amnesty to them.

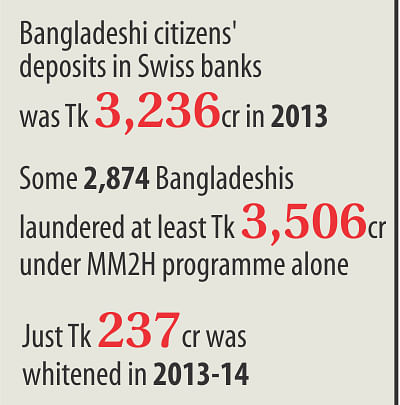

In the fiscal 2013-14, only Tk 237.78 crore was whitened, with the government getting Tk 45 crore in taxes. The response was slightly better in the previous four fiscal years -- Tk 451 crore was legalised on average each year from which the government got about Tk 58 crore in taxes each year, according to the National Board of Revenue.

That, however, is no proof that black money is decreasing. If anything, it is just the other way around.

Recent disclosures by the Swiss National Bank show deposits by Bangladeshi citizens at various Swiss banks soared 62 percent year-on-year in 2013. It stood at Tk 3,236 crore last year, up from Tk 1,991 crore the previous year.

Experts say the money deposited in Swiss banks is only a tiny fraction of the total amount siphoned off. There are other safe havens -- Malaysia, Canada and the UAE, just to name a few -- where huge sums were laundered.

To settle in Malaysia under its My Second Home (MM2H) programme, for instance, one needs to show liquid assets worth at least RM 500,000 (about Tk 1.22 crore) and offshore income of RM 10,000 (about Tk 2.45 lakh) per month.

Between 2002, when the programme was launched, and April this year, some 25,500 people from across the world migrated to the country. Of them, 2,874 (11 percent) are Bangladeshis, according to the Malaysian government website.

This means, these Bangladeshis laundered about Tk 3,500 crore at least to settle under the MM2H programme, and none was required to take approval from the competent authority in Bangladesh, as Malaysia does not inquire about the source of the money.

The Malaysian government website also shows the number of Bangladeshis settling in the country rises when election comes around. As many as 852 Bangladeshis settled there in 2005, ahead of the 2007 ninth parliament polls. The number was 388 in 2012, just before the 10th national election.

Similarly, a Bangladeshi can get residence permit in the US or Canada by showing liquid assets worth $500,000 (about Tk 3.87 crore). Statistics are hard to come by, but reportedly hundreds of affluent Bangladeshis have made these two countries their second home. Again, the US and Canada will not inquire where the money has come from, experts say.

Zahid Hussain, lead economist of the World Bank's Dhaka office, told The Daily Star that black money holders preferred to siphon off money instead of whitening it.

According to him, political unrest centring on the January 5 election prompted many to launder their undisclosed money to other countries.

“Since it was an election year, the risk of getting caught was high if the money earned through corruption was kept in the country. So they are at ease by depositing the sums in safe havens,” said the WB economist.

In the last fiscal year, 2,573 people legalised their black money by investing in the real estate business, 210 people by paying normal tax plus penalty and one person by purchasing treasury bills.

But there is no figure as to how many people siphoned off how much money. However, analysts say the difference between the formal and informal market rates of US dollar in the second half of 2013 shows the amount was not negligible.

The difference stood at Tk 4, whereas normally it stays below Tk 1, meaning a huge amount might have been laundered in the lead up to the January 5 election, according to experts who blame the complex legal structure, bureaucratic red tape and culture of vengeful politics for this.

Take, for instance, a Bangladeshi businessman whom we cannot name for safety reasons. For years, he tried to obtain permission to invest abroad in vain. He finally settled in Canada last year.

According to him, the central bank is partially responsible for a large amount of money going out of the country.

“The Bangladesh Bank doesn't permit us to invest abroad. But how much money you want to launder -- Tk 100 crore, Tk 200 crore or Tk 500 crore? It doesn't matter, you can launder it anytime to any country," he told The Daily Star.

In Bangladesh, money laundering is popularly known as Hundi or Hawala transactions. Hundi is an alternative or parallel remittance system active all over the world. Hawala is an Arabic word for transferring money or information between two people using a third person.

But businesses, especially exporters, do this in a "smarter" way.

Some exporters of readymade garments have set up a complex web of intermediaries with the sole purpose of siphoning off revenue to offshore zones and Western banks. An RMG maker, for instance, exports products first to its offshore affiliate or a buying house at a low price. Then it sells the items to Western consumers at a higher price. The extra sum, earned through such under invoicing, is then deposited in foreign banks.

Insiders say it is very easy and safe.

As for the complex legal structure, an NBR official said many people do not whiten their undisclosed money for fear of arrest under other laws.

When a black money holder whitens his money, he gets amnesty under the tax law only, the official said, adding, "But he can still face cases under other laws, including the Anti-Corruption Act."

Also, there is the fear of political vengeance. If someone affiliated with the Awami League politics, for example, legalises his undisclosed money today, he may face harassment and even cases with the change of the government.

All these discourage people from legalising their undisclosed money, despite repeated offers of amnesty by the government, analysts say.

Over the past 43 years since independence, Tk 13,753 crore of black money was disclosed -- 70 percent of the amount during the 2007-08 caretaker government tenure alone.

The WB economist spoke against extending the amnesty every year. According to him, for the amnesty provision to be effective, it has to be given for a definite period and tagged with a warning. “Plus, it is very discouraging for the honest taxpayers.”